TradingKey - Following last week’s auctions of 10-year and 30-year U.S. Treasuries, Monday’s 20-year bond auction delivered solid results, continuing to ease investor concerns over the long-end of the bond market. However, a recent report from Bank of America warns that cracks are emerging in foreign demand for U.S. debt.

On Monday, June 16, the U.S. Treasury auctioned $13 billion in 20-year bonds. The results were as follows:

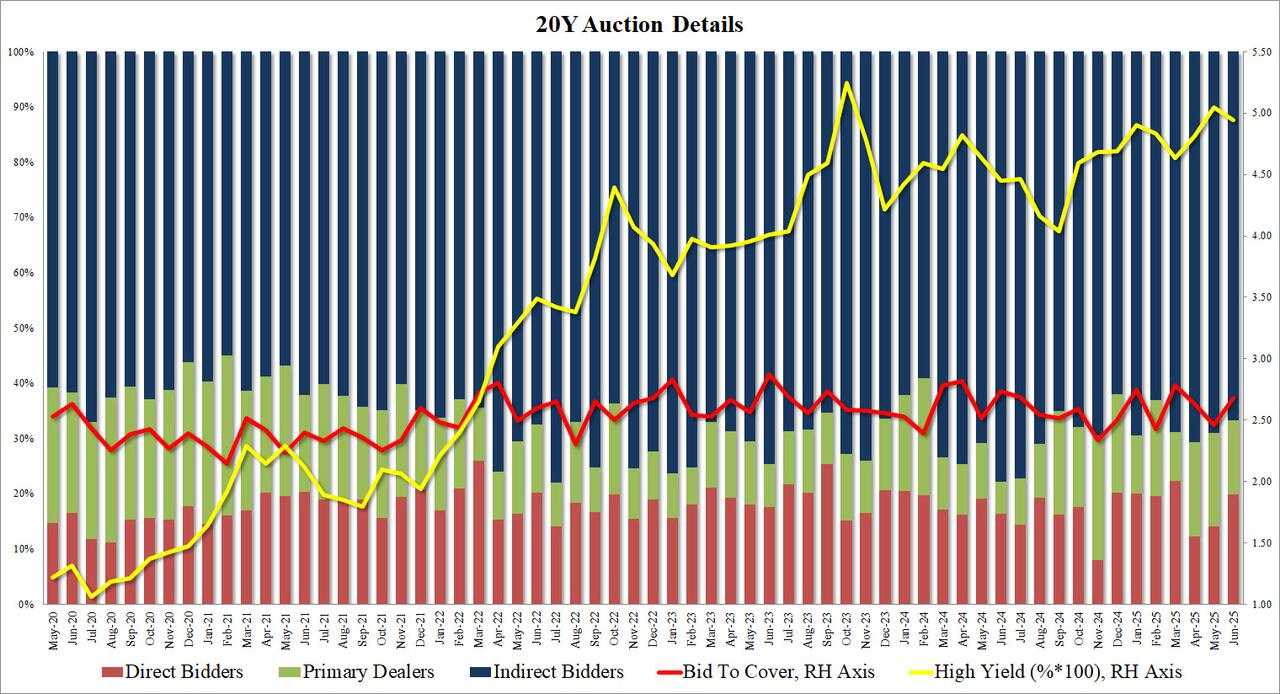

- High yield: 4.942%, down from 5.047% at May’s auction

- Bid-to-cover ratio: 2.68, the highest since March this year, and above the recent six-auction average of 2.59

- Indirect bidders (a proxy for foreign demand): accounted for 66.7%, slightly below the previous auction’s 69.0% and near the recent average of 67.2%

U.S. 20-Year Bond Auction, Source: ZeroHedge

ZeroHedge commented that the auction was “solid and smooth”, with little reaction seen in secondary markets. At the time of writing (June 17), the yield on the U.S. 20-year bond stood at 4.954%.

Auctions Offer Temporary Relief, But Concerns Remain

In recent months, uncertainty around Trump tariffs and concerns over the U.S. fiscal deficit have led foreign investors to pull back from U.S. long-term bonds. However, the three consecutive strong long-dated bond auctions have provided some relief.

Despite this, Bank of America has raised red flags regarding weakening overseas appetite for U.S. debt.

In a report titled "Foreign UST demand shows cracks", published on Monday, BofA analysts noted that central banks have been selling U.S. Treasuries since March, reflecting a broader trend of diversifying away from dollar assets.

As of the week ending June 11, central banks and other official institutions reduced their holdings of U.S. Treasuries held at the New York Fed by an average of $17 billion, bringing total reductions since late March to $48 billion.

The bank called this decline “unusual,” as central banks typically buy U.S. bonds when the dollar weakens. This year, the Bloomberg Dollar Index has fallen about 8%, hitting a three-year low — yet official foreign demand for U.S. debt continues to wane.

BofA warned that future foreign demand remains a concern, especially as more global investors seek to reduce exposure to U.S. assets or increase hedging.

The report also pointed out that foreign participation has continued to fall in recent auctions of both 2-year and 20-year U.S. Treasury bonds.

Find out more