3 Asian Growth Companies With Insider Ownership Up To 19%

Amidst the backdrop of muted market reactions to new U.S. tariffs and mixed economic indicators in Asia, investors continue to seek opportunities in growth companies that demonstrate resilience and potential for long-term value creation. In this environment, stocks with high insider ownership can be particularly attractive, as they often indicate a strong alignment between company management and shareholder interests, potentially leading to more strategic decision-making during uncertain times.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.6% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 25.7% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 27.1% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 42.2% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Click here to see the full list of 603 stocks from our Fast Growing Asian Companies With High Insider Ownership screener.

Let's review some notable picks from our screened stocks.

Hyosung Heavy Industries (KOSE:A298040)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hyosung Heavy Industries Corporation manufactures and sells heavy electrical equipment in South Korea and internationally, with a market cap of ₩9.11 trillion.

Operations: The company's revenue segments include Heavy Industry at ₩4.04 trillion and Construction at ₩1.71 trillion.

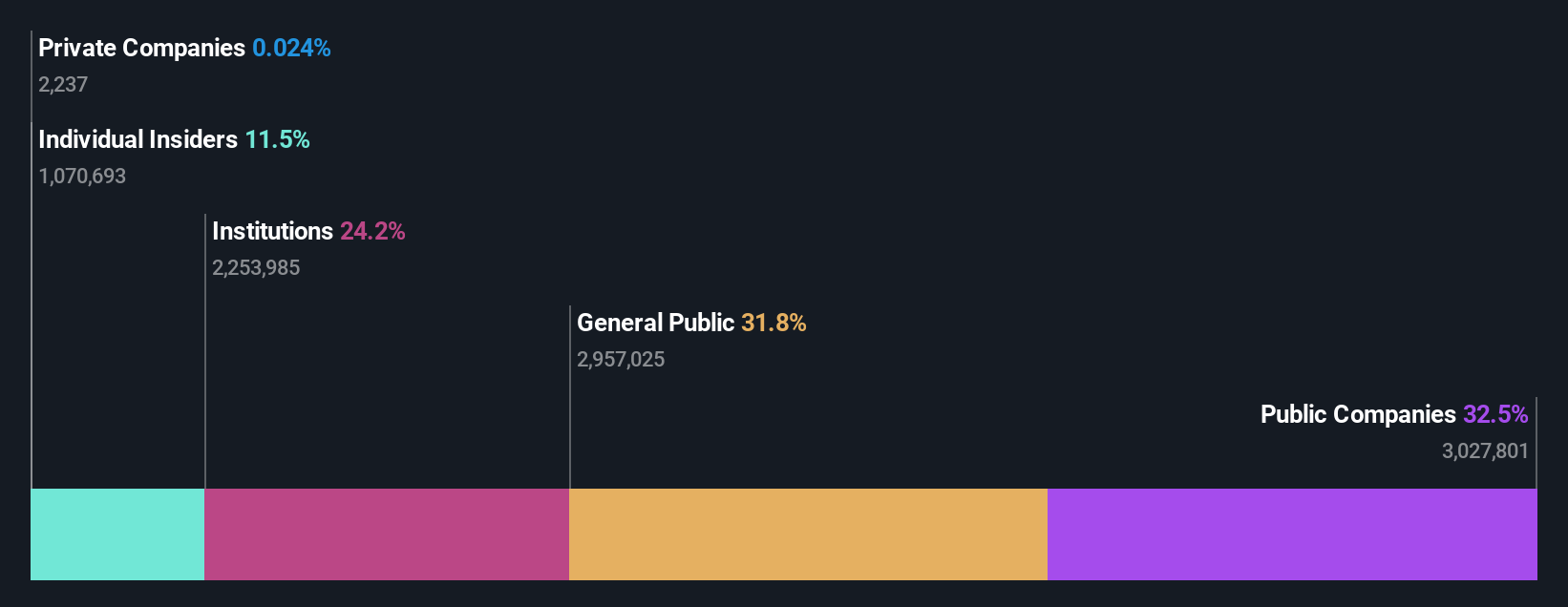

Insider Ownership: 11.5%

Hyosung Heavy Industries is experiencing strong growth, with earnings up 98% over the past year and expected to grow at 22.65% annually, outpacing the Korean market's 20.8%. Revenue growth is forecasted at 9.2% annually, surpassing the market average of 6.5%. Despite a low forecasted Return on Equity of 19.6%, substantial insider ownership aligns management interests with shareholders, supporting its position as a promising growth entity in Asia.

- Navigate through the intricacies of Hyosung Heavy Industries with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Hyosung Heavy Industries' current price could be inflated.

Lianlian DigiTech (SEHK:2598)

Simply Wall St Growth Rating: ★★★★☆☆

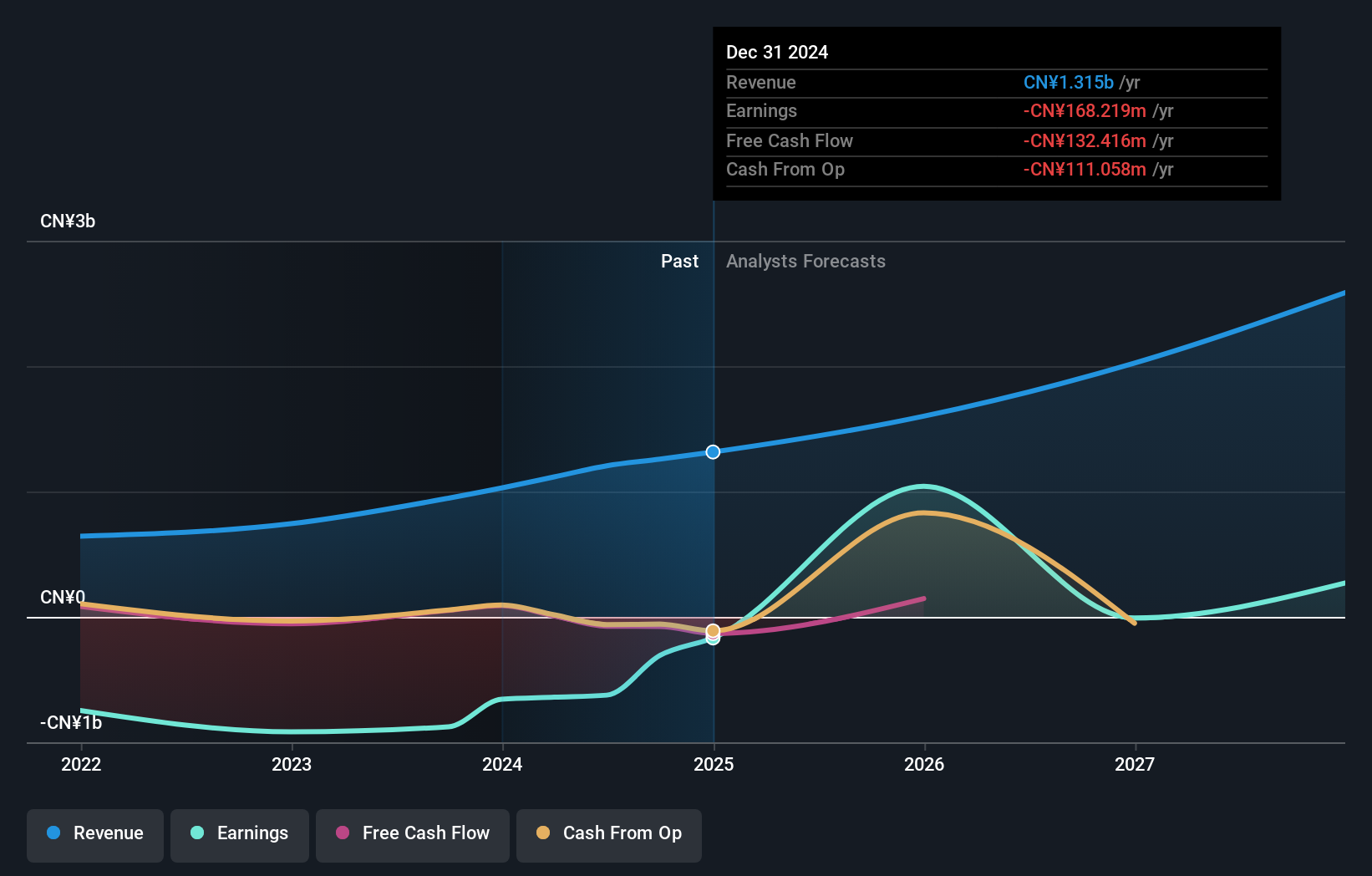

Overview: Lianlian DigiTech Co., Ltd. offers digital payment and value-added services to small and midsized merchants and enterprises both in China and internationally, with a market cap of HK$12.29 billion.

Operations: The company's revenue segments comprise CN¥807.77 million from global payment services, CN¥342.86 million from domestic payment services, and CN¥146.19 million from value-added services.

Insider Ownership: 19.7%

Lianlian DigiTech is poised for significant revenue growth, forecasted at 21.82% annually, outpacing the Hong Kong market's average. Despite a volatile share price and a low projected Return on Equity of 10.5%, the company is expected to become profitable within three years. Recent share repurchases could enhance earnings per share and net asset value, aligning with substantial insider ownership to potentially bolster shareholder confidence amidst these developments.

- Unlock comprehensive insights into our analysis of Lianlian DigiTech stock in this growth report.

- Upon reviewing our latest valuation report, Lianlian DigiTech's share price might be too optimistic.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications services globally with a market cap of approximately ¥1.73 trillion.

Operations: The company's revenue is primarily derived from its Internet Services segment at ¥1.30 billion, followed by Fin Tech at ¥850.54 million and Mobile services at ¥451.56 million.

Insider Ownership: 12%

Rakuten Group is trading at a significant discount to its fair value, with revenue expected to grow faster than the Japanese market. The company anticipates double-digit revenue growth for 2025, excluding its securities business. Recent product announcements in affiliate marketing and planned mergers could enhance operational efficiency. While profitability is projected within three years, Return on Equity remains low. Despite these prospects, insider ownership details are not disclosed for recent months.

- Get an in-depth perspective on Rakuten Group's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Rakuten Group's current price could be quite moderate.

Where To Now?

- Dive into all 603 of the Fast Growing Asian Companies With High Insider Ownership we have identified here.

- Contemplating Other Strategies? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10