Unveiling Three Undiscovered Gems in Australia

As Australian shares anticipate a modest rise and the global market buzzes with record highs in the U.S. indices, small-cap companies are catching investors' attention amid shifting economic landscapes. In this dynamic environment, identifying promising stocks involves looking for those with solid fundamentals and growth potential, offering unique opportunities despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Euroz Hartleys Group | NA | 5.92% | -17.96% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Click here to see the full list of 49 stocks from our ASX Undiscovered Gems With Strong Fundamentals screener.

Here's a peek at a few of the choices from the screener.

Bell Financial Group (ASX:BFG)

Simply Wall St Value Rating: ★★★★☆☆

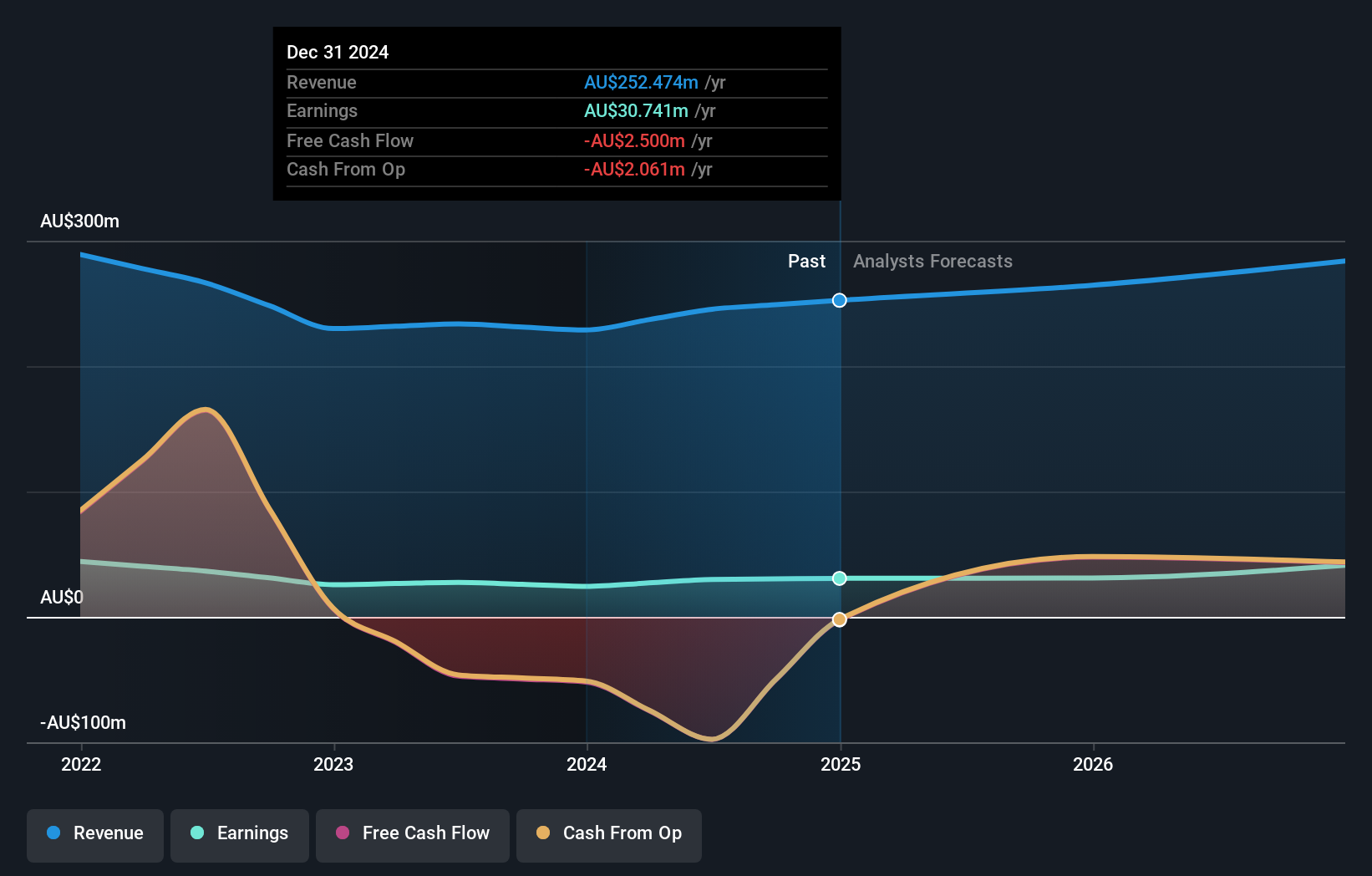

Overview: Bell Financial Group Limited provides full-service and online broking, corporate finance, and financial advisory services to a diverse clientele in Australia and internationally, with a market cap of A$386.50 million.

Operations: The company's revenue streams are primarily derived from broking services, contributing A$173.47 million, followed by products & services at A$51.01 million, and technology & platforms generating A$29.89 million.

Bell Financial Group, a promising player in the Australian financial landscape, is trading at a 14.9% discount to its estimated fair value. Over the past year, earnings surged by 26.4%, outpacing the Capital Markets industry growth of 23.6%. The company has reduced its debt-to-equity ratio significantly from 83.9% to 17.7% over five years, indicating improved financial health and stability. With more cash than total debt and high-quality non-cash earnings, Bell Financial seems well-positioned for further growth despite challenges with free cash flow positivity in recent quarters.

- Navigate through the intricacies of Bell Financial Group with our comprehensive health report here.

Examine Bell Financial Group's past performance report to understand how it has performed in the past.

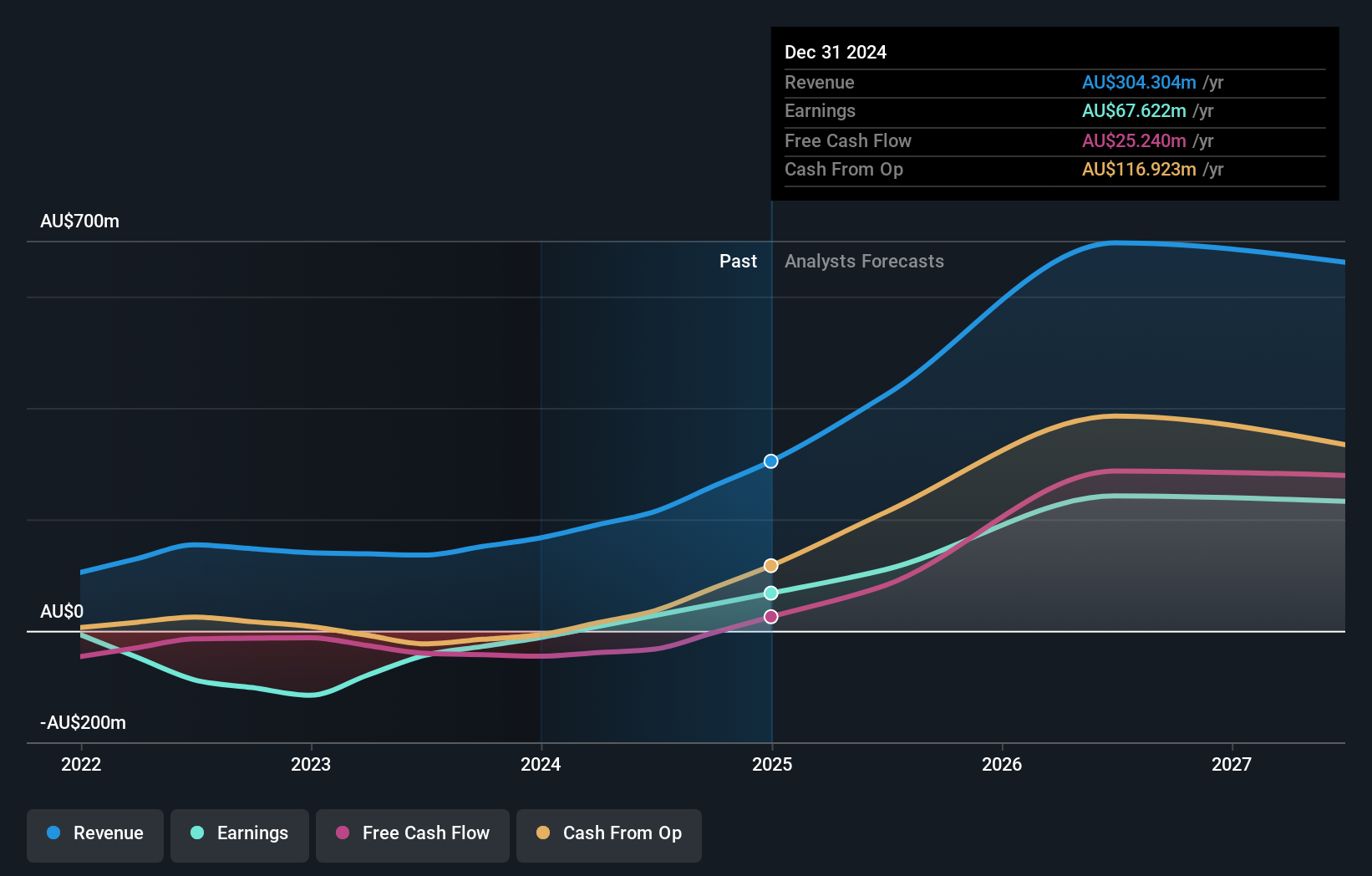

Ora Banda Mining (ASX:OBM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties with a market capitalization of approximately A$1.39 billion.

Operations: Ora Banda Mining generates revenue primarily from its gold mining activities, amounting to A$304.30 million.

Ora Banda Mining, a nimble player in the Australian mining sector, has recently turned profitable, showcasing a promising trajectory with earnings expected to grow 46% annually. The company’s interest payments are comfortably covered by EBIT at 29 times over, indicating robust financial health. With more cash than total debt and a manageable debt-to-equity ratio of 2.6%, OBM's balance sheet remains solid. Trading at roughly 72% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities. Recent participation in the Global Resource Innovation Expo highlights its proactive engagement within the industry landscape.

- Click to explore a detailed breakdown of our findings in Ora Banda Mining's health report.

Assess Ora Banda Mining's past performance with our detailed historical performance reports.

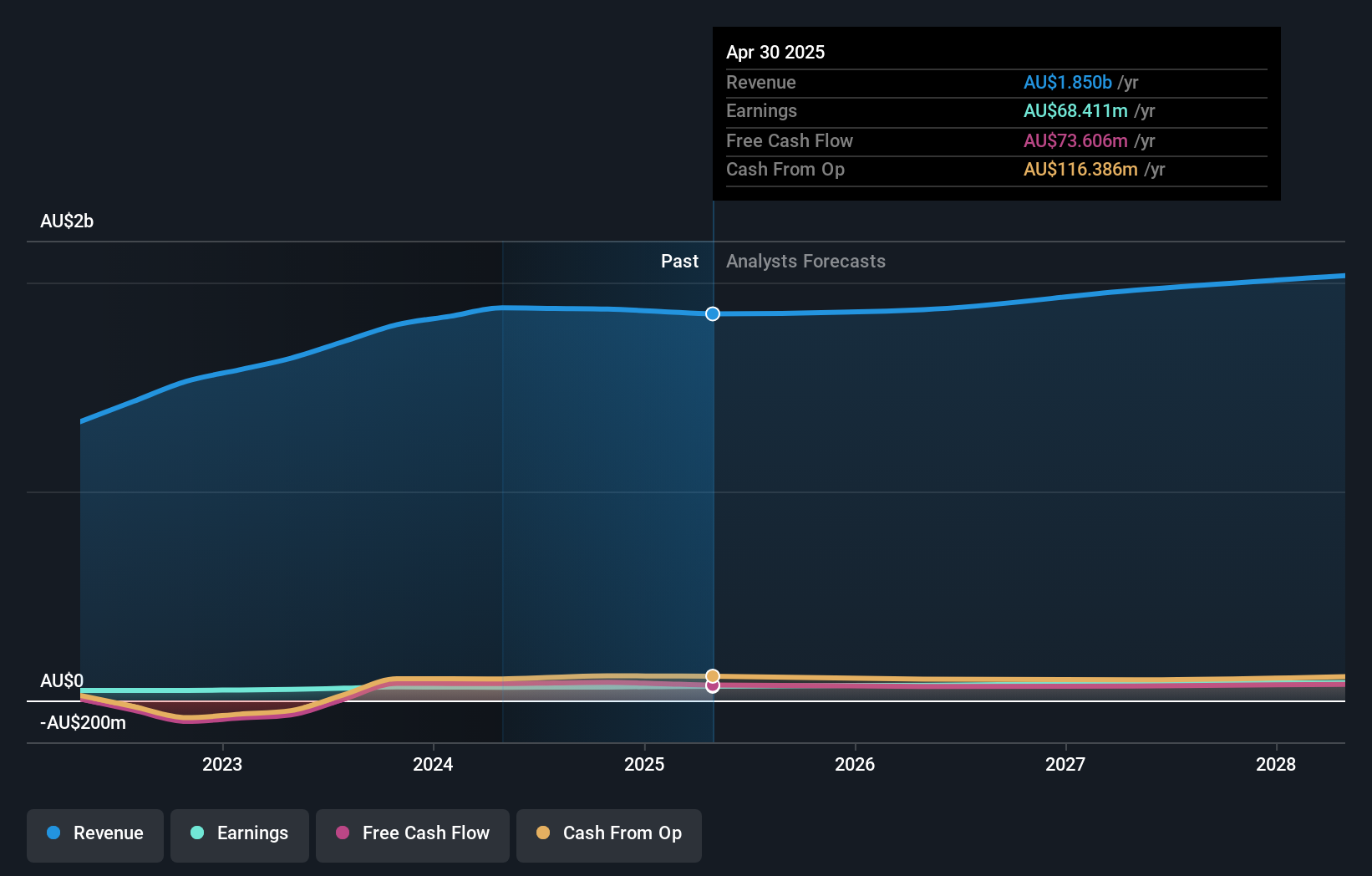

Ricegrowers (ASX:SGLLV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ricegrowers Limited is a rice food company with operations spanning Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia, and North America; it has a market capitalization of A$677.31 million.

Operations: Ricegrowers Limited generates revenue primarily from its International Rice segment, contributing A$860.96 million, and the Rice Pool segment with A$481.87 million. Other significant segments include Cop Rice at A$250.64 million and Riviana at A$231.14 million, while the Corporate Segment adds A$26.93 million to total revenues.

Ricegrowers, a nimble player in the food industry, is making waves with its strategic expansion into the Middle East and U.S., capitalizing on rising rice demand. The company reported net income of A$68.41 million for the year ending April 2025, up from A$63.14 million previously. Its earnings per share increased to A$1.029 from A$0.975, showcasing solid growth despite a slight dip in sales to A$1,844.61 million from A$1,874.17 million last year. With investments in agritech and manufacturing efficiencies alongside environmental sustainability efforts, Ricegrowers aims to enhance profit margins while navigating challenges like cost inflation and competitive pressures.

- Ricegrowers is strategically expanding into high-growth regions to leverage rising rice demand; click here to explore the full narrative on their growth strategy.

Make It Happen

- Unlock more gems! Our ASX Undiscovered Gems With Strong Fundamentals screener has unearthed 46 more companies for you to explore.Click here to unveil our expertly curated list of 49 ASX Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bell Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10