Vitalik Drops Two Trillion in Meme Tokens: ETH Market Reacts Instantly

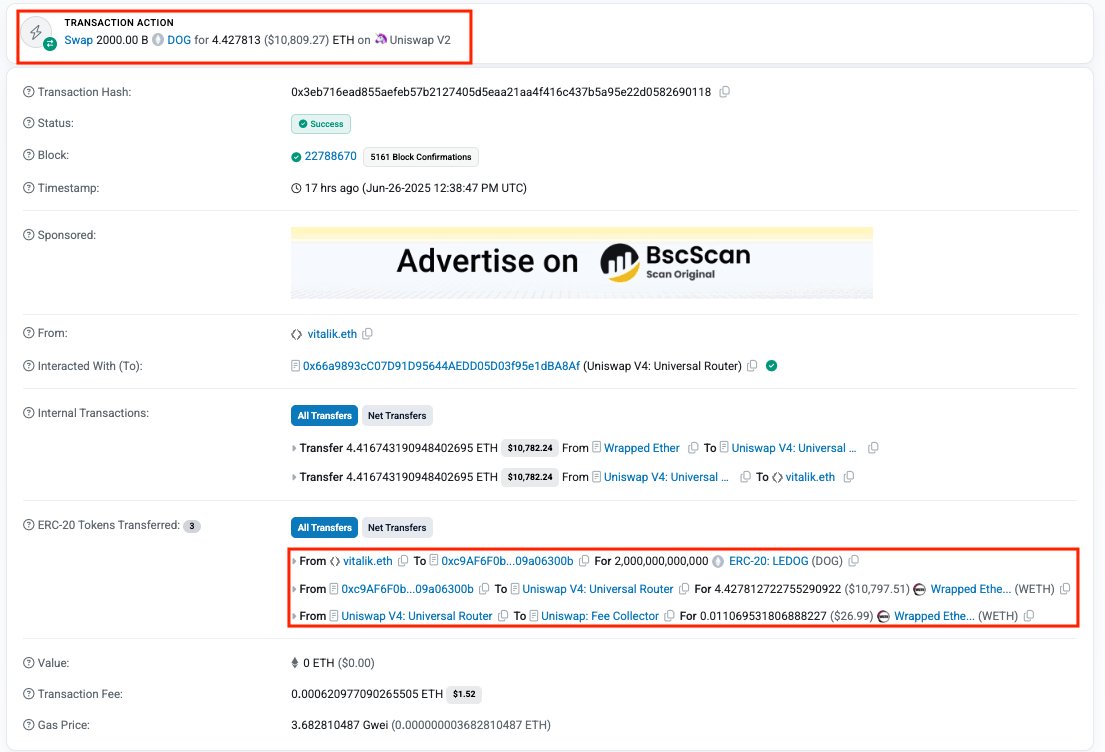

Vitalik Buterin, cofounder of Ethereum, recently sold an astounding two trillion DOG tokens on Uniswap V4. The transaction, which is visible on the blockchain explorer, demonstrates that the tokens were delivered to his address — likely without his consent, as is frequently the case when meme coin developers attempt to capitalize on his notoriety. Instead of keeping tokens, Vitalik quickly sold them, turning them into Ethereum, a decision that nearly instantly caused a stir in the market.

The exact moment this swap occurred is marked by a noticeable volume spike on the ETH hourly chart. Fast-moving traders and bots anticipated volatility from either a wider chain reaction or abrupt sell pressure. In monetary terms, 4.4 ETH is hardly a whale-scale liquidation, but the symbolism is what counts, and holders have been known to become alarmed by big token sales by people like Buterin.

In particular, meme coins are susceptible to this. In the past, the tokens frequently go into a death spiral of panic selling liquidity drains and plunging price floors when well-known individuals sell off such holdings. A lot of low-cap projects experienced this collapsing nearly immediately after their distributions were dumping. If trust wanes, DOG may suffer a similar fate.

It is important to keep in mind that not all meme coins collapse instantly. For instance, Shiba Inu managed to withstand a much more extensive sell-off by Buterin and subsequently became one of the market's largest meme assets. Therefore, although today's action is concerning, it is not necessarily a death sentence; however, the onus of proof rests with the DOG community to maintain the line.

Additionally given Buterin's history of swiftly redistributing or selling such assets, the ETH that was purchased might wind up back on the market. This possible overhang raises additional concerns about Ethereum's short-term price stability. Micro-cap meme coin owners should always evaluate their risks correctly in order to avoid losses ignited by large sell-offs.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10