Cardano price target: bullish setup forms with $2.04 in sight 6 seconds ago

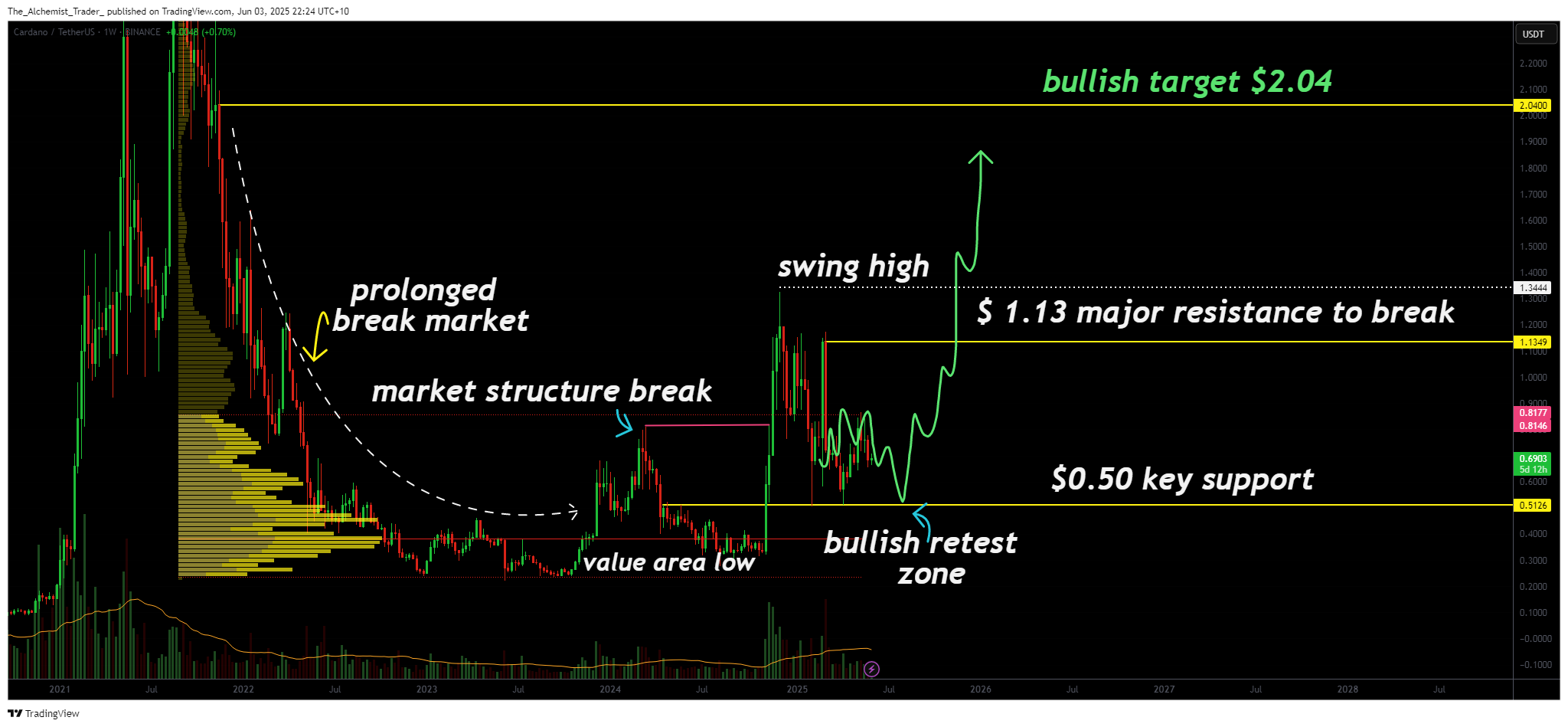

Cardano has defended a crucial support level at $0.50 after a market structure shift to the upside. With a swing high recently established and the correction now stalling at support, the groundwork for a long-term move toward $2.04 is forming.

After a prolonged bearish phase, Cardano (ADA) has shown signs of strength with a clean breakout from accumulation and the confirmation of a new swing high. This marks the first significant bullish structure break in months and suggests that a new macro trend may be underway.

The current correction, now respecting support at $0.50, appears to be forming a higher low, offering strong evidence that ADA is setting up for its next leg higher.

Key technical points

- $0.50 Key Support Level: Price has been consolidating above this zone for weeks, marking it as a likely higher low in the bullish market structure.

- Market Structure Shift Confirmed: A new swing high has been printed, confirming a bullish reversal from the previous downtrend.

- $2.04 Swing Target: From a high-timeframe perspective, $2.04 marks the next key resistance and a realistic long-term objective once upside momentum returns.

The value area low formed during the bear market has acted as a long-term accumulation zone. This was followed by an impulsive breakout that triggered the first true structural shift, breaking above previous lower highs and confirming a swing high. Since that breakout, price action has retraced—though in a controlled, corrective manner, and is now basing at the $0.50 support.

This support level holds significance due to the time spent consolidating here. Multiple weekly closes above this region suggest strong buyer presence. From a technical lens, this retest can be considered a bullish retest of broken resistance now turned support, a classic pattern seen in trend continuation setups.

Price may continue to range or trade sideways near this zone over the coming weeks. However, as long as the $0.50 support remains intact, the current correction will serve as a base for the next expansion phase. Once momentum returns, the next logical target is the $2.04 high-timeframe resistance—a key level from prior price cycles.

What to expect in the coming price action

Cardano’s bullish market structure remains intact as long as $0.50 holds. This level is likely a higher low forming in a broader uptrend. A breakout from this region could initiate a macro rotation toward $2.04, continuing ADA’s long-term recovery and trend reversal from the recent bear market.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10