Asian Penny Stocks: LX Technology Group Leads 3 Compelling Picks

As global markets experience a resurgence, with notable developments such as the new trade deal between the U.S. and China, investor sentiment is buoyed by optimism across major indices. Amidst this backdrop, penny stocks in Asia emerge as intriguing prospects for those seeking opportunities beyond traditional blue-chip investments. While often associated with smaller or newer companies, these stocks can present underappreciated growth potential when backed by solid financials and robust fundamentals. In this article, we explore three Asian penny stocks that stand out for their resilience and potential to offer significant returns.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.29 | HK$813.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.04 | HK$3.53B | ✅ 5 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.27 | HK$1.89B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.05 | HK$1.75B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.25 | SGD8.86B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.182 | SGD36.26M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.12 | SGD855.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.64 | HK$53.16B | ✅ 4 ⚠️ 1 View Analysis > |

| United Energy Group (SEHK:467) | HK$0.52 | HK$13.44B | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 1,001 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

LX Technology Group (SEHK:2436)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: LX Technology Group Limited offers device lifecycle management solutions in the People’s Republic of China and Hong Kong, with a market capitalization of approximately HK$1.02 billion.

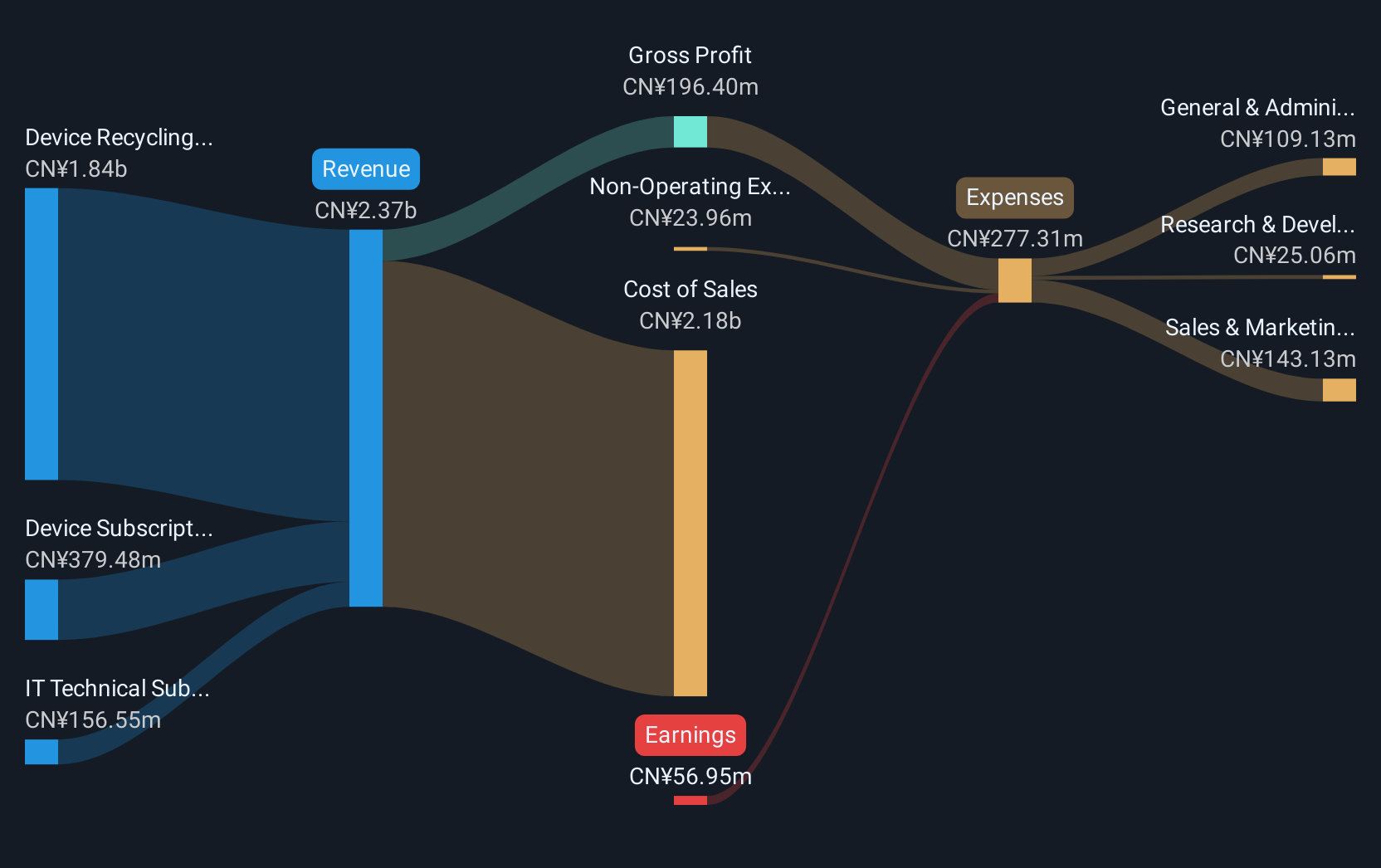

Operations: The company's revenue is derived from three main segments: Device Recycling (CN¥1.84 billion), Device Subscription (CN¥379.48 million), and IT Technical Subscription (CN¥156.55 million).

Market Cap: HK$1.02B

LX Technology Group Limited, with a market capitalization of HK$1.02 billion, derives significant revenue from device lifecycle management solutions in China and Hong Kong. Despite being unprofitable, the company has reduced its losses by 19.8% annually over the past five years and maintains a seasoned management team with an average tenure of 6.2 years. The company's short-term assets exceed both short- and long-term liabilities, indicating solid liquidity. However, it faces high volatility in share price and a net debt to equity ratio of 56.8%. Shareholders have not experienced meaningful dilution recently, reflecting stability in ownership structure.

- Dive into the specifics of LX Technology Group here with our thorough balance sheet health report.

- Examine LX Technology Group's past performance report to understand how it has performed in prior years.

PropNex (SGX:OYY)

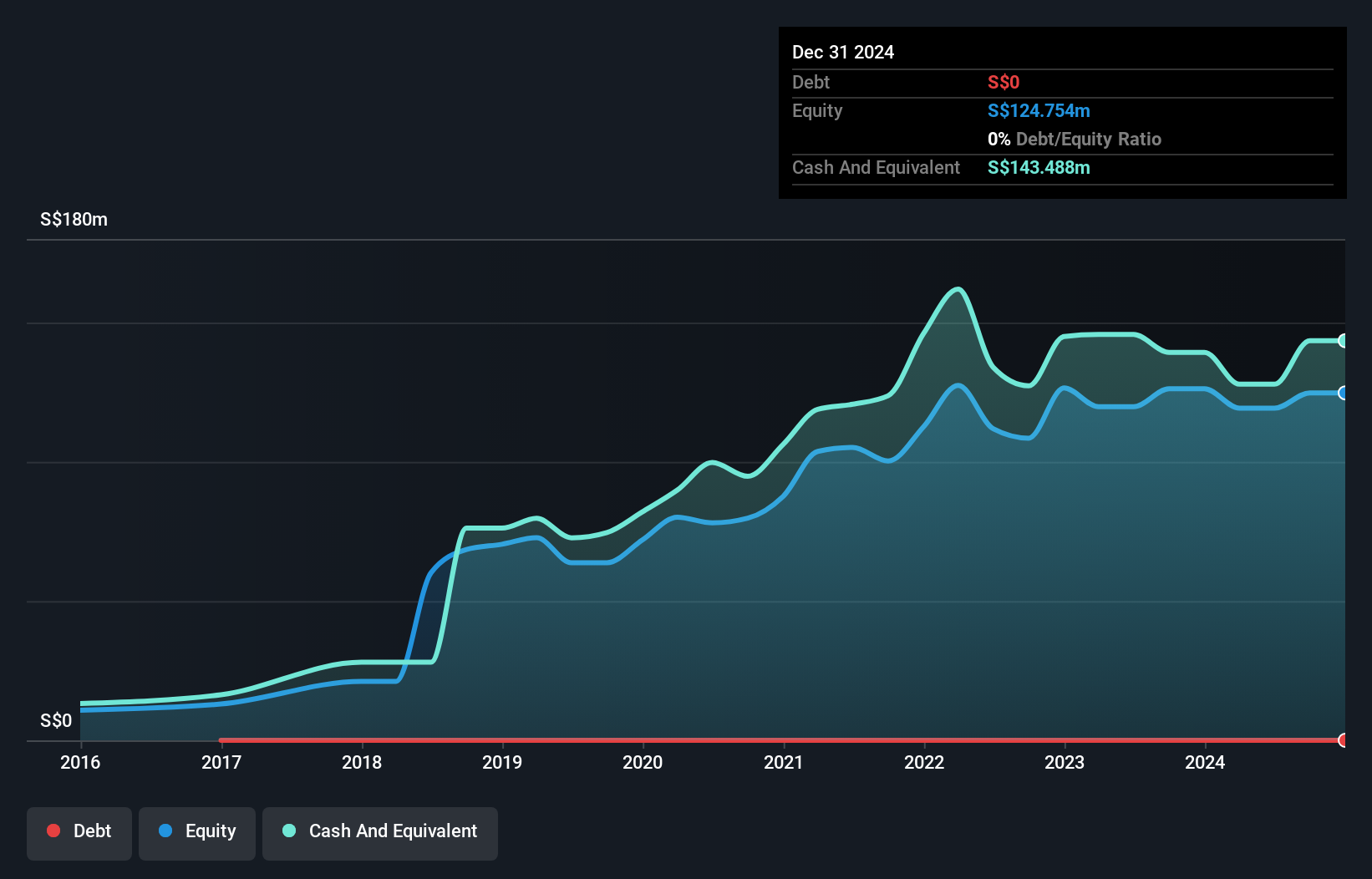

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PropNex Limited is an investment holding company that offers real estate services in Singapore, with a market capitalization of SGD 814 million.

Operations: The company's revenue is primarily derived from Agency Services at SGD 591.61 million and Project Marketing Services at SGD 185.57 million, with additional contributions from Training Services at SGD 3.48 million and Administrative Support Services at SGD 2.29 million.

Market Cap: SGD814M

PropNex Limited, with a market cap of SGD 814 million, has shown mixed performance as a penny stock. Despite being debt-free and having high-quality earnings, the company faces challenges such as negative earnings growth over the past year and unsustainable dividend coverage. Its net profit margin has declined slightly to 5.2%, and management is relatively inexperienced with an average tenure of 1.9 years. However, PropNex maintains strong liquidity with short-term assets exceeding liabilities and offers a high return on equity at 33.4%. The stock trades significantly below estimated fair value, presenting potential opportunities for investors mindful of its volatility and recent financial performance trends.

- Click here to discover the nuances of PropNex with our detailed analytical financial health report.

- Evaluate PropNex's prospects by accessing our earnings growth report.

Quzhou Xin'an Development (SHSE:600208)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quzhou Xin'an Development Co., Ltd. operates in real estate development, technology manufacturing, and financial services in China with a market cap of CN¥24.32 billion.

Operations: The company generates CN¥14.59 billion in revenue from its operations in China.

Market Cap: CN¥24.32B

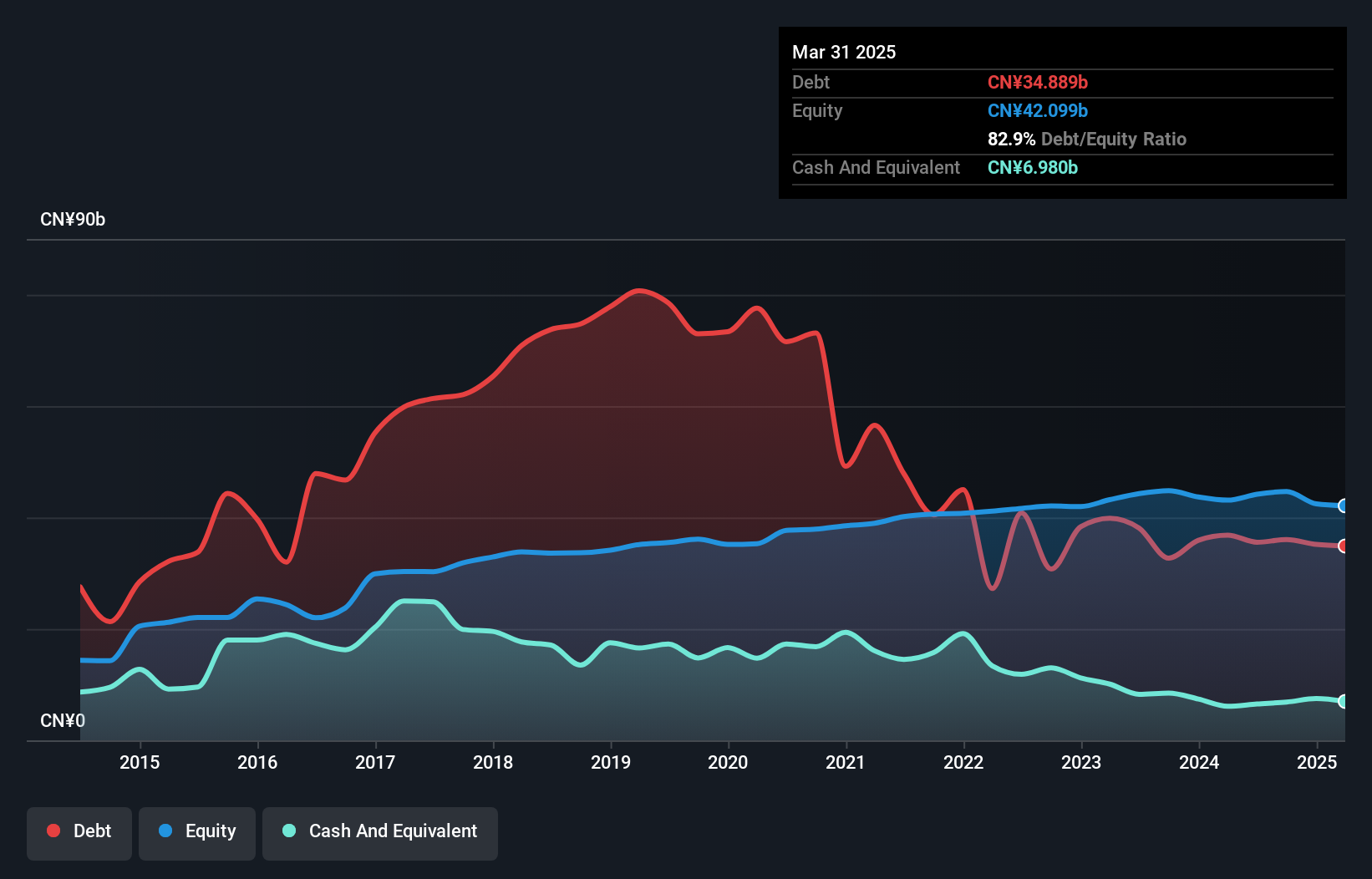

Quzhou Xin'an Development, with a market cap of CN¥24.32 billion, presents a complex picture for potential investors. The company's revenue has dropped significantly to CN¥344.89 million from CN¥2.24 billion year-on-year, yet net income rose to CN¥423.95 million, indicating improved profit margins of 7.3%. Despite high debt levels and low return on equity at 4.5%, the company maintains strong short-term asset coverage over liabilities and has reduced its debt-to-equity ratio over five years. Trading at good value relative to peers, it offers high-quality earnings but faces challenges with negative recent earnings growth and limited operating cash flow coverage for its debt obligations.

- Click to explore a detailed breakdown of our findings in Quzhou Xin'an Development's financial health report.

- Assess Quzhou Xin'an Development's future earnings estimates with our detailed growth reports.

Make It Happen

- Unlock our comprehensive list of 1,001 Asian Penny Stocks by clicking here.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 22 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10