Credo Technology Group Holding Ltd (NASDAQ:CRDO) will release its fourth-quarter earnings results after the closing bell on Monday, June 2.

Analysts expect the Grand Cayman, Cayman Islands-based company to report quarterly earnings at 27 cents per share, up from 7 cents per share in the year-ago period. Credo Technology Group projects to report quarterly revenue of $159.59 million, compared to the 60.78 million it reported last year, according to data from Benzinga Pro.

On March 13, the company announced it filed a patent infringement complaint and asked the FTC to investigate and block the importation of products part of the infringement.

Credo Technology Group shares fell 4.5% to close at $60.96 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

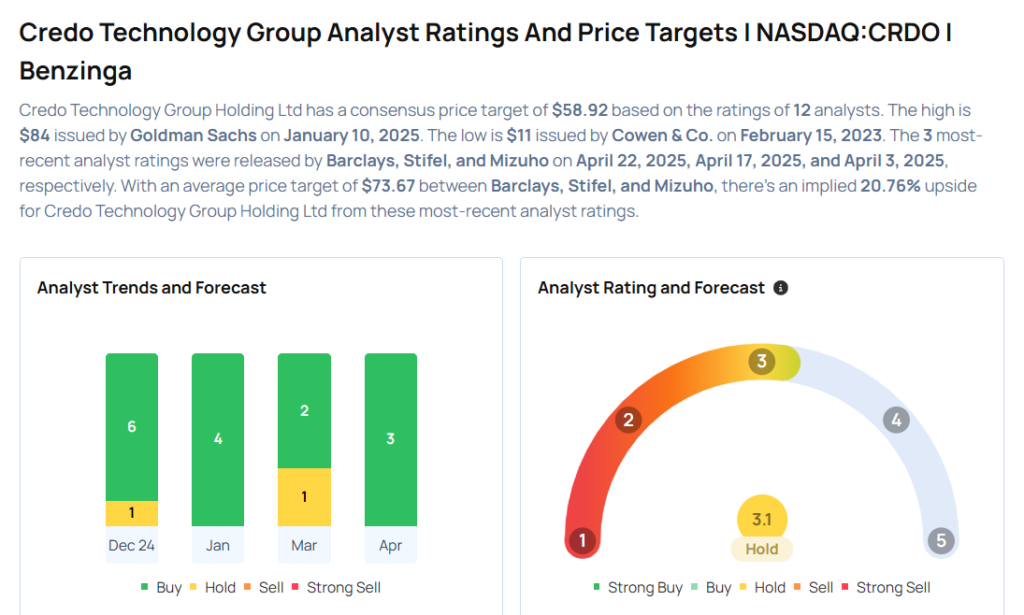

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Barclays analyst Thomas O'Malley maintained an Overweight rating and slashed the price target from $90 to $70 on April 22, 2025. This analyst has an accuracy rate of 72%.

- Stifel analyst Tore Svanberg maintained a Buy rating and cut the price target from $85 to $69 on April 17, 2025. This analyst has an accuracy rate of 76%.

- Mizuho analyst Vijay Rakesh maintained an Outperform rating and cut the price target from $90 to $82 on April 3, 2025. This analyst has an accuracy rate of 75%.

- Susquehanna analyst Christopher Rolland upgraded the stock from Neutral to Positive with a price target of $60 on March 10, 2025. This analyst has an accuracy rate of 74%.

- B of A Securities analyst Vivek Arya maintained a Buy rating and slashed the price target from $83 to $75 on March 5, 2025. This analyst has an accuracy rate of 80%

Considering buying CRDO stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Spotlight On 3 Utilities Stocks Delivering High-Dividend Yields

Photo via Shutterstock