Does PPG’s 100th Electrostatic Marine Coating Milestone Change The Bull Case For PPG Industries (PPG)?

- PPG Industries recently marked its 100th dry docking using electrostatic application for marine hull coatings, completing the milestone on the MV Colossus for Enterprises Shipping and Trading S.A. at the CUD Weihai Shipyard in China.

- This achievement highlights PPG’s adaptation of advanced spraying technology from the automotive and aerospace sectors to marine applications, resulting in improved efficiency, lower waste, and enhanced environmental outcomes.

- We'll now assess how PPG’s expansion of sustainable coating technologies could shape its overall investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

PPG Industries Investment Narrative Recap

To be a shareholder in PPG Industries, you need to believe in the company’s ability to leverage its leadership in advanced and sustainable coatings technologies, despite macroeconomic challenges. The recent milestone in electrostatic marine hull coatings underlines PPG’s innovation and its commitment to environmental outcomes, supporting its reputation in high-value markets. However, this development is not expected to materially impact near-term catalysts, such as aerospace and protective coatings performance, nor does it lessen ongoing risks from foreign currency headwinds and automotive sector weakness.

One especially relevant recent announcement was PPG’s showcase at its Coatings Innovation Center, where it introduced new sustainable solutions designed to improve operational efficiency and reduce application costs. These initiatives complement the advancements seen with the marine electrostatic coating milestone, reflecting the same focus on productivity and environmental responsibility that underpins key catalysts like share gains in technology-driven segments.

Yet, it’s important to note a less visible factor: while sustainable innovation continues, investors should also be alert to volatility from unfavorable currency translations...

Read the full narrative on PPG Industries (it's free!)

PPG Industries' outlook estimates $16.8 billion in revenue and $1.9 billion in earnings by 2028. This scenario assumes 2.3% annual revenue growth and a $0.6 billion increase in earnings from the current level of $1.3 billion.

Uncover how PPG Industries' forecasts yield a $125.77 fair value, a 9% upside to its current price.

Exploring Other Perspectives

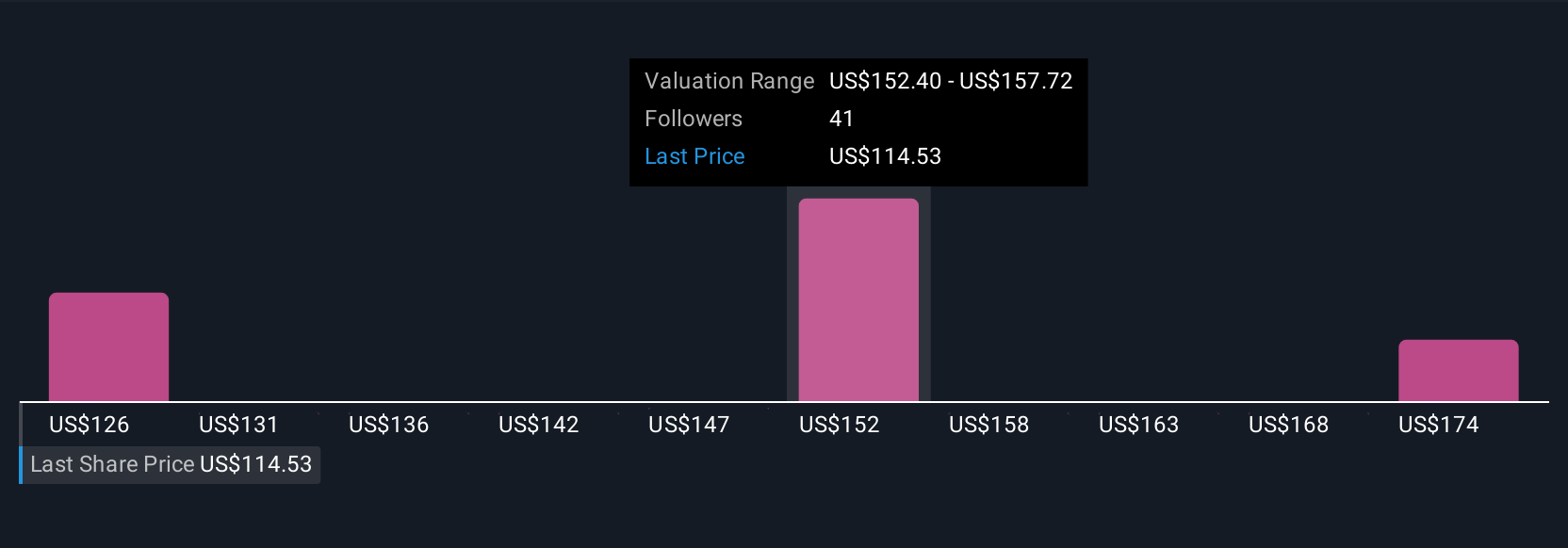

Four unique fair value estimates from the Simply Wall St Community span from US$125.77 to US$178.93 per share. While these reflect broad viewpoints, remember that ongoing challenges in core end markets could influence future returns, consider multiple perspectives to fully inform your outlook.

Explore 4 other fair value estimates on PPG Industries - why the stock might be worth as much as 55% more than the current price!

Build Your Own PPG Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PPG Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PPG Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PPG Industries' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10