Rising bond yields: the ASX winners and losers according to Macquarie

It's good news for bond yields this week.

President Trump's trade war has begun to de-escalate, and expectations there will be more interest rate cuts out of the Reserve Bank have caused a shift in market sentiment.

The dip in bond yields seen during the peak of trade war panic earlier this year appears to be reversing as "economic surprises" continue to turn positive.

In a recent note to investors, Macquarie Group Ltd (ASX: MQG) said it expects the market to react normally to the surprise cycle.

This means bond yields rise with surprises, as the market pares back rate cut expectations.

"This eventually leads to a hawkish shift from central banks to catch up with markets. We still see more cuts from the RBA than the Fed, as the Fed is more constrained by tariffs and inflation," the note said.

"In a market focused on data indicating strength or weakness in growth, we think yields will remain closely tied to surprises. As a result, we expect bond yields to rise in the near term."

The turnaround is good news for ASX shares, which are correlated to higher bond yields. But for those on the other end of the scale, headwinds might be about to ramp up.

Sector winners and losers

Macquarie's note points to technology and discretionary as the two sectors with the highest correlations to bond yields, and which likely outperformed as yields rose in the last 3 years.

"In these cases, prices are responding more to the growth signal from higher yields," the note said.

The financial sector is the third highest, led by insurance.

But the defensive Staples and Health sectors have been poor performers as yields rose. Resources were poor, as stronger growth did not mean stronger commodities.

Rising bond yields: The ASX winners and losers

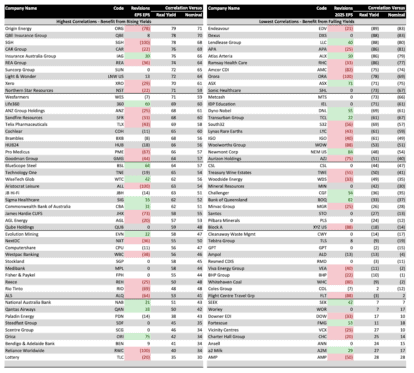

Macquarie's investor note highlights the winners and losers of the turnaround in bond yields.

ASX-listed stocks with a high correlation to bond yields and that do not have a negative earnings per share (EPS) should outperform in a period of rising yields.

Macquarie highlights QBE Insurance Group Ltd (ASX: QBE), Insurance Australia Group Ltd (ASX: IAG), Suncorp Group Ltd (ASX: SUN), Light & Wonder Inc (ASX: LNW), and BlueScope Steel Ltd (ASX: BSL).

Each of these stocks should see tailwinds if yields continue to rise.

Meanwhile, the note also highlights stocks with high negative correlations to bond yields, which do not have an offset with positive revisions.

Endeavour Group Ltd (ASX: EDV), Dexus (ASX: DXS), APA Group (ASX: APA), Amcor PLC (ASX: AMC), and Woolworths Group Ltd (ASX: WOW) are highlighted in the investor note.

These stocks are likely to see headwinds if yields continue increasing.

Here's the full list:

ASX 100 Highest & Lowest Correlations to US Bond Yields

Source: FactSet, Macquarie Research, May 2025. Correlation based on weekly changes over last 3 years

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10