Becton Dickinson (NYSE:BDX) Appoints Bilal Muhsin As President Of New Connected Care Segment

Becton Dickinson (NYSE:BDX) has recently announced the appointment of Bilal Muhsin as Executive Vice President, tasked with leading the company's future Connected Care segment. Despite this significant leadership change, the company's stock performance remained flat over the past week, similar to the broader market trends where the Dow Jones Industrial Average also hovered near unchanged levels amid trade uncertainties. While Muhsin’s appointment adds depth to BD's ambitious healthcare strategies, the lack of immediate major market shifts suggests that any potential positive momentum driven by this event has not been reflected in the short-term price movements.

Every company has risks, and we've spotted 2 risks for Becton Dickinson (of which 1 doesn't sit too well with us!) you should know about.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

The appointment of Bilal Muhsin as Executive Vice President may bolster Becton Dickinson's efforts in advancing its Connected Care segment, potentially impacting long-term revenue growth and operational efficiency. However, recent market neutrality has not yet reflected this development in the company's share price, which experienced a 21.82% decline over the past year, contrasting with its flat performance over the previous week. This decline highlights the need for sustained strategic execution to improve investor sentiment.

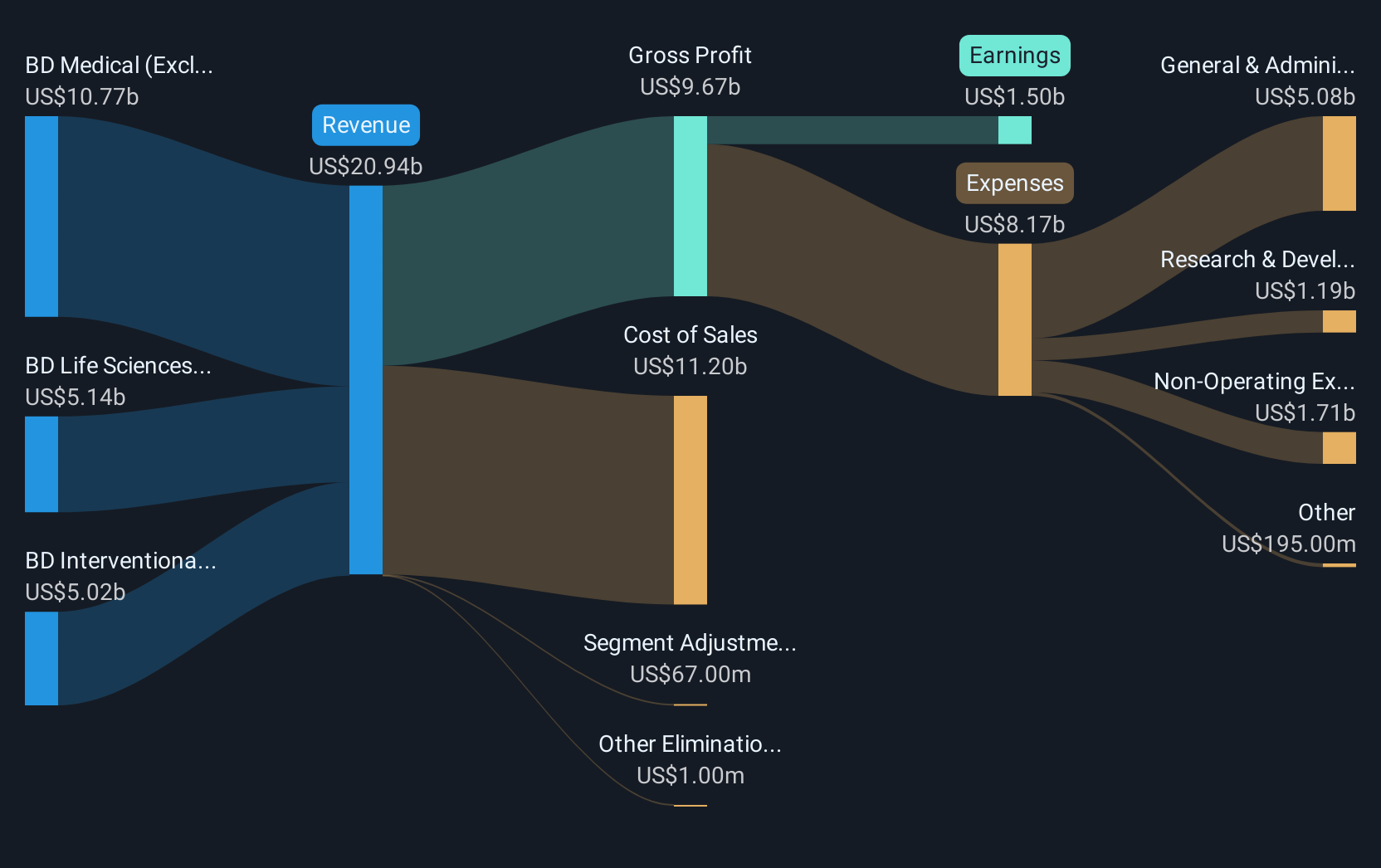

On a comparative basis, over the past year, Becton Dickinson's returns have underperformed relative to both the US market and the Medical Equipment industry, which returned 12.5% and 10.3%, respectively. Despite robust earnings projected to rise to US$2.9 billion by May 2028 and a transition to higher-margin products, analysts' price target of US$225.25 implies a 26.7% premium over the current share price of US$165.15. Achieving this target would necessitate improved market conditions and successful execution of strategic initiatives, including potential enhancements in the Life Sciences segment from new product launches like the FACSDiscover A8.

Review our growth performance report to gain insights into Becton Dickinson's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10