Alcoa Corporation (NYSE:AA) will release earnings results for the second quarter, after the closing bell on Wednesday, July 16.

Analysts expect the Pittsburgh, Pennsylvania-based company to report quarterly earnings at 51 cents per share, up from 16 cents per share in the year-ago period. Alcoa projects to report quarterly revenue at $2.96 billion, compared to $2.91 billion a year earlier, according to data from Benzinga Pro.

On July 14, Alcoa and its joint venture partner announced that San Ciprián smelter operations will be delayed to mid-2026 following a national power outage.

Alcoa shares fell 4.2% to close at $29.79 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

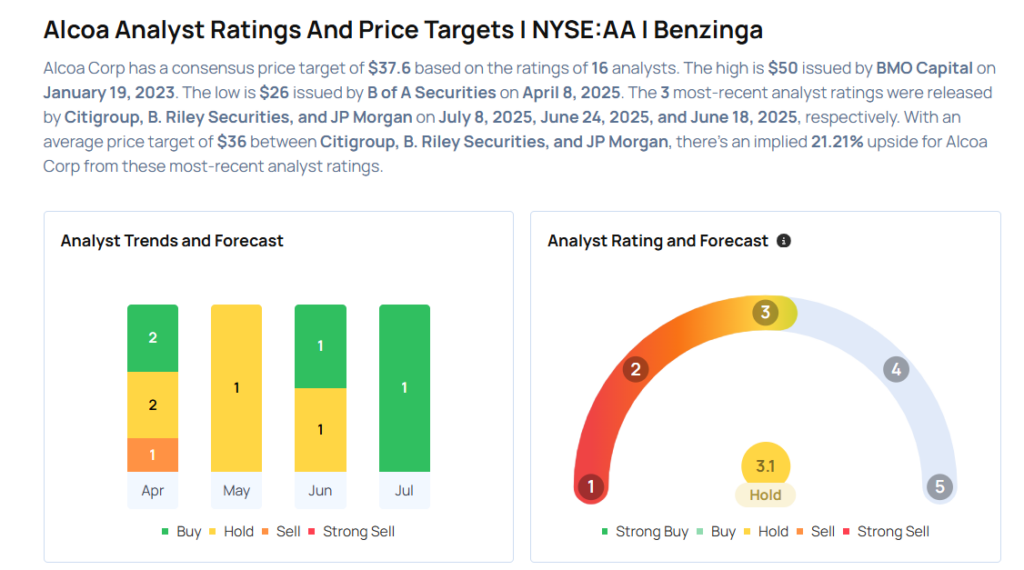

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Citigroup analyst Alexander Hacking reinstated a Buy rating with a price target of $42 on July 8, 2025. This analyst has an accuracy rate of 66%.

- B. Riley Securities analyst Lucas Pipes maintained a Buy rating and cut the price target from $43 to $38 on June 24, 2025. This analyst has an accuracy rate of 68%.

- UBS analyst Daniel Major downgraded the stock from Buy to Neutral with a price target of $31 on May 15, 2025. This analyst has an accuracy rate of 70%.

- Morgan Stanley analyst Carlos De Alba maintained an Overweight rating and cut the price target from $51 to $39 on April 9, 2025. This analyst has an accuracy rate of 72%.

- Jefferies analyst Chris LaFemina maintained a Buy rating and cut the price target from $50 to $45 on Jan. 6, 2025. This analyst has an accuracy rate of 62%.

Considering buying AA stock? Here’s what analysts think:

Read This Next:

- JPMorgan, Wells Fargo And 3 Stocks To Watch Heading Into Tuesday

Photo via Shutterstock