Weekly Picks: 📈 MSTR's Leveraged Bitcoin Exposure, QS' Breakthrough Battery Tech, and BBWI's Turnaround Potential

Each week our analysts hand pick their favourite Narratives from the community ( what is a Narrative? ).

This week’s picks cover:

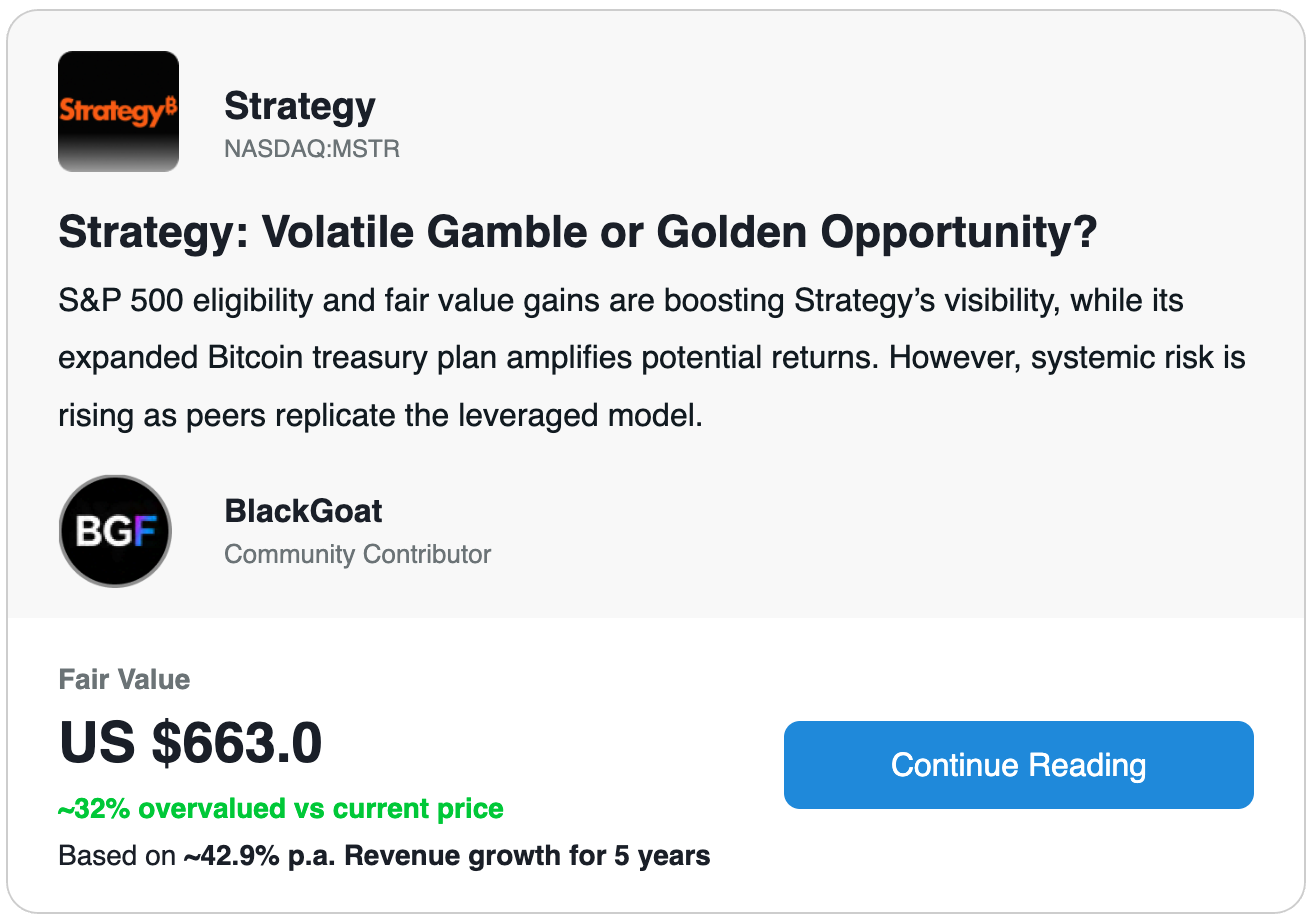

- 📈 Why Strategy is a compelling vehicle to gain leveraged Bitcoin exposure.

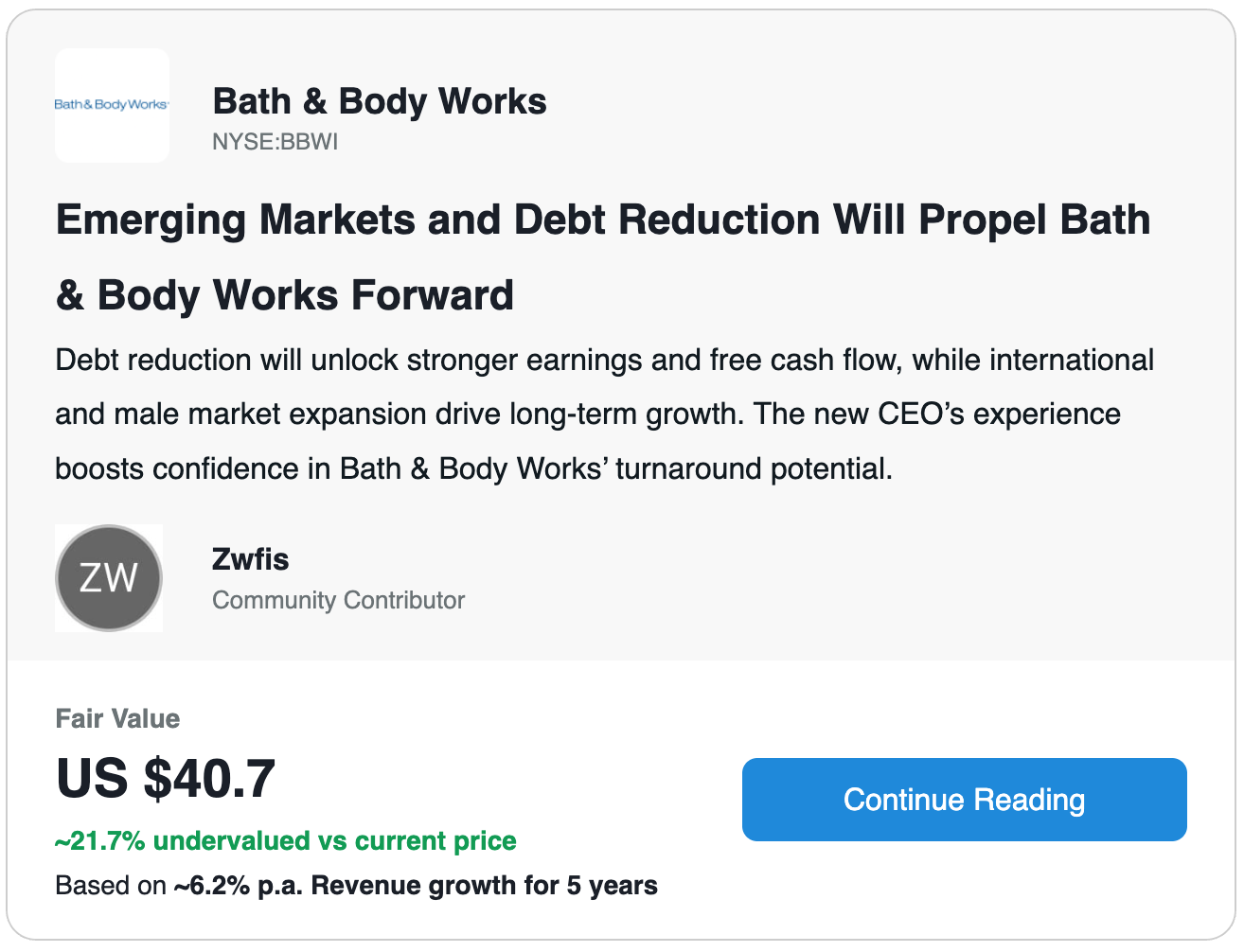

- 💰 How debt reduction is a key driver to Bath & Body Works' success.

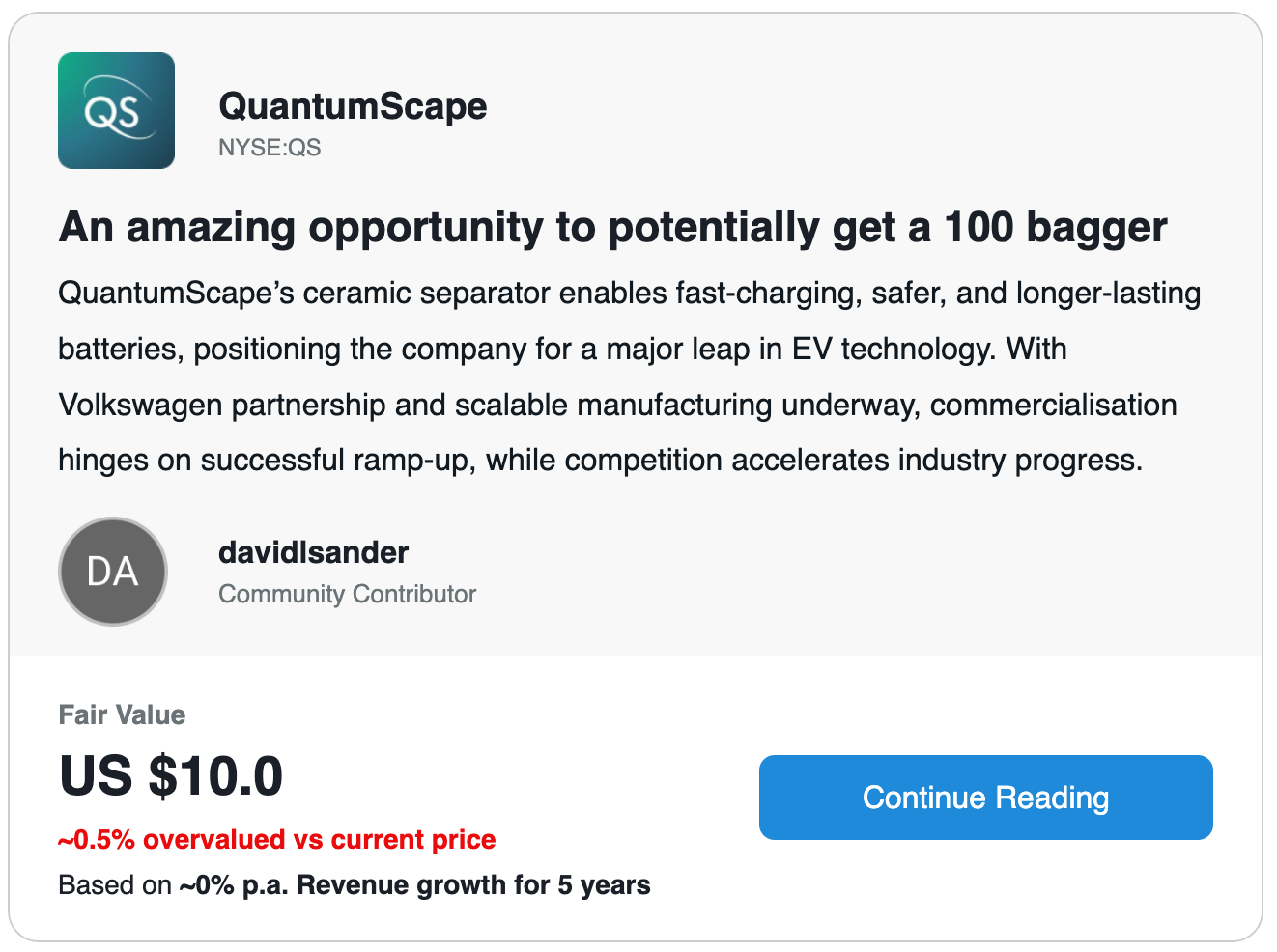

- 🔋 Why QuantumScape’s technology could solve all current EV problems.

💡 Why we like it: This narrative nails the bull and bear case balance for one of the market’s most volatile Bitcoin plays. It lays out Strategy’s evolution into a Bitcoin-native financial platform well, detailing catalysts like S&P 500 inclusion, regulatory tailwinds, and the ambitious 42 42 Plan. The base/bull/bear scenario framing makes the asymmetric risk/reward pretty clear for investors debating if this is a leveraged bet or a generational opportunity.

💡 Why we like it: This is a thoughtful deep-dive into Bath & Body Works’ turnaround potential, blending clear-eyed analysis of its debt drag with optimism for growth under new leadership. Zwfis connects the dots between Heaf’s Nike experience, international expansion, and untapped male-market demand while showing how deleveraging could unlock significant shareholder value. Like the MSTR narrative, the bear/base/bull projections give a grounded but ambitious framework for assessing the upside.

💡 Why we like it: This narrative is a masterclass in battery science. The deep dive into QuantumScape’s ceramic separator, Cobra process, and “and problem” solutions reads like a rare glimpse under the hood of a potentially world-changing technology. While the science is compelling, it’s not commercial yet. An estimate of its future revenue and earnings potential would help justify the valuation estimate.

What's next?

-

🔔 Know when to act: Set the narrative valuations as your own fair value to know when to buy, hold or sell the stock.

-

🤔 Get answers: Ask the author any questions in the comments section. Feel free to like as well to support their work.

-

✨ Discover more Narratives: There are hundreds of other insightful stock narratives on our Community page .

-

✍️ Build an audience: Have your narrative seen by millions of investors, simply meet our Featuring criteria to go into the running!

Disclaimer

BlackGoat is an employee of Simply Wall St, but has written a narrative in their capacity as an individual investor. Simply Wall St analyst Michael Paige has a position in NASDAQ:MSTR. Simply Wall St have no position in any of the companies mentioned. These narratives are general in nature and explore scenarios and estimates created by the authors. These narratives do not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company’s future performance and are exploratory in the ideas they cover. The fair value estimate’s are estimations only, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Michael Paige and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10