Top Growth Companies With Insider Ownership For July 2025

The United States market has experienced a flat performance over the last week but has seen a 12% increase over the past year, with earnings forecasted to grow by 15% annually. In this environment, identifying growth companies with significant insider ownership can be crucial as it often signals strong confidence from those closest to the business in its future potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 15.4% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Prairie Operating (PROP) | 34.6% | 92.4% |

| McEwen (MUX) | 15.8% | 148.5% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 51.7% |

| Eagle Financial Services (EFSI) | 15.8% | 82.8% |

| Credo Technology Group Holding (CRDO) | 11.8% | 47% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.7% |

| Astera Labs (ALAB) | 13% | 44.4% |

Click here to see the full list of 191 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Let's take a closer look at a couple of our picks from the screened companies.

CarGurus (CARG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CarGurus, Inc. operates an online automotive platform facilitating vehicle transactions both in the United States and internationally, with a market cap of $3.33 billion.

Operations: The company's revenue is primarily derived from its U.S. Marketplace segment, which generated $755.93 million, and its Digital Wholesale segment, contributing $82.13 million.

Insider Ownership: 15.2%

Earnings Growth Forecast: 31.9% p.a.

CarGurus, a growth-focused company, is experiencing substantial earnings growth, forecasted at 31.9% annually, outpacing the broader US market. Despite slower revenue growth of 6.5%, the company trades significantly below its estimated fair value and boasts high insider ownership, enhancing investor confidence. Recent initiatives include an AI-powered search experience and a marketing campaign with celebrity endorsements to boost brand engagement and sales momentum in the competitive automotive marketplace.

- Click here and access our complete growth analysis report to understand the dynamics of CarGurus.

- Our valuation report here indicates CarGurus may be overvalued.

Ryan Specialty Holdings (RYAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ryan Specialty Holdings, Inc. is a service provider offering specialty insurance products and solutions to brokers, agents, and carriers across multiple regions including the United States, Canada, the United Kingdom, Europe, India, and Singapore with a market cap of approximately $17.32 billion.

Operations: The company's revenue is primarily derived from its Insurance Brokers segment, totaling approximately $2.59 billion.

Insider Ownership: 15.6%

Earnings Growth Forecast: 95.3% p.a.

Ryan Specialty Holdings is experiencing significant earnings growth, forecasted at 95.3% annually, surpassing the US market average. However, revenue growth of 16.7% per year is slower than typical high-growth benchmarks but still exceeds market averages. Despite a recent net loss and insider selling activity, the company maintains a strong balance sheet and prioritizes M&A opportunities to drive future expansion. Recent bylaw amendments and conference presentations highlight ongoing strategic initiatives and shareholder engagement efforts.

- Take a closer look at Ryan Specialty Holdings' potential here in our earnings growth report.

- Our expertly prepared valuation report Ryan Specialty Holdings implies its share price may be too high.

Spotify Technology (SPOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market cap of approximately $147.93 billion.

Operations: Spotify generates revenue primarily through its Premium segment, which accounts for €14.34 billion, and its Ad-Supported segment, contributing €1.88 billion.

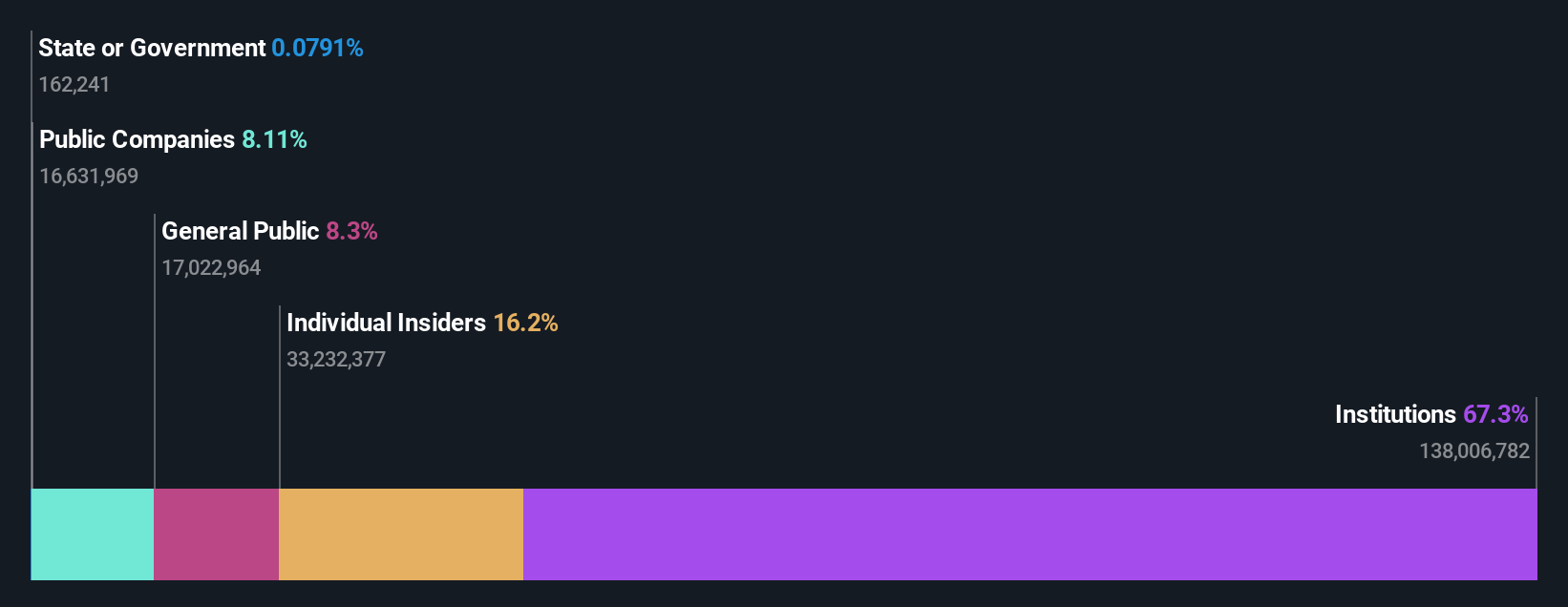

Insider Ownership: 16.2%

Earnings Growth Forecast: 25.7% p.a.

Spotify Technology is experiencing robust earnings growth, forecasted at 25.7% annually, outpacing the US market average. Revenue growth is projected at 12.1% per year, slower than high-growth benchmarks but still above market averages. Recent earnings showed increased sales of €4.19 billion and net income of €225 million for Q1 2025. Despite no recent insider trading activity, the company's strategic focus remains evident through conference presentations and confirmed guidance for $4.3 billion in Q2 revenue.

- Click here to discover the nuances of Spotify Technology with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Spotify Technology's share price might be too optimistic.

Turning Ideas Into Actions

- Delve into our full catalog of 191 Fast Growing US Companies With High Insider Ownership here.

- Ready For A Different Approach? We've found 16 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10