Exploring 3 High Growth Tech Stocks In The US Market

As the U.S. stock market experiences mixed movements with major indexes reaching record highs amidst inflation data and earnings reports, the tech sector stands out with notable rallies spurred by companies like Nvidia. In this dynamic environment, identifying high-growth tech stocks involves looking at those that can leverage current trends such as AI advancements and strategic partnerships to sustain their momentum in a competitive landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.14% | 38.20% | ★★★★★★ |

| Circle Internet Group | 30.80% | 60.64% | ★★★★★★ |

| Ardelyx | 21.16% | 61.58% | ★★★★★★ |

| TG Therapeutics | 26.05% | 39.12% | ★★★★★★ |

| AVITA Medical | 27.81% | 61.04% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.85% | 59.42% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 34.90% | 59.91% | ★★★★★★ |

| Caris Life Sciences | 24.80% | 71.12% | ★★★★★★ |

| Lumentum Holdings | 21.30% | 105.07% | ★★★★★★ |

Click here to see the full list of 225 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Anavex Life Sciences (AVXL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anavex Life Sciences Corp. is a biopharmaceutical company with a market capitalization of $948.48 million.

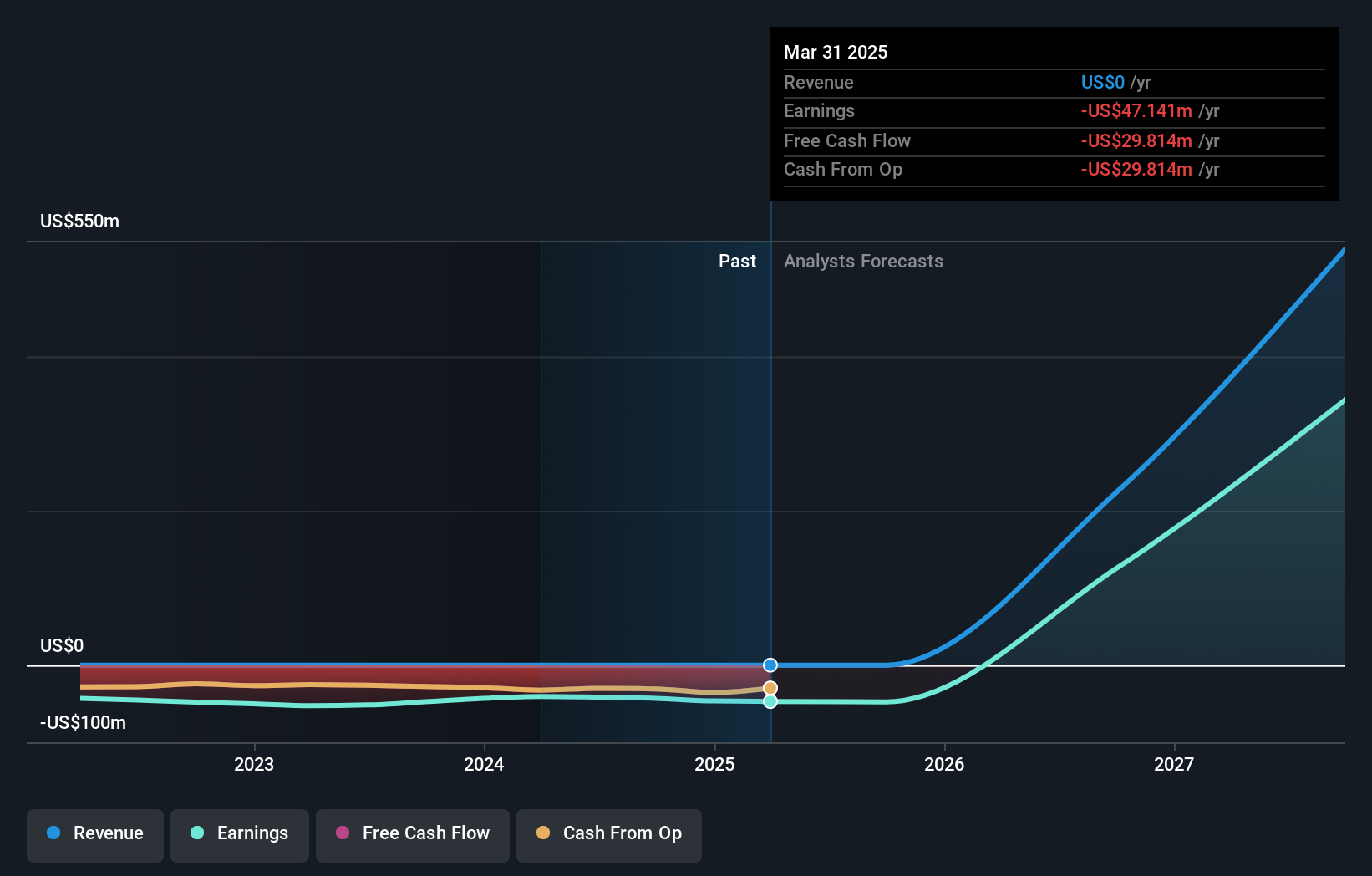

Operations: Anavex Life Sciences Corp. focuses on developing therapeutics for the treatment of central nervous system diseases. The company does not currently report any revenue segments, indicating its primary focus is on research and development activities rather than commercial product sales.

Anavex Life Sciences, despite its current unprofitability, shows promising growth with expected profitability within three years. The company's revenue is projected to surge by 57.2% annually, outpacing the U.S. market's average of 8.8%. Recent strategic moves include a $300 million Shelf Registration and continuous participation in high-profile conferences, signaling robust efforts to bolster its financial and market position. These steps could potentially accelerate Anavex’s transition from R&D-focused operations towards commercial viability in the biotech sector.

- Navigate through the intricacies of Anavex Life Sciences with our comprehensive health report here.

Gain insights into Anavex Life Sciences' past trends and performance with our Past report.

Caris Life Sciences (CAI)

Simply Wall St Growth Rating: ★★★★★★

Overview: Caris Life Sciences, Inc. is an artificial intelligence TechBio company that offers molecular profiling services both in the United States and internationally, with a market cap of $7.37 billion.

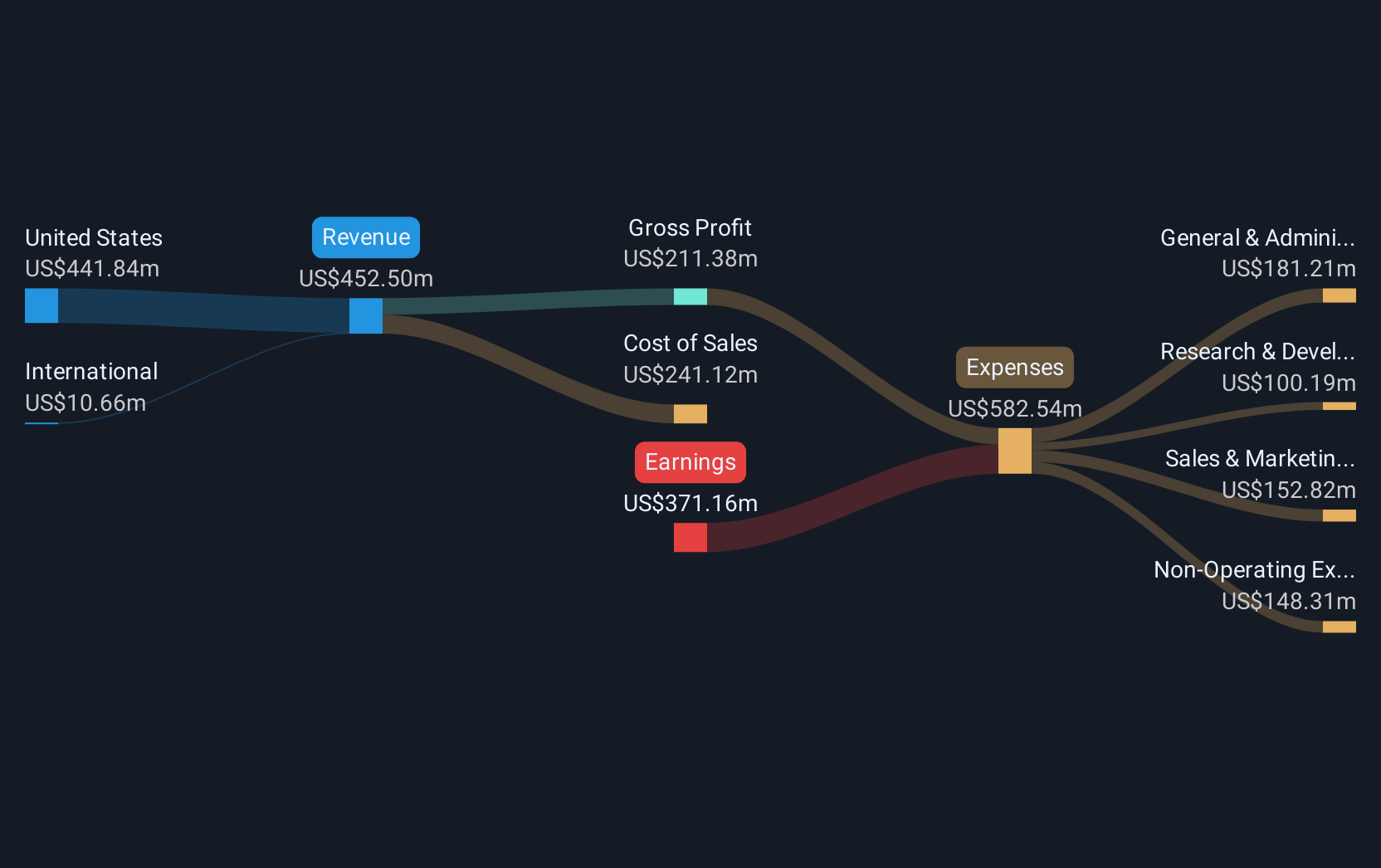

Operations: Caris Life Sciences generates revenue primarily from its biotechnology segment, amounting to $452.50 million. The company leverages artificial intelligence in its molecular profiling services across domestic and international markets.

Caris Life Sciences, recently added to the NASDAQ Composite Index, is making significant strides in precision medicine with its innovative Caris Assure platform. This cutting-edge technology, which integrates Whole Exome and Transcriptome Sequencing with advanced AI, has shown high sensitivity across various cancer stages, achieving up to 95.7% sensitivity at 99.6% specificity for early cancer detection. Despite concerns from auditors about its ongoing viability post-IPO, Caris's recent $872.7 million Shelf Registration suggests robust financial planning aimed at sustaining its pioneering work in blood-based biopsy assays and molecular profiling. These developments could potentially reshape oncological diagnostics and treatment landscapes significantly.

- Click here to discover the nuances of Caris Life Sciences with our detailed analytical health report.

Review our historical performance report to gain insights into Caris Life Sciences''s past performance.

Vertex Pharmaceuticals (VRTX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for cystic fibrosis, with a market cap of approximately $120.40 billion.

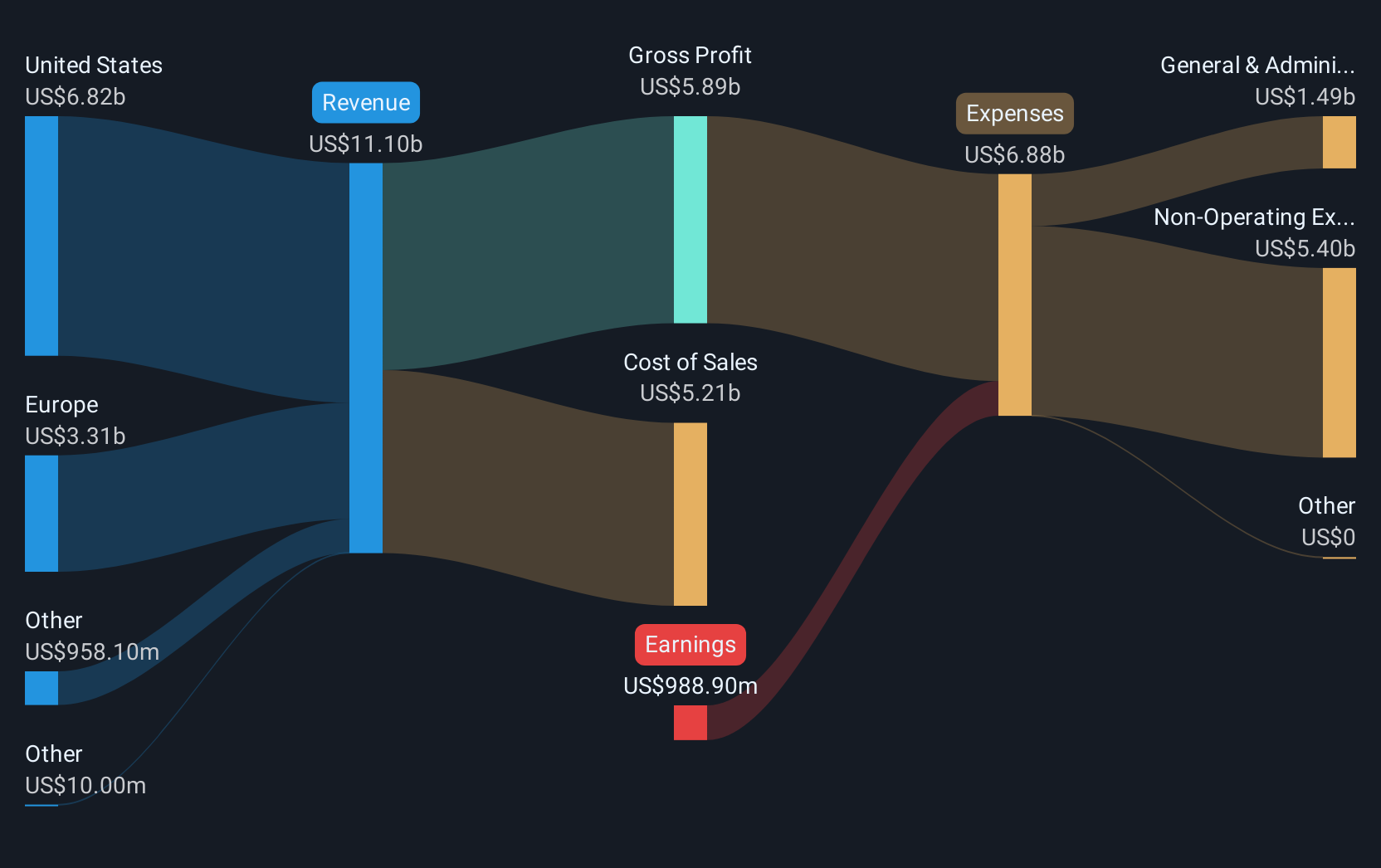

Operations: Vertex Pharmaceuticals generates revenue primarily from its pharmaceuticals segment, which amounts to $11.10 billion. The company concentrates on therapies for cystic fibrosis, contributing significantly to its financial performance.

Vertex Pharmaceuticals, despite recent drops from multiple Russell indices, is making significant strides with its groundbreaking cystic fibrosis (CF) treatments and gene-editing therapies. The company's recent broad reimbursement agreement with NHS England for ALYFTREK® underscores its commitment to expanding access to these innovative treatments globally. Vertex's R&D efforts are robust, demonstrated by a 9.5% annual revenue growth and an anticipated leap into profitability within three years due to its strategic focus on high-impact genetic diseases like CF and sickle cell disease. This pivot towards advanced gene-editing technologies not only enhances Vertex's market position but also promises substantial improvements in patient outcomes across several countries.

- Delve into the full analysis health report here for a deeper understanding of Vertex Pharmaceuticals.

Understand Vertex Pharmaceuticals' track record by examining our Past report.

Make It Happen

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 222 more companies for you to explore.Click here to unveil our expertly curated list of 225 US High Growth Tech and AI Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10