Litecoin price forms bullish flag as LTC ETF odds jumps 7 seconds ago

Litecoin has pulled back in the past month, erasing its gains after bottoming in April.

Litecoin (LTC) was trading at $85.98 on Sunday, down by almost 20% from its highest point in May. This pullback has mirrored that of other altcoins like Cardano (ADA) and Chainlink (LINK).

Litecoin has pulled back despite data showing that the odds of the Securities and Exchange Commission approving a LTC ETF have jumped to 76%.

The probability that the agency will approve the ETF is high because it is a proof-of-work cryptocurrency like Bitcoin (BTC). Its main difference from Bitcoin is its supply limit of 84 million coins, compared to Bitcoin’s 21 million.

Therefore, since the SEC has already approved Bitcoin ETFs, there is a good chance it will do the same for Litecoin. An LTC ETF approval would be good for the coin since it would likely lead to more inflows from American investors.

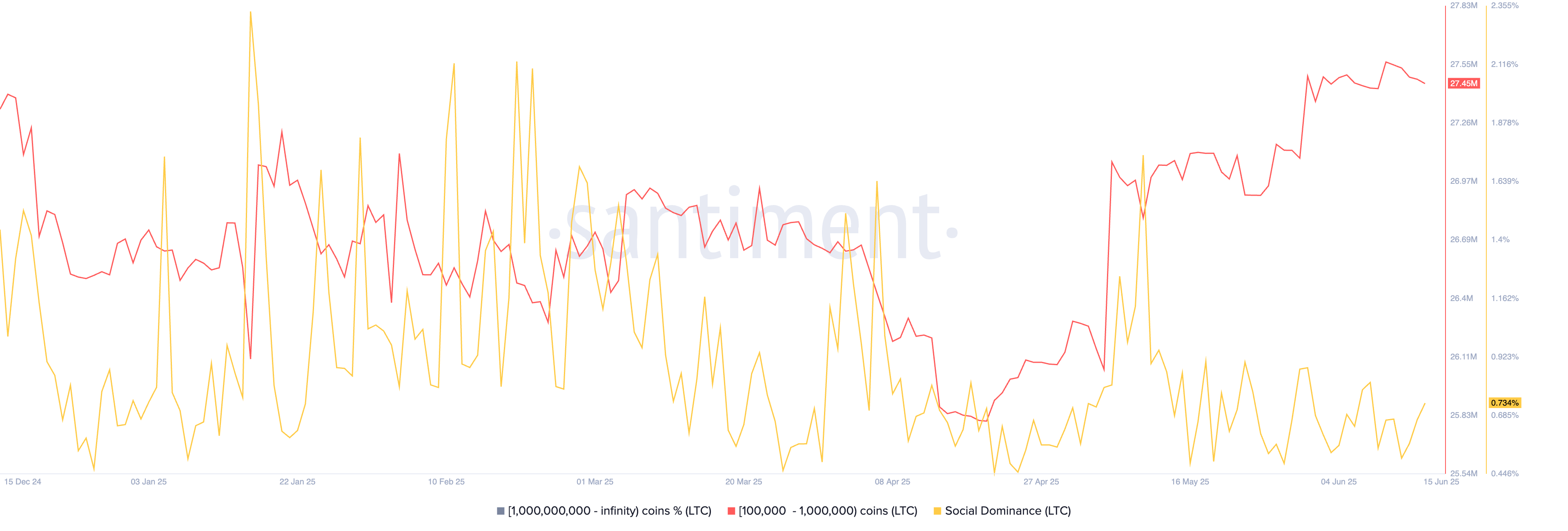

Another potential catalyst for LTC price is that whales have continued accumulating it. Santiment data shows that the accounts holding between 100,000 and 1 million tokens have increased their holdings from 25.8 million on April 15 to 27.8 million today.

Further data shows that Litecoin’s social dominance has pointed upwards in the past few days, a sign that it is attracting attention from social media users. It rose to 0.734% from 0.512%.

Litecoin price technical analysis

The daily chart shows that the LTC price dropped to $63.30 in April and then bounced back to $106.72 as the crypto market rally happened.

Recently, however, it has pulled back and moved below the 50-day and 200-day Exponential Moving Averages. Falling below that level is a sign that bears have prevailed.

Litecoin price has formed a bullish flag chart pattern, a popular continuation sign. This pattern comprises of a vertical line, which in this case starts at $63.29 and ends at $106.72. It is now forming the flag section in the form of a descending channel.

Therefore, Litecoin price will likely rebound, and initially target the resistance at $106.7, which is up by 25% from the current level. A climb above that resistance will point to more gains, potentially to $140, the highest swing in January and February this year.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10