Court Ruling on Toll Increase Could Be a Game Changer for Atlas Arteria (ASX:ALX)

- On July 17, 2025, the Supreme Court of Virginia upheld a previous regulatory decision denying Atlas Arteria’s request to increase tolls on the Dulles Greenway, a major US transport asset.

- This outcome not only restricts immediate revenue enhancements for the company but also pushes Atlas Arteria to pursue a federal legal case seeking alternative relief and compensation.

- We’ll examine how this setback in securing higher tolls may shape Atlas Arteria’s investment narrative amid ongoing regulatory challenges.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Atlas Arteria's Investment Narrative?

To be an Atlas Arteria shareholder, you need to be comfortable with the idea that regulated toll road assets can offer stable cash flows and long-term income, but that headline catalysts often come down to regulatory decisions and the ability to raise tolls. The recent Virginia Supreme Court decision, denying a toll increase on Dulles Greenway, has landed squarely in the path of one of the company’s biggest near-term catalysts: driving up revenue through higher toll rates. This now shifts the focus heavily onto Atlas Arteria’s pending federal court case and ongoing regulatory negotiations, raising the risk profile in the short term, especially since recent guidance and fair value estimates didn’t price in this level of legal resistance. While earnings have been growing and dividends have remained substantial according to previous results, the even greater scrutiny on regulatory outcomes could weigh on sentiment, as the Dulles Greenway setback may slow revenue momentum and cast uncertainty over the sustainability of future cash flows. By contrast, regulatory challenges can sometimes have broader consequences for long-term rewards.

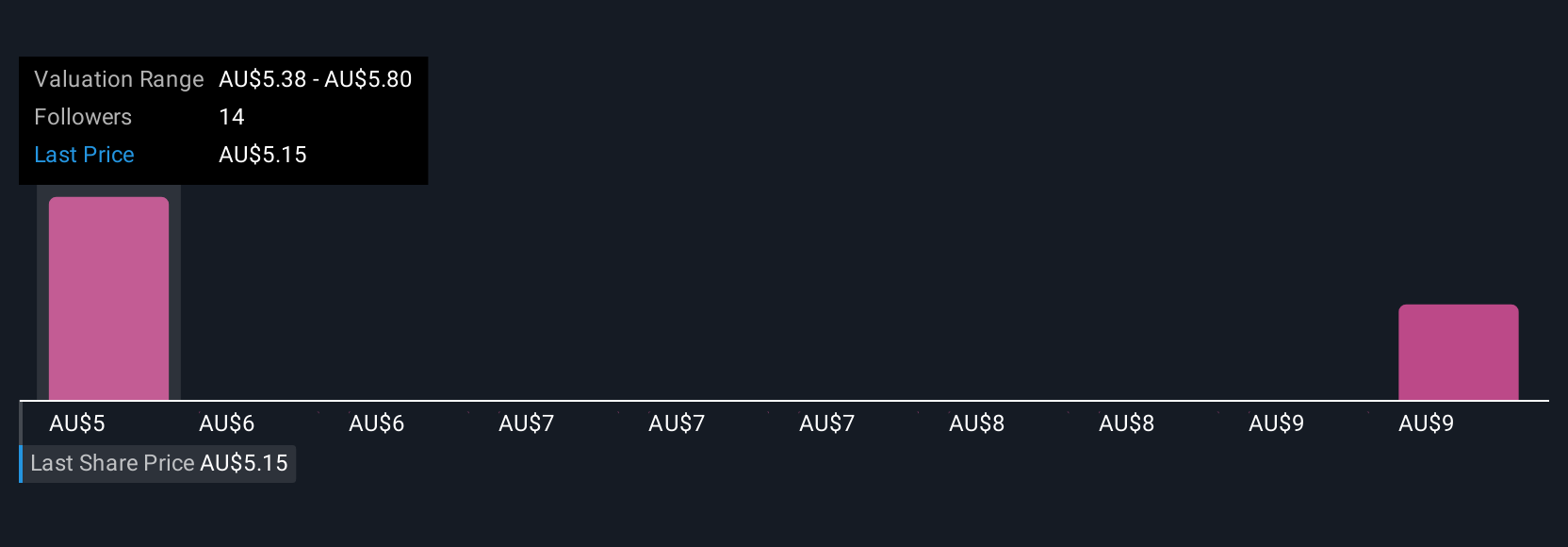

Atlas Arteria's shares have been on the rise but are still potentially undervalued by 46%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Atlas Arteria - why the stock might be worth as much as 85% more than the current price!

Build Your Own Atlas Arteria Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atlas Arteria research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Atlas Arteria research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atlas Arteria's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10