EverCommerce Inc. (NASDAQ:EVCM) About To Shift From Loss To Profit

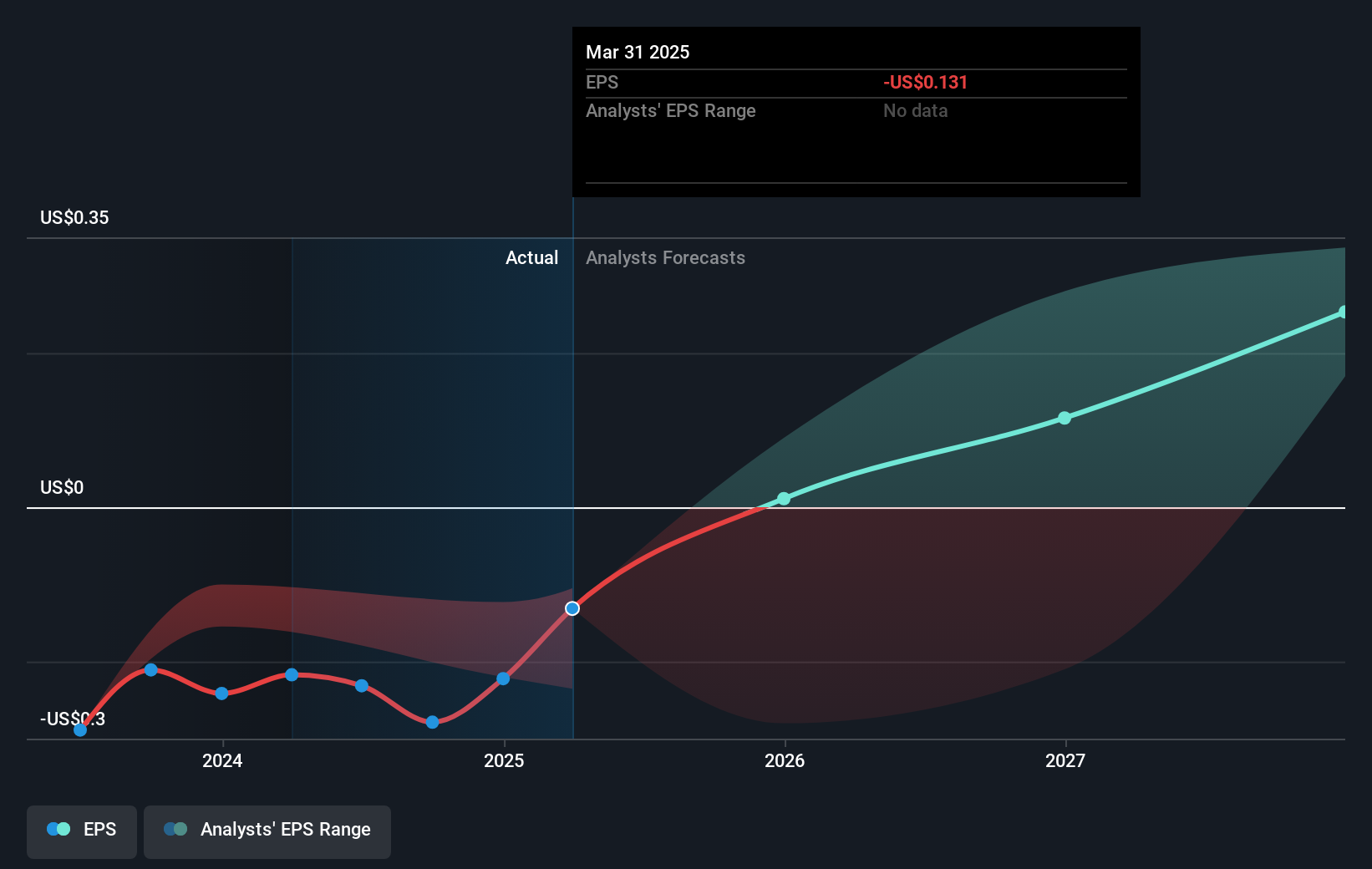

We feel now is a pretty good time to analyse EverCommerce Inc.'s (NASDAQ:EVCM) business as it appears the company may be on the cusp of a considerable accomplishment. EverCommerce Inc., together with its subsidiaries, provides integrated software-as-a-service solutions for service-based small and medium-sized businesses in the United States and internationally. The US$1.9b market-cap company’s loss lessened since it announced a US$41m loss in the full financial year, compared to the latest trailing-twelve-month loss of US$24m, as it approaches breakeven. Many investors are wondering about the rate at which EverCommerce will turn a profit, with the big question being “when will the company breakeven?” In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

EverCommerce is bordering on breakeven, according to the 10 American Software analysts. They expect the company to post a final loss in 2024, before turning a profit of US$15m in 2025. So, the company is predicted to breakeven approximately a year from now or less! At what rate will the company have to grow in order to realise the consensus estimates forecasting breakeven in under 12 months? Using a line of best fit, we calculated an average annual growth rate of 88%, which is extremely buoyant. Should the business grow at a slower rate, it will become profitable at a later date than expected.

We're not going to go through company-specific developments for EverCommerce given that this is a high-level summary, however, take into account that generally a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

View our latest analysis for EverCommerce

One thing we would like to bring into light with EverCommerce is its relatively high level of debt. Typically, debt shouldn’t exceed 40% of your equity, which in EverCommerce's case is 72%. Note that a higher debt obligation increases the risk around investing in the loss-making company.

Next Steps:

This article is not intended to be a comprehensive analysis on EverCommerce, so if you are interested in understanding the company at a deeper level, take a look at EverCommerce's company page on Simply Wall St. We've also put together a list of essential aspects you should further research:

- Valuation: What is EverCommerce worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether EverCommerce is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on EverCommerce’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

Valuation is complex, but we're here to simplify it.

Discover if EverCommerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10