Bank of Jiujiang's (HKG:6190) Shareholders Will Receive A Smaller Dividend Than Last Year

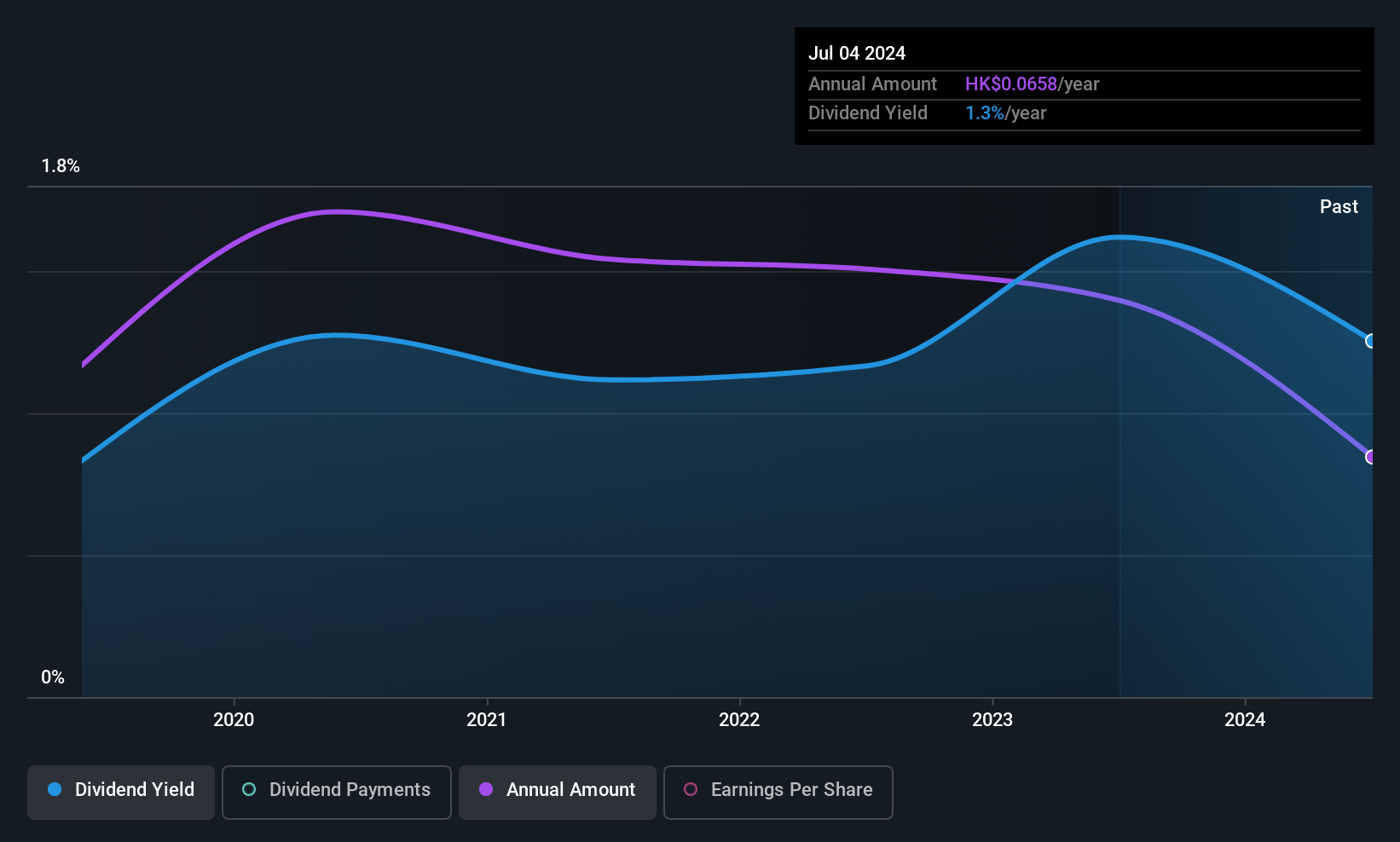

Bank of Jiujiang Co., Ltd. (HKG:6190) is reducing its dividend from last year's comparable payment to CN¥0.0624 on the 31st of July. This means that the dividend yield is 1.6%, which is a bit low when comparing to other companies in the industry.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

Bank of Jiujiang Not Expected To Earn Enough To Cover Its Payments

If it is predictable over a long period, even low dividend yields can be attractive.

Bank of Jiujiang has established itself as a dividend paying company, given its 6-year history of distributing earnings to shareholders. Past distributions unfortunately do not guarantee future ones, and Bank of Jiujiang's last earnings report actually showed that the company went over its net earnings in its total dividend distribution. This value is at an alarming sign that could mean that Bank of Jiujiang's dividend at its current rate may no longer be sustainable for longer.

EPS is set to fall by 56.0% over the next 12 months if recent trends continue. Assuming the dividend continues along recent trends, we believe the future payout ratio could reach 1,066%, which could put the dividend under pressure if earnings don't start to improve.

View our latest analysis for Bank of Jiujiang

Bank of Jiujiang's Dividend Has Lacked Consistency

Bank of Jiujiang has been paying dividends for a while, but the track record isn't stellar. This suggests that the dividend might not be the most reliable. Since 2019, the dividend has gone from CN¥0.08 total annually to CN¥0.057. Doing the maths, this is a decline of about 5.5% per year. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. Bank of Jiujiang's EPS has fallen by approximately 56% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

We're Not Big Fans Of Bank of Jiujiang's Dividend

To sum up, we don't like when dividends are cut, but in this case the dividend may have been too high to begin with. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Overall, this doesn't get us very excited from an income standpoint.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 2 warning signs for Bank of Jiujiang (of which 1 shouldn't be ignored!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Jiujiang might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10