With a 36% stake, Haidilao International Holding Ltd. (HKG:6862) insiders have a lot riding on the company

Key Insights

- Insiders appear to have a vested interest in Haidilao International Holding's growth, as seen by their sizeable ownership

- The top 2 shareholders own 53% of the company

- Analyst forecasts along with ownership data serve to give a strong idea about prospects for a business

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

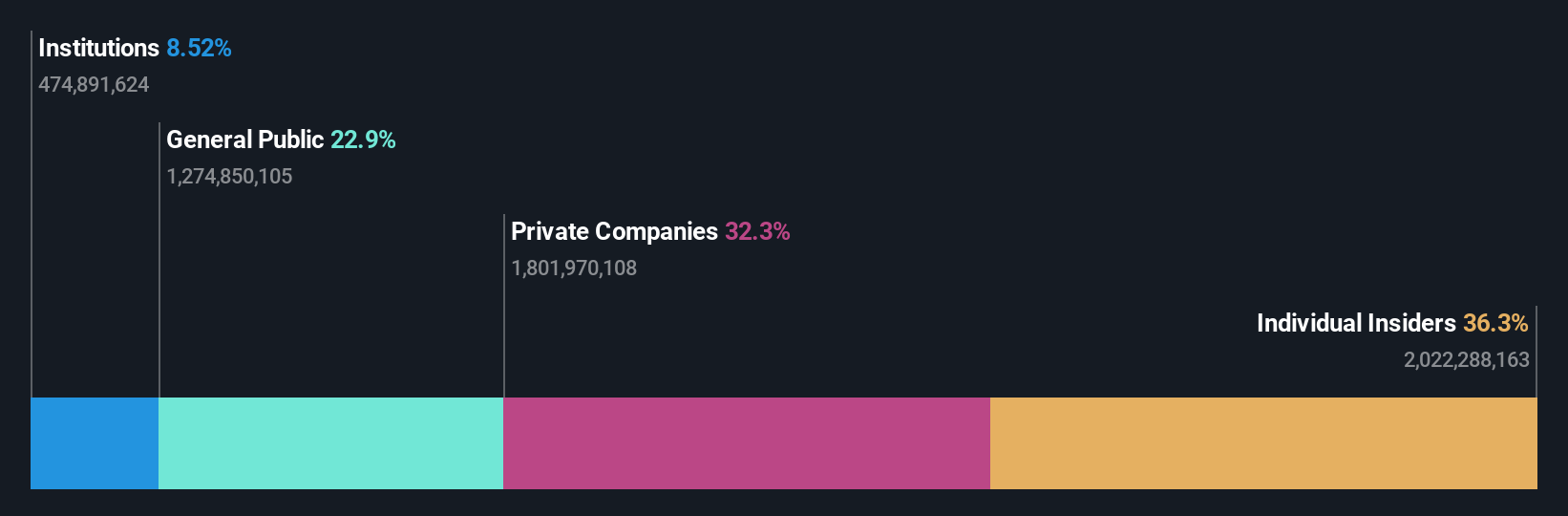

A look at the shareholders of Haidilao International Holding Ltd. (HKG:6862) can tell us which group is most powerful. And the group that holds the biggest piece of the pie are individual insiders with 36% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

So it follows, every decision made by insiders of Haidilao International Holding regarding the company's future would be crucial to them.

Let's delve deeper into each type of owner of Haidilao International Holding, beginning with the chart below.

View our latest analysis for Haidilao International Holding

What Does The Institutional Ownership Tell Us About Haidilao International Holding?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

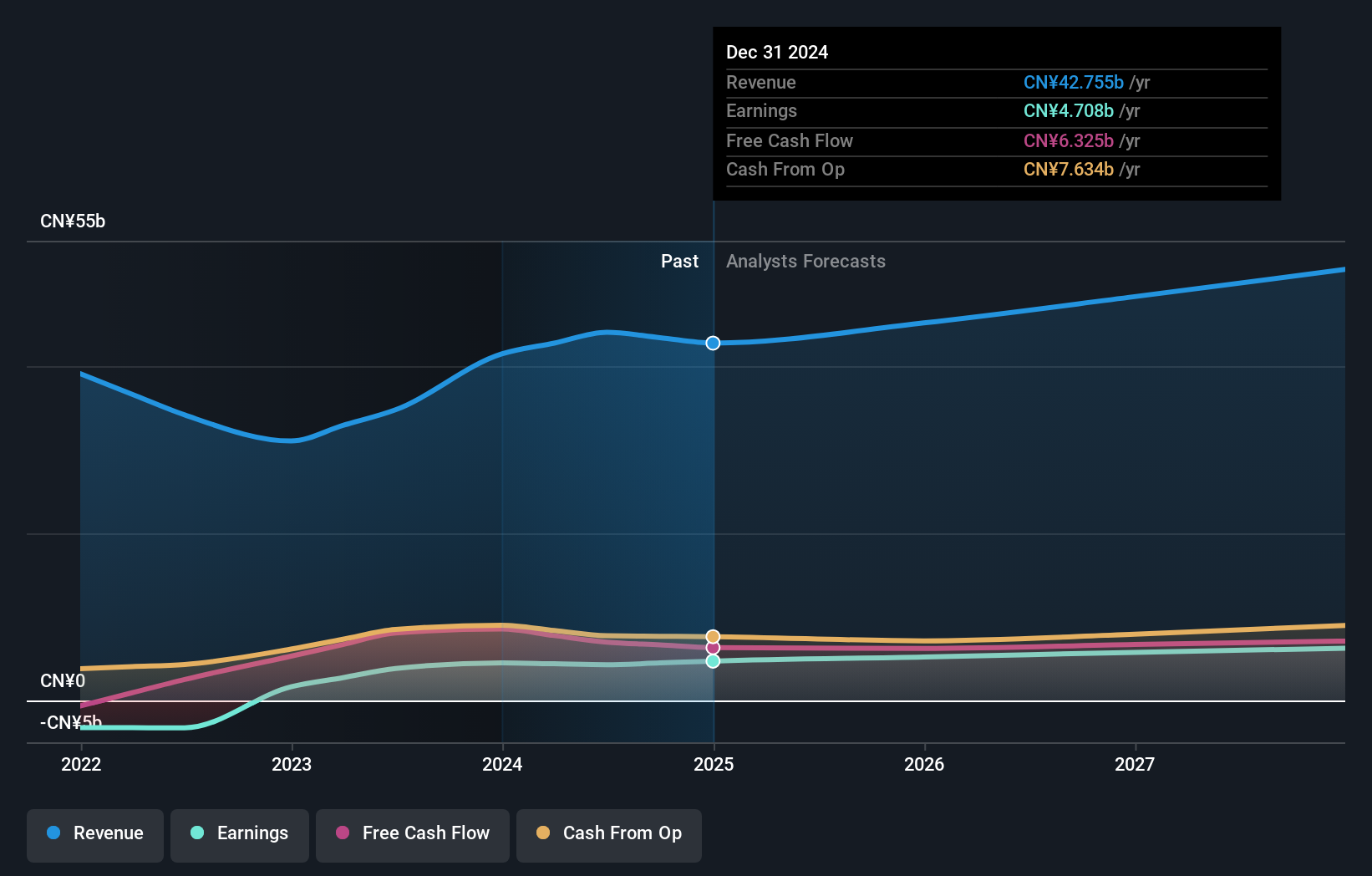

Haidilao International Holding already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Haidilao International Holding's earnings history below. Of course, the future is what really matters.

We note that hedge funds don't have a meaningful investment in Haidilao International Holding. Our data shows that Np United Holding Ltd is the largest shareholder with 32% of shares outstanding. For context, the second largest shareholder holds about 21% of the shares outstanding, followed by an ownership of 8.3% by the third-largest shareholder. Yong Zhang, who is the second-largest shareholder, also happens to hold the title of Top Key Executive.

A more detailed study of the shareholder registry showed us that 2 of the top shareholders have a considerable amount of ownership in the company, via their 53% stake.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Haidilao International Holding

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own a reasonable proportion of Haidilao International Holding Ltd.. It has a market capitalization of just HK$82b, and insiders have HK$30b worth of shares in their own names. That's quite significant. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public-- including retail investors -- own 23% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

Our data indicates that Private Companies hold 32%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. For example, we've discovered 1 warning sign for Haidilao International Holding that you should be aware of before investing here.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Haidilao International Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10