Cleveland-Cliffs (NYSE:CLF) Q1 Earnings Disappoint Despite US$150 Million Investment

Cleveland-Cliffs (NYSE:CLF) has faced significant changes recently, particularly with its removal from several key Russell benchmarks as of late June 2025. However, the company is simultaneously expanding its operations, as evidenced by the commissioning of a new high-tech annealing line at its Coshocton facility. While these events have coincided with its stock's rise of 27% over the last quarter, the broader market environment, which saw an increase of 14% over the year and 1.8% recently, also plays a role. Despite disappointing Q1 earnings, the $150 million investment underscores Cleveland-Cliffs's focus on strengthening its productions.

We've spotted 3 possible red flags for Cleveland-Cliffs you should be aware of, and 1 of them can't be ignored.

The end of cancer? These 24 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

The recent removal of Cleveland-Cliffs from key Russell benchmarks marks a challenging phase. However, the expansion at their Coshocton facility and a 27% quarterly share price increase indicate optimism about their operational capabilities. This expansion, in light of the recent steel tariffs and Stelco acquisition, is likely to bolster Cleveland-Cliffs' competitive position in the steel industry. Since tariffs are expected to drive domestic demand, there could be a positive impact on both revenue and earnings forecasts in the coming years.

Over the past five years, Cleveland-Cliffs delivered a total shareholder return of 53.66%, reflecting robust longer-term performance despite recent market volatility. However, the company's one-year return underperformed both the broader US market, which gained 13.7%, and the US Metals and Mining industry, which gained 10.1%. Such a discrepancy highlights the challenges Cleveland-Cliffs faces in keeping pace with industry and market trends.

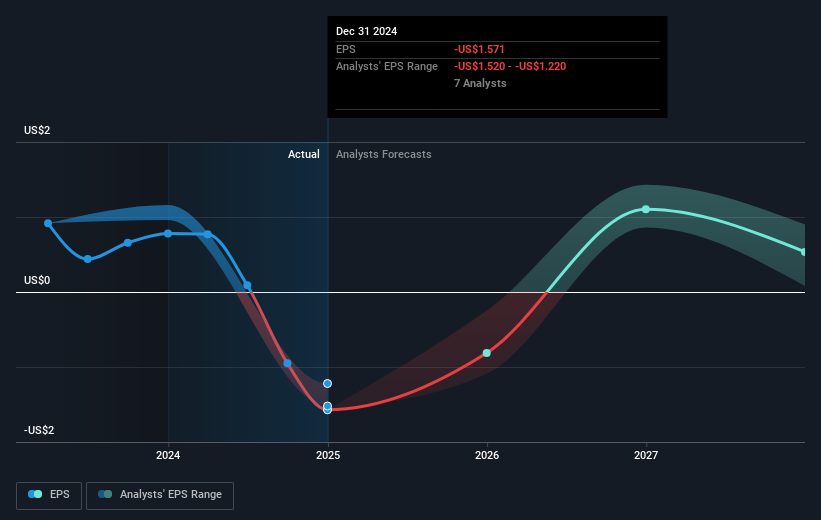

The current share price of $8.61 is 21.1% below the consensus analyst price target of $10.91, suggesting potential upside. However, the company’s negative earnings of US$1.18 billion and debt challenges could place pressure on achieving these targets. Furthermore, the company's initiatives around debt reduction and cost structure improvements must be considered carefully, as their success is critical to hitting the projected 5.2% annual revenue growth over the next three years and transitioning to profitability. Overall, stakeholders should consider how these elements might influence the company's future trajectory and investment potential.

Click here to discover the nuances of Cleveland-Cliffs with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10