These Analysts Revise Their Forecasts On Salesforce Following Q1 Results

Salesforce Inc (NYSE:CRM) reported better-than-expected first-quarter financial results after the market close on Wednesday.

Salesforce reported first-quarter revenue of $9.83 billion, beating the consensus estimate of $9.75 billion. The company reported first-quarter adjusted earnings of $2.58 per share, beating analyst estimates of $2.55 per share, according to Benzinga Pro.

"We've built a deeply unified enterprise AI platform — with agents, data, apps and a metadata platform — that is unmatched in the industry. With Agentforce, Data Cloud, our Customer 360 apps, Tableau, and Slack all built on one trusted, unified foundation, companies of every size can build a digital labor force — boosting productivity, reducing costs and accelerating growth," said Marc Benioff, chair and CEO of Salesforce.

Salesforce said it expects second-quarter revenue to be in the range of $10.11 billion to $10.16 billion versus estimates of $10.01 billion. The company anticipates second-quarter adjusted earnings of $1.80 to $1.82 per share versus estimates of $1.71 per share.

Salesforce also raised its fiscal-year 2026 revenue guidance to a range of $41 billion to $41.3 billion versus estimates of $40.83 billion. The company raised its full-year adjusted earnings guidance to $7.15 and $7.21 per share versus estimates of $7.24 per share

Salesforce shares fell 0.4% to close at $276.03 on Wednesday.

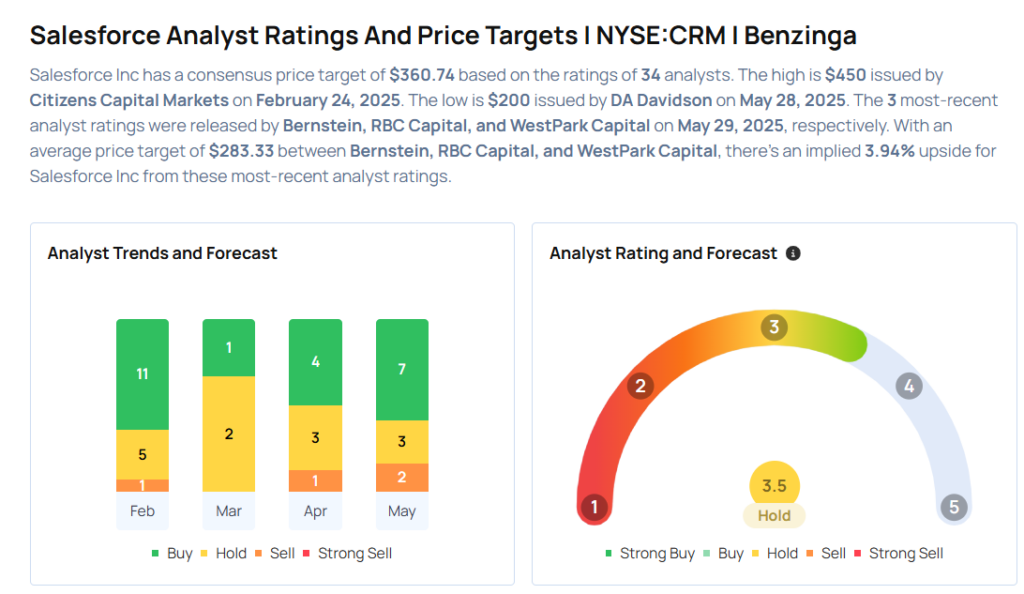

These analysts made changes to their price targets on Salesforce following earnings announcement.

- RBC Capital analyst Rishi Jaluria downgraded Salesforce from Outperform to Sector Perform and lowered the price target from $420 to $275.

- Bernstein analyst Mark Moerdler maintained Salesforce with an Underperform rating and raised the price target from $243 to $255.

Considering buying CRM stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says This Quantum Computing Stock Is ‘So High’ And ‘Too Speculative’

Photo via Shutterstock

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10