KB Home Analysts Slash Their Forecasts After Q2 Earnings

KB Home (NYSE:KBH) posted better-than-expected earnings for the second quarter after the closing bell on Monday.

KB Home reported second-quarter revenue of $1.52 billion, beating analyst estimates of $1.51 billion. The company reported second-quarter earnings of $1.50 per share, beating analyst estimates of $1.47 per share, according to Benzinga Pro.

"Our second quarter financial performance was solid, with results meeting or exceeding our guidance ranges, as we continue to navigate the current environment. Our team is producing improvements in two key areas, lowering our build times and reducing direct construction costs, helping to strengthen our business," said Jeffrey Mezger, chairman and CEO of KB Home.

KB Home expects full-year 2025 housing revenue to be in the range of $6.3 billion to $6.5 billion, down from prior guidance of $6.6 billion to $7 billion. The company anticipates 2025 average selling prices of $480,000 to $490,000.

KB Home shares gained 0.8% to trade at $53.72 on Tuesday.

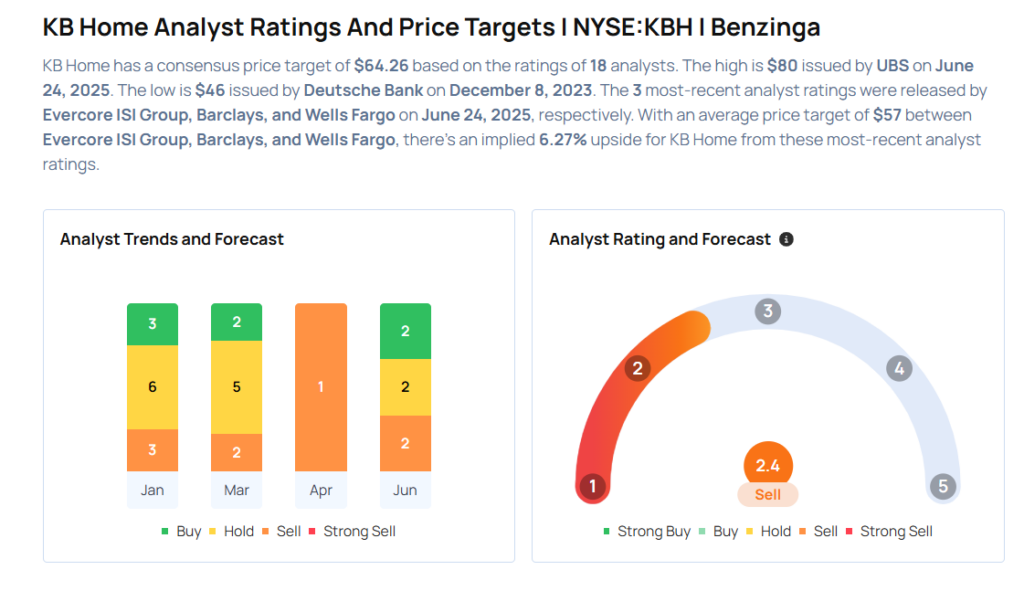

These analysts made changes to their price targets on KB Home following earnings announcement.

- B of A Securities analyst Rafe Jadrosich maintained KB Home with a Neutral and lowered the price target from $58 to $54.

- UBS analyst John Lovallo maintained the stock with a Buy and cut the price target from $86 to $80.

- Wells Fargo analyst Sam Reid maintained KB Home with an Underweight rating and lowered the price target from $53 to $52.

- Barclays analyst Matthew Bouley maintained the stock with an Equal-Weight rating and lowered the price target from $56 to $49.

- Evercore ISI Group analyst Stephen Kim maintained KB Home with an Outperform rating and cut the price target from $77 to $70.

Considering buying KBH stock? Here’s what analysts think:

Read This Next:

- BlackBerry Gears Up For Q1 Print; Here Are The Recent Forecast Changes From Wall Street’s Most Accurate Analysts

Photo via Shutterstock

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10