Private companies invested in China Energy Engineering Corporation Limited (HKG:3996) copped the brunt of last week's HK$1.7b market cap decline

Key Insights

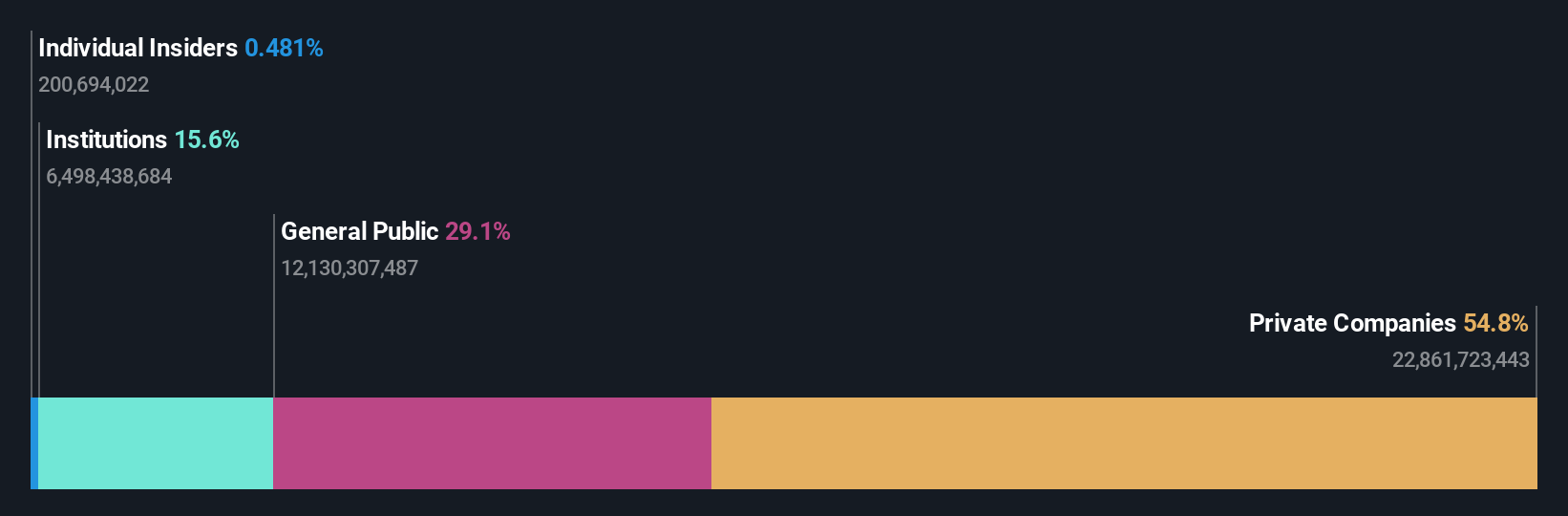

- Significant control over China Energy Engineering by private companies implies that the general public has more power to influence management and governance-related decisions

- The top 3 shareholders own 53% of the company

- Institutional ownership in China Energy Engineering is 16%

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

If you want to know who really controls China Energy Engineering Corporation Limited (HKG:3996), then you'll have to look at the makeup of its share registry. We can see that private companies own the lion's share in the company with 55% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

As market cap fell to HK$89b last week, private companies would have faced the highest losses than any other shareholder groups of the company.

Let's delve deeper into each type of owner of China Energy Engineering, beginning with the chart below.

See our latest analysis for China Energy Engineering

What Does The Institutional Ownership Tell Us About China Energy Engineering?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

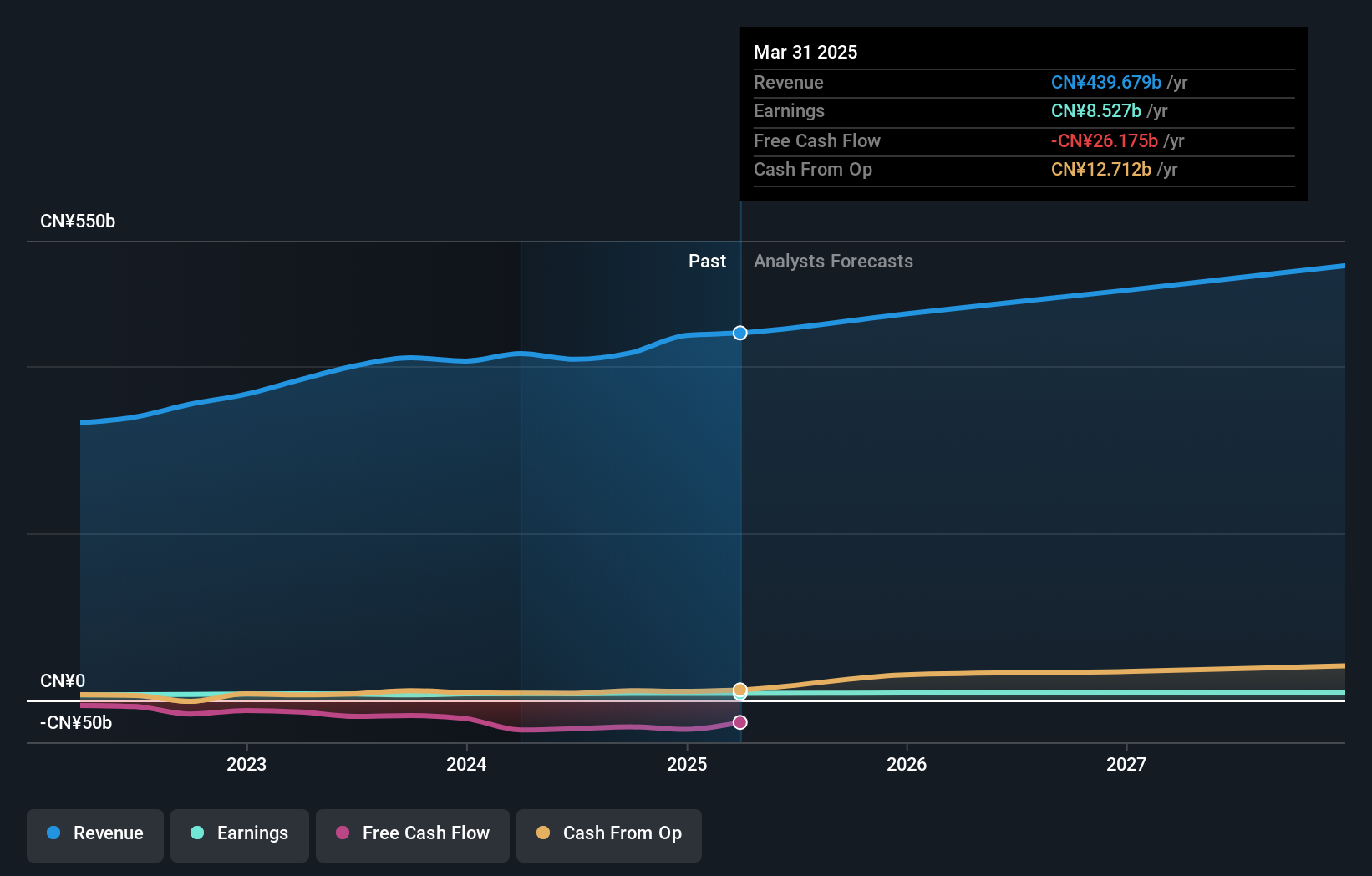

We can see that China Energy Engineering does have institutional investors; and they hold a good portion of the company's stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see China Energy Engineering's historic earnings and revenue below, but keep in mind there's always more to the story.

Hedge funds don't have many shares in China Energy Engineering. The company's largest shareholder is China Energy Engineering Group Co., Ltd., with ownership of 45%. China Reform Holdings Corporation Ltd is the second largest shareholder owning 4.9% of common stock, and The Silk Road Fund Co Ltd. holds about 3.5% of the company stock.

To make our study more interesting, we found that the top 3 shareholders have a majority ownership in the company, meaning that they are powerful enough to influence the decisions of the company.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There is some analyst coverage of the stock, but it could still become more well known, with time.

Insider Ownership Of China Energy Engineering

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our data suggests that insiders own under 1% of China Energy Engineering Corporation Limited in their own names. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. It is a very large company, so it would be surprising to see insiders own a large proportion of the company. Though their holding amounts to less than 1%, we can see that board members collectively own HK$428m worth of shares (at current prices). It is always good to see at least some insider ownership, but it might be worth checking if those insiders have been selling.

General Public Ownership

With a 29% ownership, the general public, mostly comprising of individual investors, have some degree of sway over China Energy Engineering. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

It seems that Private Companies own 55%, of the China Energy Engineering stock. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand China Energy Engineering better, we need to consider many other factors. Take risks for example - China Energy Engineering has 2 warning signs (and 1 which is significant) we think you should know about.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10