Salesforce Likely To Report Higher Q1 Earnings; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Salesforce, Inc. (NYSE:CRM) will release its first-quarter earnings results after the closing bell on Wednesday, May 28.

Analysts expect the San Francisco, California-based company to report quarterly earnings at $2.55 per share, up from $2.44 per share in the year-ago period. Salesforce projects to report quarterly revenue at $9.75 billion, compared to $9.13 billion a year earlier, according to data from Benzinga Pro.

On Tuesday, Salesforce officially agreed to acquire Informatica for approximately $8 billion in equity value, net of Salesforce's current investment in Informatica.

Salesforce shares gained 1.5% to close at $277.19 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

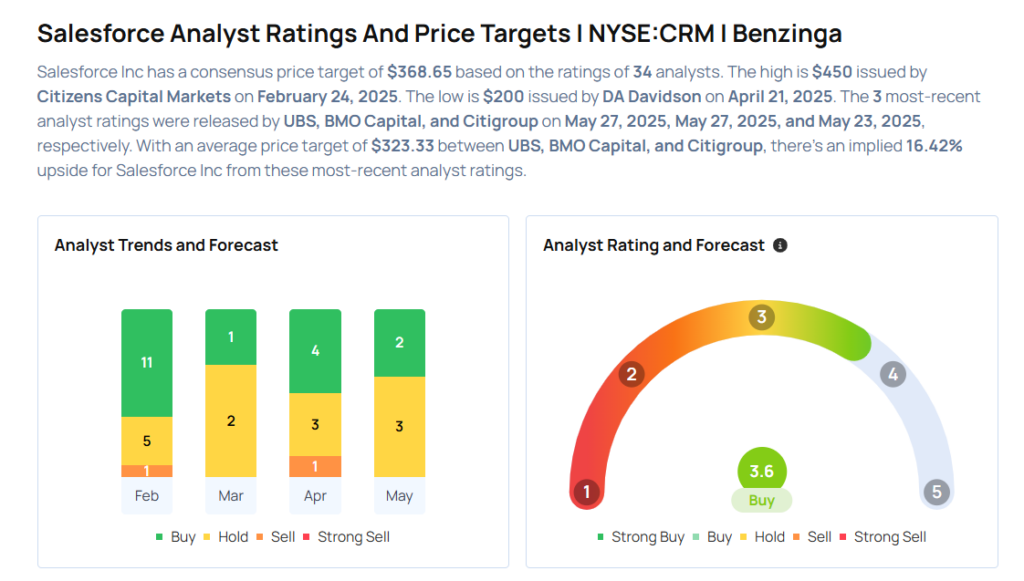

- UBS analyst Karl Keirstead maintained a Neutral rating and cut the price target from $320 to $300 on May 27, 2025. This analyst has an accuracy rate of 76%.

- BMO Capital analyst Keith Bachman maintained an Outperform rating and slashed the price target from $367 to $350 on May 27, 2025. This analyst has an accuracy rate of 82%.

- Citigroup analyst Tyler Radke maintained a Neutral rating and cut the price target from $335 to $320 on May 23, 2025. This analyst has an accuracy rate of 70%.

- Mizuho analyst Gregg Moskowitz maintained an Outperform rating and cut the price target from $425 to $380 on May 15, 2025. This analyst has an accuracy rate of 72%.

- Piper Sandler analyst Brent Bracelin maintained an Overweight rating and lowered the price target from $400 to $315 on April 23, 2025. This analyst has an accuracy rate of 76%.

Considering buying CRM stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says Rocket Is A ‘Very Fine’ Company, Recommends Buying This Health Care Stock

Photo via Shutterstock

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10