We're Hopeful That LARK Distilling (ASX:LRK) Will Use Its Cash Wisely

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether LARK Distilling (ASX:LRK) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Does LARK Distilling Have A Long Cash Runway?

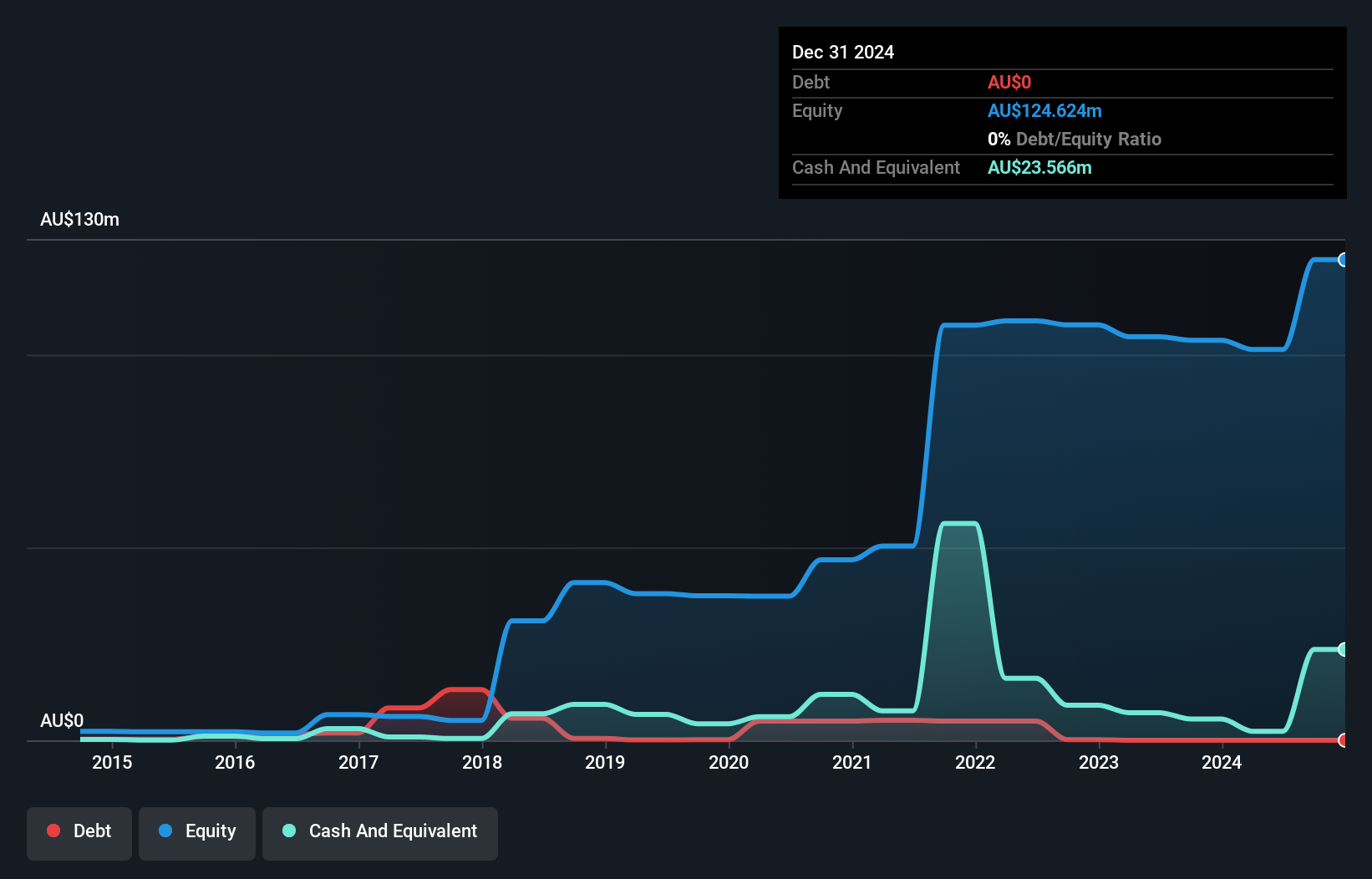

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In December 2024, LARK Distilling had AU$24m in cash, and was debt-free. Looking at the last year, the company burnt through AU$6.2m. That means it had a cash runway of about 3.8 years as of December 2024. A runway of this length affords the company the time and space it needs to develop the business. However, if we extrapolate the company's recent cash burn trend, then it would have a longer cash run way. You can see how its cash balance has changed over time in the image below.

See our latest analysis for LARK Distilling

How Well Is LARK Distilling Growing?

LARK Distilling boosted investment sharply in the last year, with cash burn ramping by 56%. As if that's not bad enough, the operating revenue also dropped by 7.5%, making us very wary indeed. Considering both these metrics, we're a little concerned about how the company is developing. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can LARK Distilling Raise Cash?

Even though it seems like LARK Distilling is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

LARK Distilling has a market capitalisation of AU$86m and burnt through AU$6.2m last year, which is 7.2% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

So, Should We Worry About LARK Distilling's Cash Burn?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought LARK Distilling's cash runway was relatively promising. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. On another note, LARK Distilling has 3 warning signs (and 1 which is significant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10