Ostin Technology Group (NasdaqCM:OST) Completes US$5 Million Equity Offering

Ostin Technology Group (NasdaqCM:OST) experienced a notable 12% increase in its stock price last week. This movement comes on the heels of significant corporate developments, including the completion of a $5 million follow-on equity offering and governance changes with an upcoming vote on amending the company bylaws. These events could have provided additional momentum to the broader market trends, even as the major indexes, including the S&P 500 and Nasdaq Composite, showed modest gains amid trade policy uncertainties. Despite persistent macroeconomic concerns, Ostin's recent announcements might have bolstered investor confidence, supporting the upward stock movement.

Every company has risks, and we've spotted 3 warning signs for Ostin Technology Group (of which 2 are concerning!) you should know about.

Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

Over the past year, Ostin Technology Group's total returns, including share price and dividends, have declined 95.81%. This performance contrasts with both the US market and Electronic industry averages over the same period, with the market gaining 12.6% and the industry returning 24%. Such a stark divergence highlights the challenges the company faces.

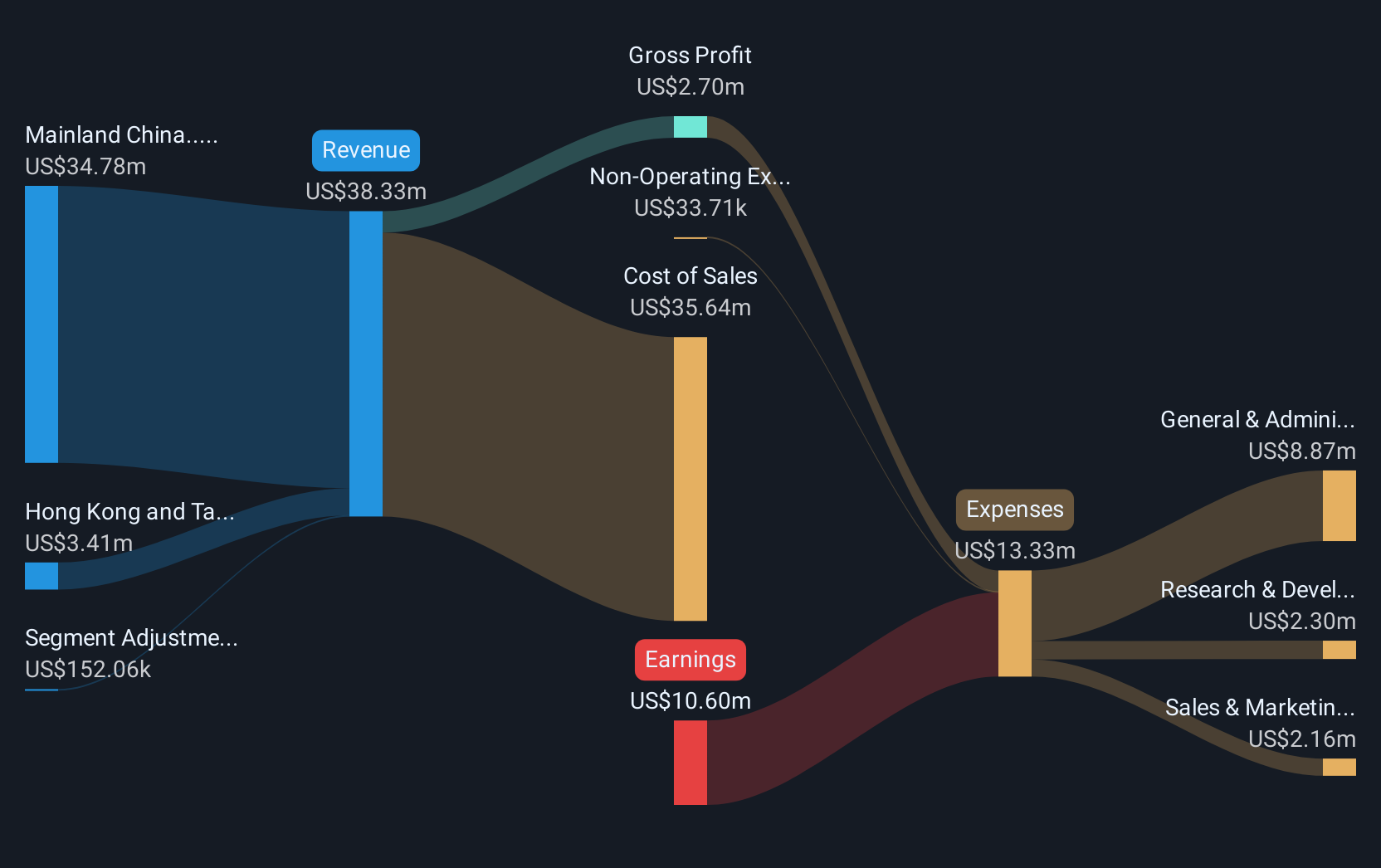

The recent developments, including the $5 million equity offering and governance changes, have the potential to influence forthcoming revenue and earnings forecasts. Ostin's recent moves may be integral as it attempts to stabilize its financial performance and investor confidence. While recent share price movements appear positive short-term, the longer-term context places significant scrutiny on its ability to transform operational adjustments into meaningful financial improvements.

With the absence of a clear consensus analyst price target and given the substantial drop in total returns, the current share price trajectory demands careful observation and analysis. Investors may be watching closely to determine if the company can pivot towards aligning its performance more closely with industry averages.

Our expertly prepared valuation report Ostin Technology Group implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10