G-III Apparel Group, LTD. (NASDAQ:GIII) posted better-than-expected earnings for its first quarter on Friday.

The company reported first-quarter adjusted earnings per share of 19 cents, beating the analyst consensus estimate of 12 cents. Quarterly sales of $583.61 million (down 4% year over year), outpacing the Street view of $580.37 million.

"Our performance was fueled by double-digit growth of our key owned brands, DKNY, Karl Lagerfeld and Donna Karan, which largely offset the exit of the Calvin Klein jeans and sportswear businesses," said CEO Morris Goldfarb.

Due to tariff and macro uncertainty, G-III Apparel withdraws FY26 profit guidance and sees a $135 million unmitigated tariff hit, mostly in the second half. G-III Apparel Group affirms FY2026 sales guidance of $3.14 billion vs $3.12 billion estimate.

As previously planned, the company continues to expect sales to be lower in the first half of fiscal 2026 than in the previous year, with acceleration expected in the second half of fiscal 2026.

G-III Apparel Group expects second-quarter EPS of $0.02–$0.12 and revenue of approximately $570 million versus the $621 million estimate.

G-III Apparel shares fell 2.7% to trade at $21.90 on Monday.

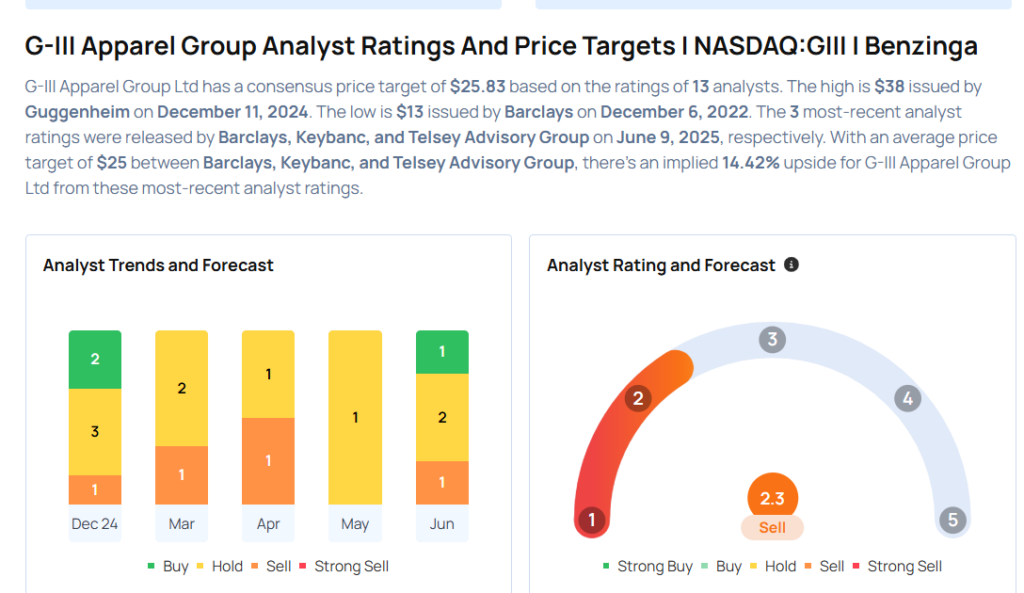

These analysts made changes to their price targets on G-III Apparel following earnings announcement.

- Telsey Advisory Group analyst Dana Telsey maintained G-III Apparel with a Market Perform and lowered the price target from $30 to $27.

- Keybanc analyst Ashley Owens maintained the stock with an Overweight rating and lowered the price target from $40 to $30.

- Barclays analyst Paul Kearney maintained G-III Apparel with an Underweight rating and cut the price target from $21 to $18.

Considering buying GIII stock? Here’s what analysts think:

Read This Next:

- Oracle To Rally Around 15%? Here Are 10 Top Analyst Forecasts For Monday

Photo via Shutterstock