Paychex, Inc. (NASDAQ:PAYX) reported in-line fiscal fourth-quarter 2025 earnings on Wednesday.

The company reported quarterly revenue growth of 10% year-on-year to $1.43 billion, marginally missing the analyst consensus estimate of $1.44 billion. The company reported an adjusted EPS of $1.19, which aligns with the analyst consensus estimate.

“Paychex demonstrated solid performance this year against our strategic objectives, underscoring our ability to effectively navigate dynamic market conditions while continuing to enhance our customer experience and market position, and maintaining our industry-leading operating margins,” stated John Gibson, President and Chief Executive Officer.

Paychex expects fiscal revenue of $6.49 billion-$6.60 billion versus the $6.36 billion analyst consensus estimate. It projects fiscal adjusted EPS of $5.40-$5.50 versus the $5.31 analyst consensus estimate. The company expects a fiscal adjusted operating margin of ~43%.

Paychex shares rose 2% to trade at $140.66 on Thursday.

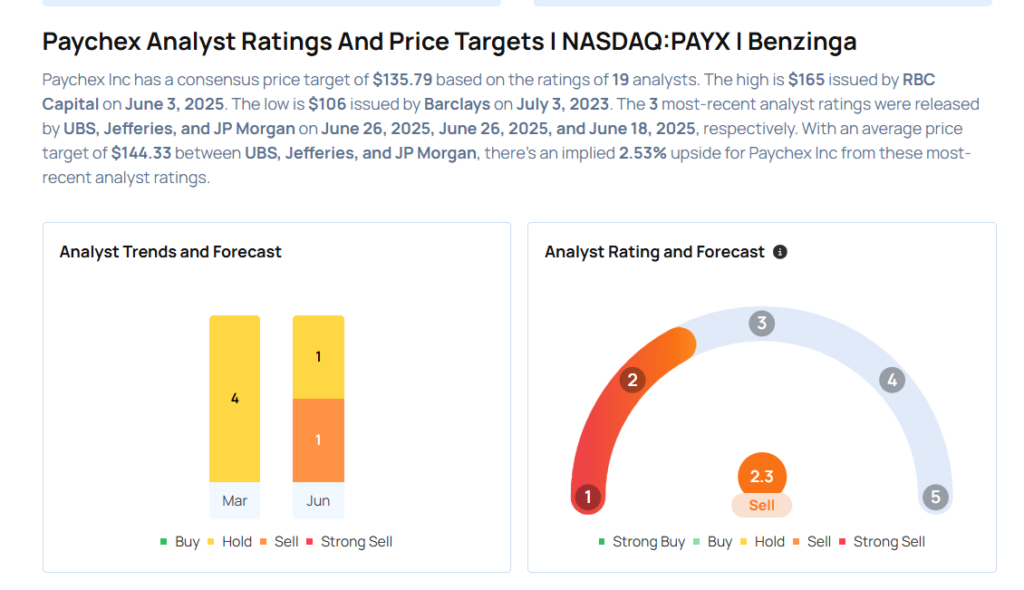

These analysts made changes to their price targets on Paychex following earnings announcement.

- Jefferies analyst Samad Samana maintained Paychex with a Hold and lowered the price target from $155 to $140.

- UBS analyst Kevin Mcveigh maintained the stock with a Neutral and lowered the price target from $155 to $145.

Considering buying PAYX stock? Here’s what analysts think:

Read This Next:

- Top 2 Utilities Stocks That May Fall Off A Cliff In Q2

Photo via Shutterstock