Globalstar, Inc. (NASDAQ:GSAT): Are Analysts Optimistic?

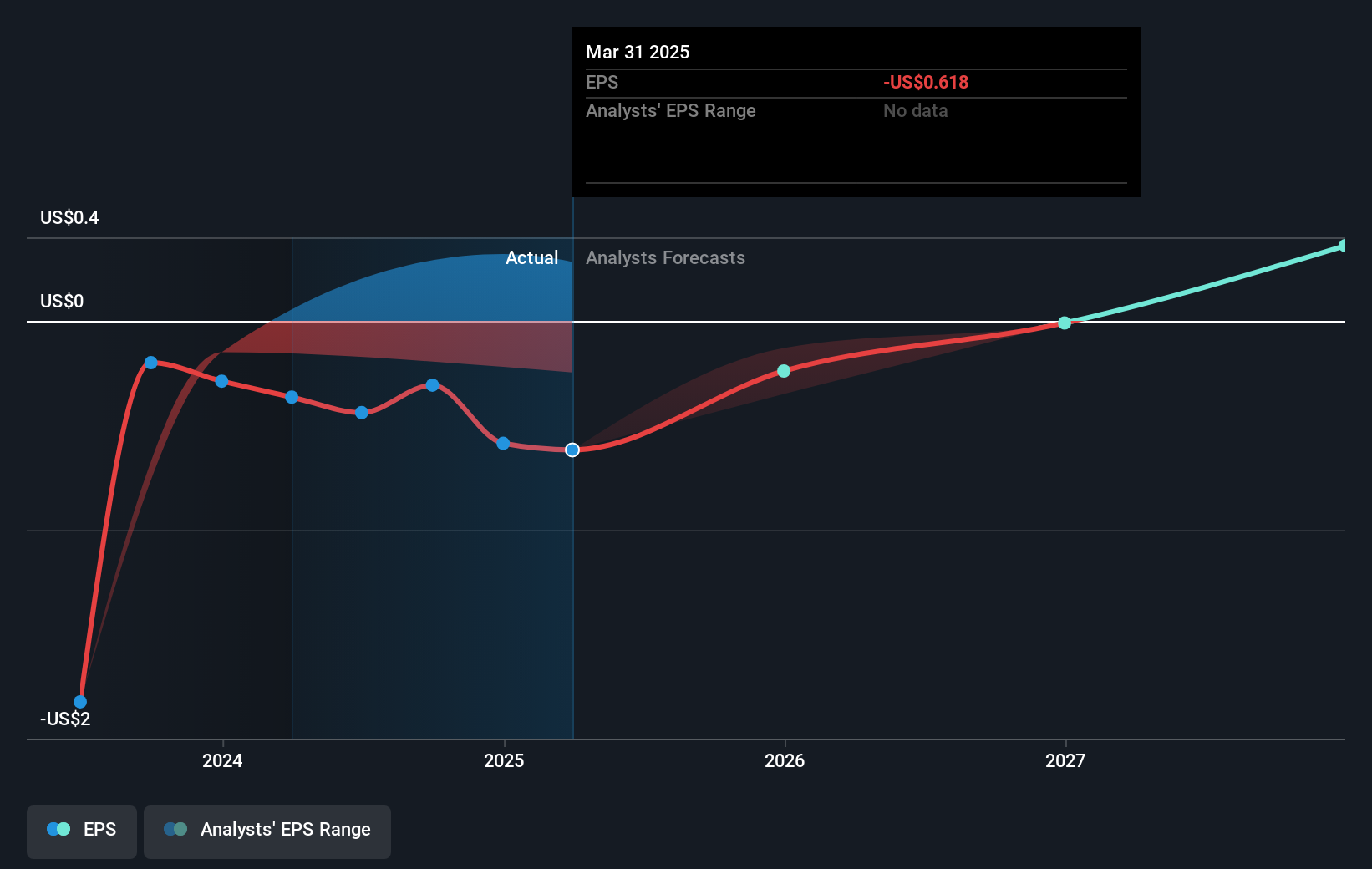

We feel now is a pretty good time to analyse Globalstar, Inc.'s (NASDAQ:GSAT) business as it appears the company may be on the cusp of a considerable accomplishment. Globalstar, Inc. provides mobile satellite services in the United States, Canada, Europe, Central and South America, and internationally. The company’s loss has recently broadened since it announced a US$74m loss in the full financial year, compared to the latest trailing-twelve-month loss of US$78m, moving it further away from breakeven. Many investors are wondering about the rate at which Globalstar will turn a profit, with the big question being “when will the company breakeven?” Below we will provide a high-level summary of the industry analysts’ expectations for the company.

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

Consensus from 2 of the American Telecom analysts is that Globalstar is on the verge of breakeven. They anticipate the company to incur a final loss in 2025, before generating positive profits of US$8.7m in 2026. Therefore, the company is expected to breakeven just over a year from now. How fast will the company have to grow each year in order to reach the breakeven point by 2026? Working backwards from analyst estimates, it turns out that they expect the company to grow 113% year-on-year, on average, which signals high confidence from analysts. If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

We're not going to go through company-specific developments for Globalstar given that this is a high-level summary, however, take into account that generally a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

View our latest analysis for Globalstar

Before we wrap up, there’s one issue worth mentioning. Globalstar currently has a debt-to-equity ratio of 146%. Typically, debt shouldn’t exceed 40% of your equity, which in this case, the company has significantly overshot. A higher level of debt requires more stringent capital management which increases the risk around investing in the loss-making company.

Next Steps:

There are too many aspects of Globalstar to cover in one brief article, but the key fundamentals for the company can all be found in one place – Globalstar's company page on Simply Wall St. We've also put together a list of key factors you should look at:

- Valuation: What is Globalstar worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Globalstar is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Globalstar’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10