Oracle Corp. (NYSE:ORCL) reported better-than-expected fourth-quarter financial results and issued upbeat outlook commentary on Wednesday.

The company reported fourth-quarter revenue of $15.9 billion, beating analyst estimates of $15.58 billion. The company reported fourth-quarter adjusted earnings of $1.70 per share, beating analyst estimates of $1.64 per share, according to Benzinga Pro.

"FY25 was a very good year — but we believe FY26 will be even better as our revenue growth rates will be dramatically higher," said Safra Catz, CEO of Oracle. "We expect our total cloud growth rate — applications plus infrastructure — will increase from 24% in FY25 to over 40% in FY26. Cloud Infrastructure growth rate is expected to increase from 50% in FY25 to over 70% in FY26. And RPO is likely to grow more than 100% in FY26."

Oracle's board declared a quarterly cash dividend of 50 cents per share, payable on July 24 to shareholders of record as of July 10.

Oracle's shares fell 0.6% to close at $176.38 on Wednesday.

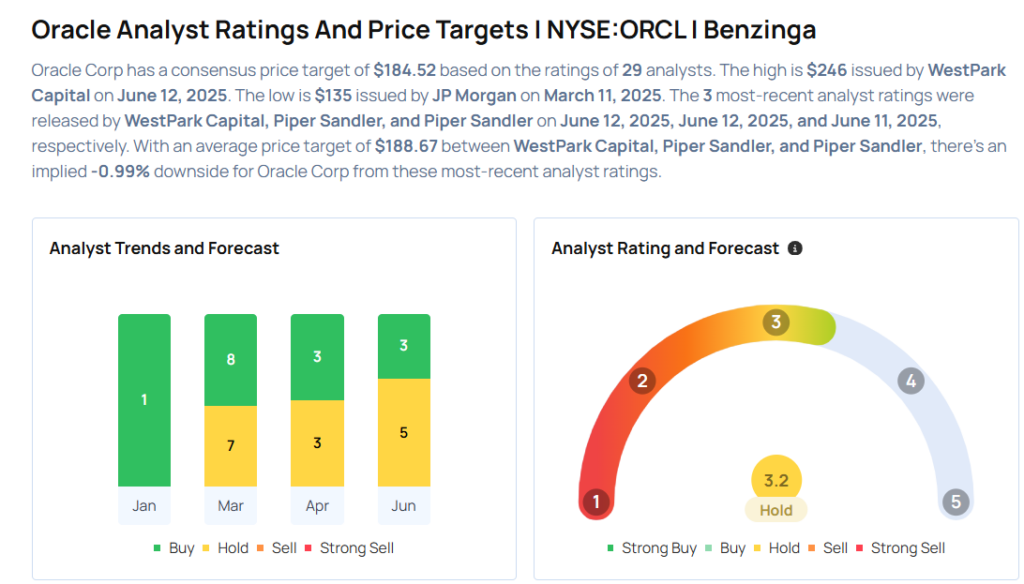

These analysts made changes to their price targets on Oracle following earnings announcement.

- Piper Sandler analyst Brent Bracelin maintained Oracle with a Neutral and raised the price target from $130 to $190.

- WestPark Capital analyst Curtis Shauger maintained the stock with a Buy and boosted the price target from $195 to $246.

Considering buying ORCL stock? Here’s what analysts think:

Read This Next:

- Top 2 Consumer Stocks That May Plunge In June

Photo via Shutterstock