Progyny (NASDAQ:PGNY) Might Have The Makings Of A Multi-Bagger

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Speaking of which, we noticed some great changes in Progyny's (NASDAQ:PGNY) returns on capital, so let's have a look.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Progyny, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = US$73m ÷ (US$730m - US$237m) (Based on the trailing twelve months to March 2025).

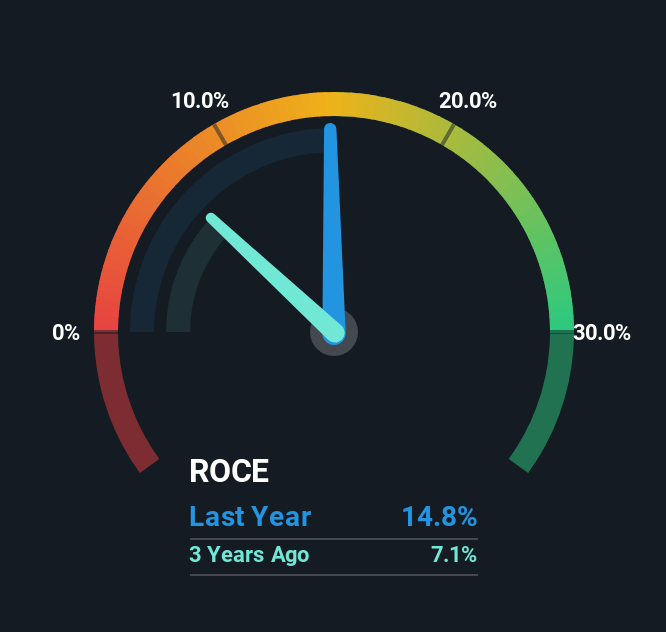

Thus, Progyny has an ROCE of 15%. On its own, that's a standard return, however it's much better than the 10% generated by the Healthcare industry.

Check out our latest analysis for Progyny

In the above chart we have measured Progyny's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free analyst report for Progyny .

What Does the ROCE Trend For Progyny Tell Us?

Investors would be pleased with what's happening at Progyny. The data shows that returns on capital have increased substantially over the last five years to 15%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 307%. So we're very much inspired by what we're seeing at Progyny thanks to its ability to profitably reinvest capital.

The Bottom Line On Progyny's ROCE

To sum it up, Progyny has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. Astute investors may have an opportunity here because the stock has declined 12% in the last five years. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

On the other side of ROCE, we have to consider valuation. That's why we have a FREE intrinsic value estimation for PGNY on our platform that is definitely worth checking out.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10