MidWestOne Financial Group, Inc.'s (NASDAQ:MOFG) high institutional ownership speaks for itself as stock continues to impress, up 9.2% over last week

Key Insights

- Given the large stake in the stock by institutions, MidWestOne Financial Group's stock price might be vulnerable to their trading decisions

- A total of 7 investors have a majority stake in the company with 50% ownership

- Using data from analyst forecasts alongside ownership research, one can better assess the future performance of a company

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

To get a sense of who is truly in control of MidWestOne Financial Group, Inc. (NASDAQ:MOFG), it is important to understand the ownership structure of the business. With 81% stake, institutions possess the maximum shares in the company. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

Last week’s 9.2% gain means that institutional investors were on the positive end of the spectrum even as the company has shown strong longer-term trends. The gains from last week would have further boosted the one-year return to shareholders which currently stand at 43%.

In the chart below, we zoom in on the different ownership groups of MidWestOne Financial Group.

See our latest analysis for MidWestOne Financial Group

What Does The Institutional Ownership Tell Us About MidWestOne Financial Group?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

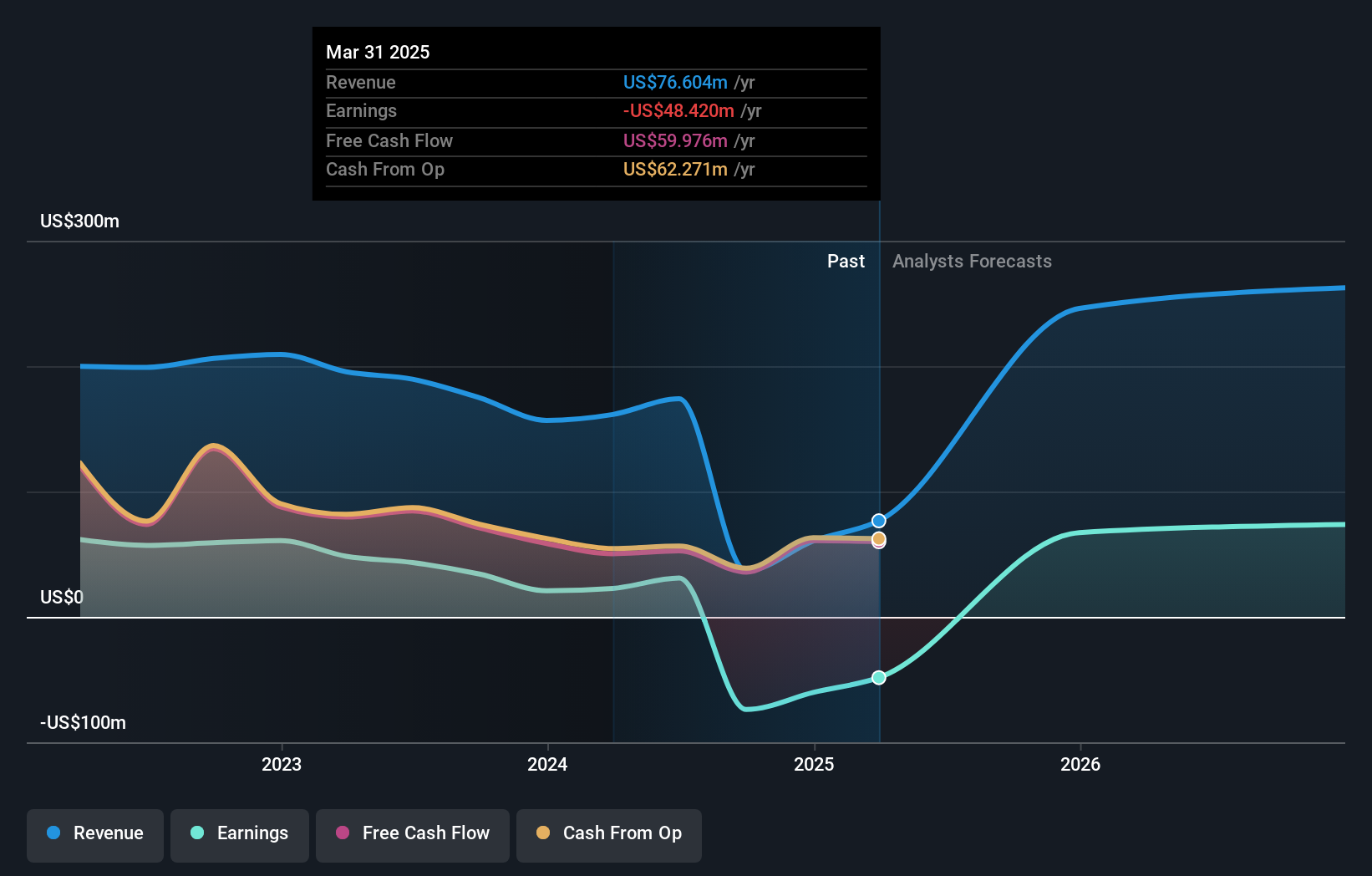

We can see that MidWestOne Financial Group does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of MidWestOne Financial Group, (below). Of course, keep in mind that there are other factors to consider, too.

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. Hedge funds don't have many shares in MidWestOne Financial Group. Our data shows that MidWest One Financial Group, Inc., Asset Management Arm is the largest shareholder with 20% of shares outstanding. For context, the second largest shareholder holds about 7.5% of the shares outstanding, followed by an ownership of 6.4% by the third-largest shareholder.

On further inspection, we found that more than half the company's shares are owned by the top 7 shareholders, suggesting that the interests of the larger shareholders are balanced out to an extent by the smaller ones.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of MidWestOne Financial Group

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Shareholders would probably be interested to learn that insiders own shares in MidWestOne Financial Group, Inc.. As individuals, the insiders collectively own US$17m worth of the US$619m company. Some would say this shows alignment of interests between shareholders and the board. But it might be worth checking if those insiders have been selling.

General Public Ownership

With a 17% ownership, the general public, mostly comprising of individual investors, have some degree of sway over MidWestOne Financial Group. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for MidWestOne Financial Group you should be aware of, and 1 of them makes us a bit uncomfortable.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10