My Top Artificial Intelligence (AI) Stock Just Announced Jaw-Dropping Growth

-

Taiwan Semiconductor has several key clients in the AI race.

-

It just announced stellar monthly growth.

In the realm of artificial intelligence (AI), my top stock pick is Taiwan Semiconductor Manufacturing (TSM 3.66%). Its position within the AI race is one of the most neutral ways to play this theme, and its stock rewarded investors with impressive returns, continuing to notch new all-time highs.

Those highs are likely to keep coming, especially when you consider the performance that TSMC (as it's also known) is putting up. It's one of the fastest-growing stocks on the market, which is even more impressive when you consider its size.

Image source: Getty Images.

TSMC is in a crucial position in the AI race

TSMC is a chip foundry, which means it produces chips for companies that can't do it themselves. If you can name a company that's involved in the AI race, the likelihood is nearly 100% that it uses TSMC chips in some way. It's a key supplier for Nvidia, Tesla, Broadcom, and Apple, among many others.

It is the top option in the big tech space for multiple reasons, but chief among them is that it is just a foundry; it's not selling its own products. This means that intellectual property from Nvidia or Apple won't be used for its own purpose to market a chip that could rival what they design. This has become a concern with some other chip foundries, which are often competing against their customers.

Another differentiating factor is that the chipmaker is always one of the first to launch cutting-edge technologies. Its 3-nanometer (nm) chip node has been a big seller and has far surpassed production yields of its competitors.

And management is not stopping there. It's on track to launch a 2nm node later this year and a 1.6nm node next year. This continual improvement cycle is what keeps clients around: They know it's unlikely they'll need to switch suppliers to gain access to the most innovative chips.

As a result of its market position, TSMC continues to win business, but it is also succeeding with longtime customers, which has driven a huge amount of growth.

Its growth is incredibly rapid considering its size

The chip foundry goes above and beyond to provide investors with valuable information about its business. It announces revenue figures every month, providing an update on how the company is doing, in addition to the standard quarterly updates.

One thing to keep in mind is that these monthly updates can be skewed in favor of one year or another. For example, there were 21 working days in June 2025 but only 20 in June 2024. These comparisons are drowned out in a quarterly view, but you need to be aware of them when examining monthly sales. In any case, revenue rose an impressive 26.9% in June, which followed up strong results in May and April.

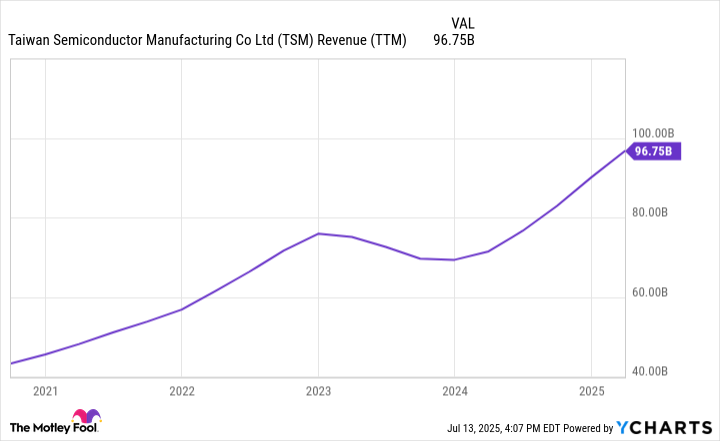

This also brings its year-to-date growth to 40% year over year, showing how rapidly the company is expanding compared to last year, despite 2024 also being a strong year for chip production.

TSM Revenue (TTM) data by YCharts; TTM = trailing 12 months.

This kind of growth is incredible, especially considering that it is the ninth-largest company in the world. The only other one in the top 10 growing as quickly is Nvidia, which is an excellent stock to be compared to.

While this growth may have surprised the market, it didn't surprise management. At the start of 2025, it predicted that the company's five-year compound annual growth rate (CAGR) would approach 20%, so this rapid increase is expected to persist for some time.

I believe this makes TSMC one of the best stocks to buy and hold since it takes advantage of the AI race, regardless of whether a company like Nvidia maintains its dominance. It will continue to sell chips to both Nvidia and likely other competitors that arise. Taiwan Semiconductor Manufacturing is one of my top buys now, and this impressive growth confirms that sentiment.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10