Undiscovered Gems in Asia to Watch This July 2025

As global markets navigate the complexities of new U.S. tariffs and mixed economic indicators, investor sentiment remains cautious, particularly in Asia where hopes for stimulus measures in China have buoyed local indices. Amid these dynamic conditions, identifying promising small-cap stocks requires a keen eye on companies with solid fundamentals and potential resilience to geopolitical shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Argosy Research | NA | 6.09% | 11.72% | ★★★★★★ |

| Cresco | 5.53% | 8.75% | 11.19% | ★★★★★★ |

| GakkyushaLtd | 17.84% | 4.47% | 15.16% | ★★★★★★ |

| Nantong Guosheng Intelligence Technology Group | NA | 8.02% | 1.71% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Konishi | 0.15% | 0.46% | 12.50% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 16.31% | 7.95% | -9.56% | ★★★★★★ |

| Zhejiang Chinastars New Materials Group | 38.79% | 0.20% | 4.21% | ★★★★★☆ |

| Eclatorq Technology | 10.07% | 11.67% | 25.66% | ★★★★★☆ |

| Zhejiang Fuchunjiang Environmental ThermoelectricLTD | 61.23% | 1.99% | -6.62% | ★★★★☆☆ |

Click here to see the full list of 2603 stocks from our Asian Undiscovered Gems With Strong Fundamentals screener.

Let's review some notable picks from our screened stocks.

Zhongyuan Bank (SEHK:1216)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhongyuan Bank Co., Ltd. offers a range of banking products and services across the Asia Pacific, North America, and internationally, with a market capitalization of HK$14.44 billion.

Operations: Zhongyuan Bank generates its revenue primarily from retail banking, corporate banking, and financial markets business, with retail banking contributing CN¥5.29 billion and financial markets business adding CN¥5.09 billion. Corporate banking accounts for CN¥2.63 billion of the revenue stream.

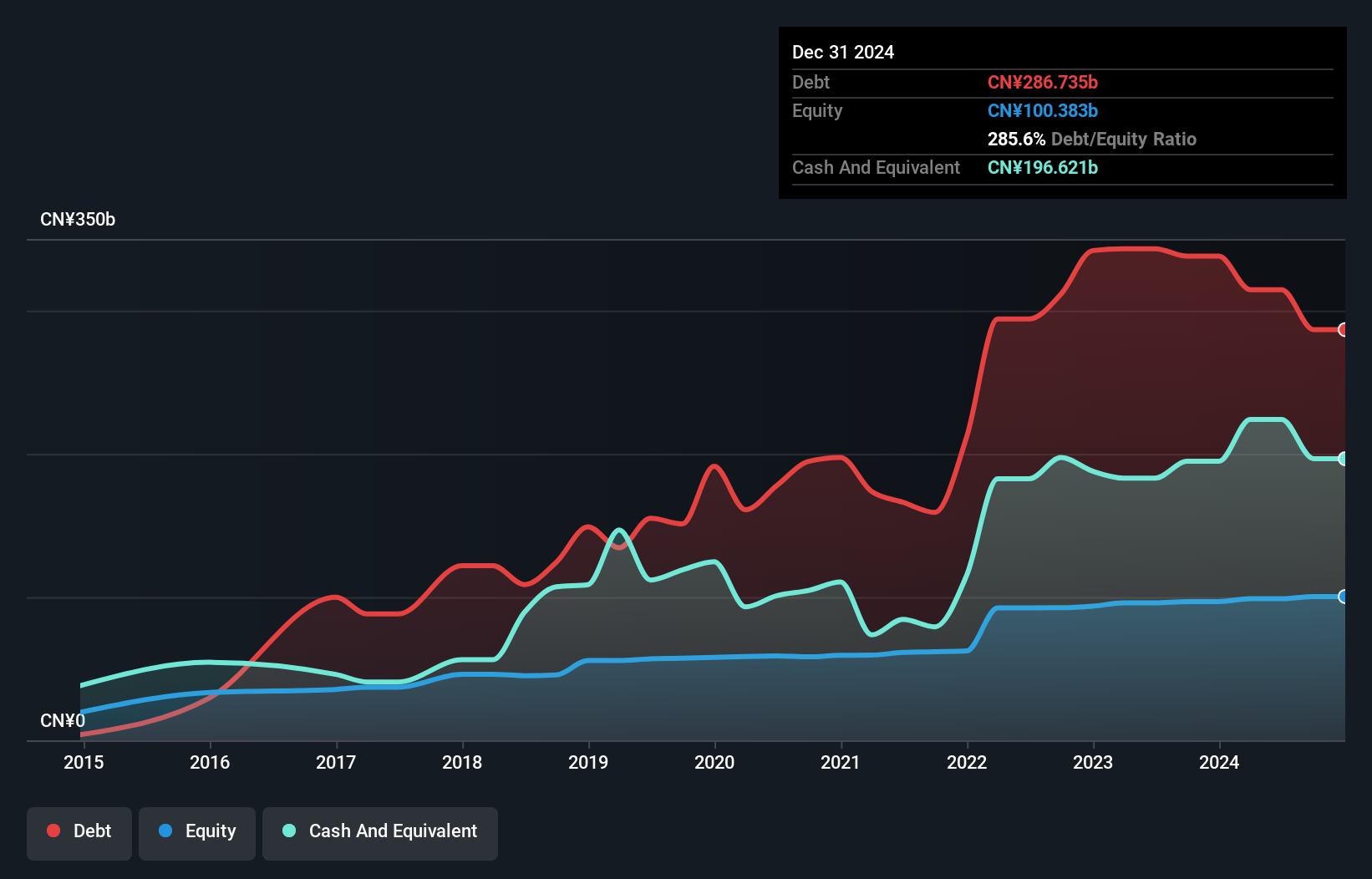

Zhongyuan Bank, a small player in the Asian financial landscape, showcases promising aspects for investors. With total assets of CN¥1,365.2 billion and equity of CN¥100.4 billion, it maintains a solid foundation. The bank's ability to manage risk is evident with 74% of its liabilities sourced from low-risk customer deposits and an appropriate bad loans ratio at 1.9%. Earnings growth last year was impressive at 16.1%, outpacing the industry average of 3.1%. Trading at 20% below its estimated fair value, Zhongyuan offers potential upside for those looking for undervalued opportunities in the sector.

- Take a closer look at Zhongyuan Bank's potential here in our health report.

Gain insights into Zhongyuan Bank's past trends and performance with our Past report.

Acotec Scientific Holdings (SEHK:6669)

Simply Wall St Value Rating: ★★★★★☆

Overview: Acotec Scientific Holdings Limited is an interventional medical device company that provides vascular interventional treatment products in Mainland China and internationally, with a market capitalization of HK$3.79 billion.

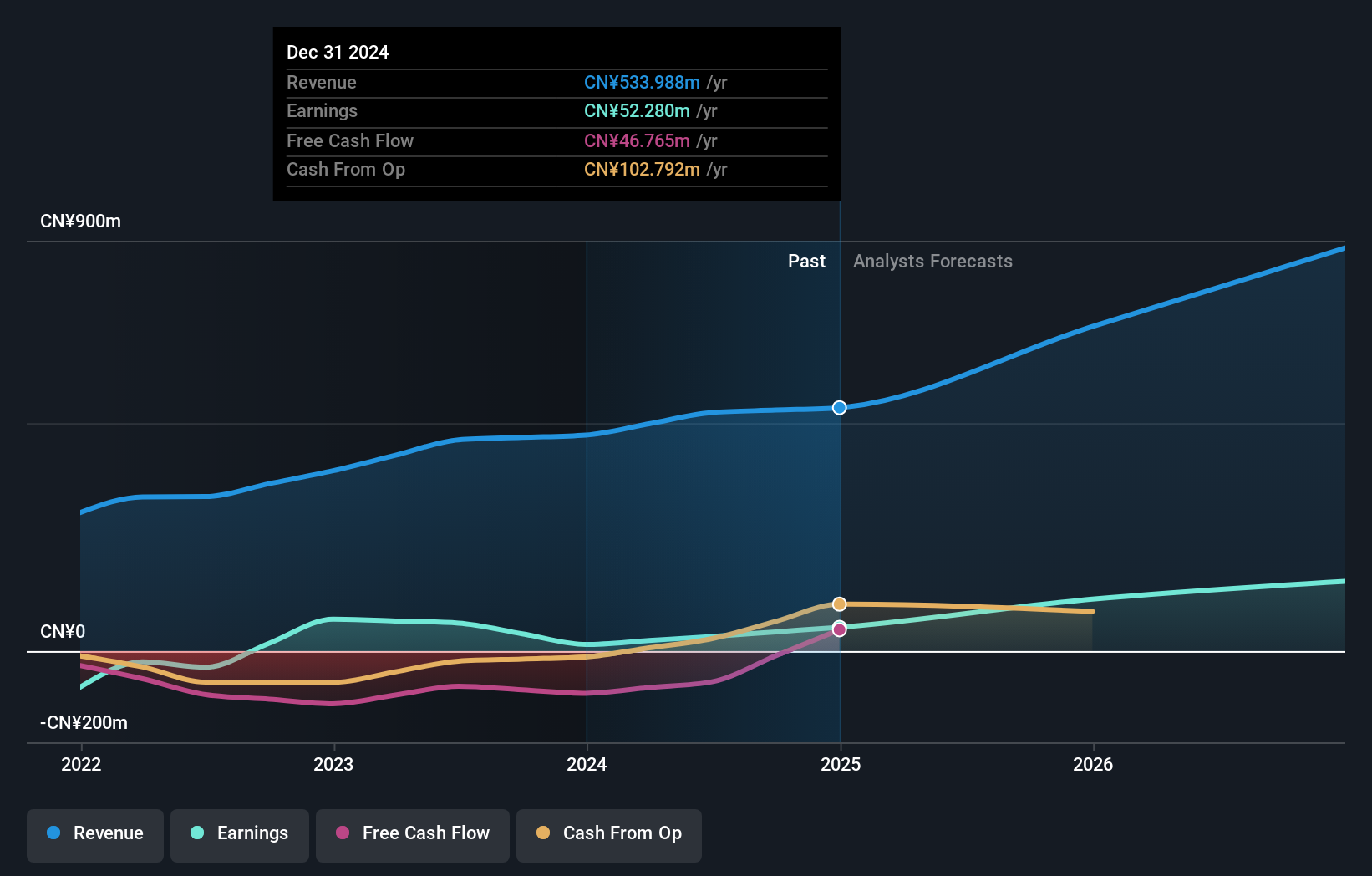

Operations: The company generates revenue primarily from its surgical and medical equipment segment, with reported earnings of CN¥533.99 million.

Acotec Scientific Holdings, a nimble player in the medical equipment sector, has seen its earnings grow by an impressive 260.9% over the past year, significantly outpacing the industry average of 9.6%. The company is trading at 6.3% below its estimated fair value, suggesting potential undervaluation. Recent product approvals from China's National Medical Products Administration include innovative devices like the Peripheral High-pressure Balloon Dilation Catheter Armoni-HP and AcoArt Verbena for vertebral artery stenosis treatment, which showed a restenosis rate of just 13.04% compared to a control group's 37.31%, indicating strong clinical performance and market potential in China.

- Delve into the full analysis health report here for a deeper understanding of Acotec Scientific Holdings.

Examine Acotec Scientific Holdings' past performance report to understand how it has performed in the past.

Hengbo HoldingsLtd (SZSE:301225)

Simply Wall St Value Rating: ★★★★★★

Overview: Hengbo Holdings Co., Ltd. specializes in the research, development, production, and sale of internal combustion engine air intake systems for automobiles, motorcycles, and general machinery with a market cap of CN¥8.36 billion.

Operations: Hengbo Holdings generates revenue primarily from its Auto Parts & Accessories segment, amounting to CN¥896.13 million.

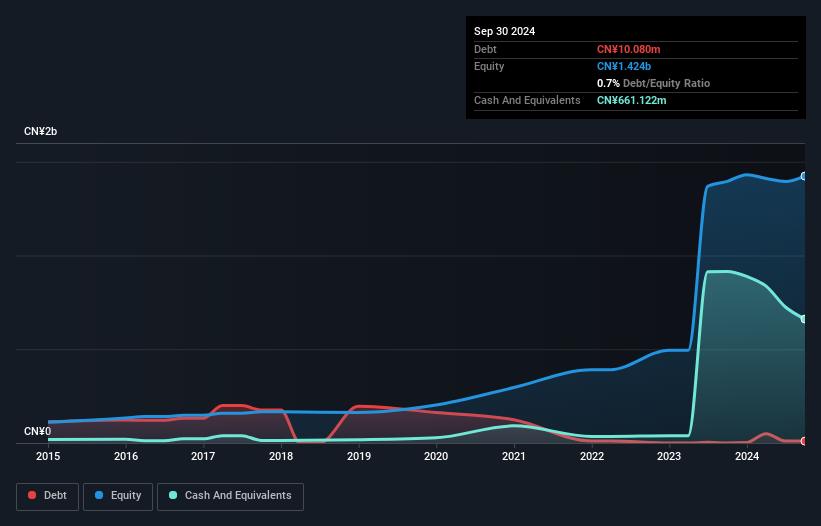

Hengbo Holdings, an intriguing player in the Auto Components sector, has shown a robust earnings growth of 16.2% over the past year, surpassing industry averages. The company is debt-free now, a significant improvement from five years ago when its debt-to-equity ratio stood at 67.8%. Recent financials highlight a net income of CNY 131 million for 2024 on sales of CNY 837.95 million, reflecting solid performance with basic earnings per share rising to CNY 1.29 from CNY 1.27 previously. Despite these strengths, Hengbo's share price has been highly volatile recently, which investors should consider carefully.

- Click here to discover the nuances of Hengbo HoldingsLtd with our detailed analytical health report.

Gain insights into Hengbo HoldingsLtd's historical performance by reviewing our past performance report.

Next Steps

- Unlock our comprehensive list of 2603 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10