Solana slides to monthly low as memecoin frenzy fizzles 4 seconds ago

After a euphoric surge that saw meme coins on the Solana blockchain skyrocket earlier this year, the hype is beginning to unravel.

Solana’s native token, SOL, has dropped for four straight days—falling nearly 18% from its May highs—as meme coin valuations across its ecosystem collapse.

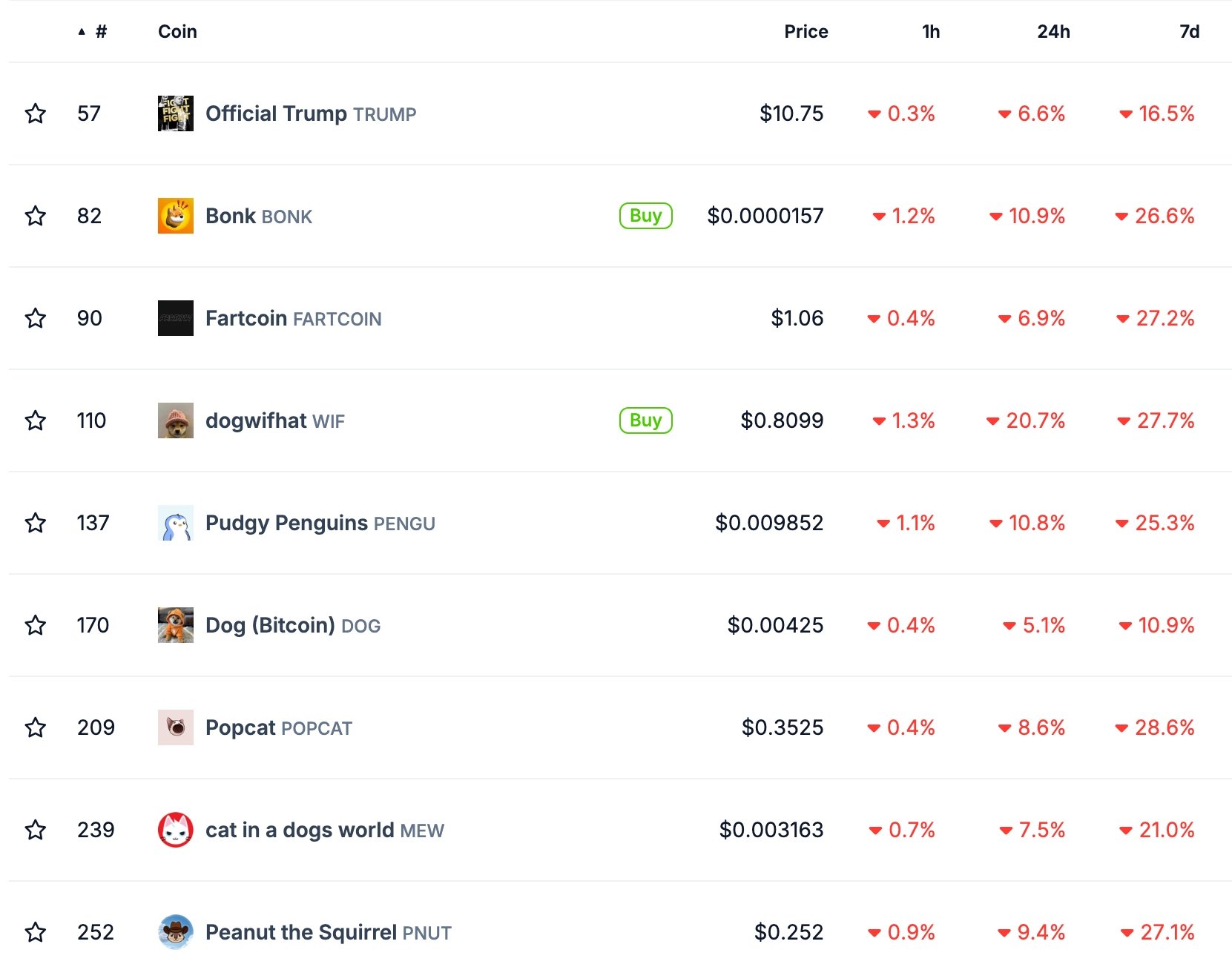

Once riding high with a combined market cap north of $15 billion, Solana’s meme assets like Dogwifhat (WIF), SPX6900 (SPX), and Popcat (POPCAT) have shed billions in value in just days. The broader sell-off mirrors a risk-off shift in the crypto market, amplified by geopolitical tensions and technical breakdowns, casting doubt on how much steam is left in Solana’s meme-fueled momentum.

Solana’s correction deepens

Solana fell to a low of $153.90, down 17.6% from its highest level in May. If the sell-off continues, it may move into a technical correction.

Solana meme coins have been some of the worst-affected as their market capitalization fell from over $15 billion mid-month to $10 billion.

Dogwifhat price tumbled by 20% in the last 24 hours, while SPX6900 (SPX) fell by 18%, as we predicted. Other top Solana meme coins like Fartcoin (FARTCOIN), Pudgy Penguins, and Popcat have tumbled by over 20% in the same period.

The ongoing Solana meme coin sell-off has also affected its ecosystem. For example, the volume handled by protocols in its DEX ecosystem has tumbled in the past few days. The volume stood at $2.4 billion in the last 24 hours, lower than Ethereum and BSC $2.98 billion and $12.1 billion.

Solana and meme coins in its ecosystem have tumbled because of profit-taking, as most of them were up by over 100% from their lowest levels in April.

SOL price technical analysis

The daily chart below shows that Solana has dropped sharply in the past few days, moving from $185 on May 23 to $154. It has moved below the 38.2% Fibonacci Retracement level.

The coin has also crashed below support at $159.45 and the neckline of the double-top pattern at $184.25. A double-top is one of the riskiest chart patterns in technical analysis.

Solana has dropped below the 50-day Exponential Moving Average, while the Relative Strength Index and the MACD have all pointed downwards.

Therefore, the coin will likely continue falling. The initial target is the 23.6% retracement point at $140, down 8.50% from the current level. If the coin rises above the double-top point at $185, more upside, potentially to $200, will be invalidated.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10