CleanSpark (NasdaqCM:CLSK) Sees 74% Stock Surge Over Last Quarter

CleanSpark (NasdaqCM:CLSK) recently highlighted its operational strength with significant bitcoin sales and production in June 2025, selling 579 bitcoin at a robust price point. Despite these achievements, the company faced the headwind of being dropped from several Russell Growth benchmarks and added to Value benchmarks. The company's share price experienced a remarkable 74% surge over the last quarter, aligning with broader market trends where the cryptocurrency sector saw gains as bitcoin achieved record highs. This volatile period was marked by market optimism around regulatory developments for digital assets, which likely bolstered CleanSpark's returns.

We've spotted 4 possible red flags for CleanSpark you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The noteworthy developments surrounding CleanSpark, such as the significant Bitcoin sales and sector-related regulatory optimism, could bolster the narrative around the company's potential for growth. Despite being removed from several growth benchmarks, CleanSpark's operational focus on expanding in energy-rich states and increasing its Bitcoin mining capacity to 50 exahash could drive future revenue growth. The company's choice to hold Bitcoin may further influence earnings if Bitcoin prices remain elevated, though it also exposes CleanSpark to potential volatility.

Over the past five years, CleanSpark's total shareholder return, combining share price movements and dividends, has been very large at 204.09%, indicating significant long-term value creation for investors. However, over the last year, CleanSpark underperformed the US Software industry, which grew by 18.9%, highlighting some challenges in aligning short-term gains with broader market trends.

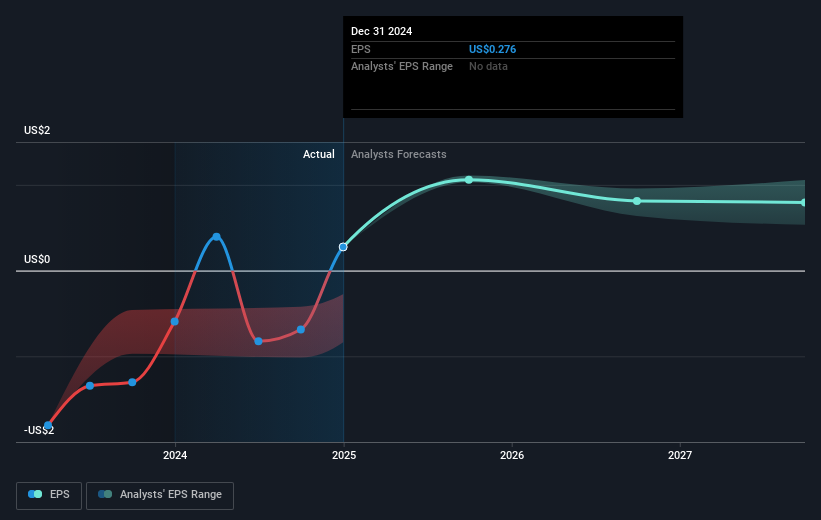

The recent surge in CleanSpark's share price aligns with positive sector sentiment and could impact revenue and earnings forecasts if sustained. Analysts have forecasted a revenue growth rate of 31.4% per year, with the company expected to become profitable in the next three years. Given the current share price of US$11.6, the analyst consensus price target of US$19.2 suggests potential upside if forecasted figures are achieved. Investors might weigh these forecasts against CleanSpark's share price performance and its position relative to both short-term industry trends and long-term historical returns.

Learn about CleanSpark's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10