Tencent Music Entertainment Group (TME) Sees 82% Price Surge Over Last Quarter

Tencent Music Entertainment Group (TME) has experienced a significant price move of 82% over the past quarter. This surge aligns with recent company events, suggesting a link to its impressive quarterly earnings announced on May 13, which revealed substantial revenue and net income growth. Additionally, M&A rumors about acquiring podcasting startup Ximalaya, reported on April 25, may have heightened investor interest, contributing positively to investor sentiment. Overall, these developments are complementary to broader market trends of positive earnings outlooks, suggesting TME's performance aligns well with enhanced corporate results across major indexes like the S&P 500.

Be aware that Tencent Music Entertainment Group is showing 1 possible red flag in our investment analysis.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

The recent developments, including Tencent Music Entertainment Group's impressive earnings and potential M&A activities, could enhance its dual-engine strategy focusing on content and platform innovation. This may support revenue growth and user engagement via expanded content offerings and AI integration, essential for subscriber conversion efficiency. Over the longer term, TME's shares have soared, achieving a total return of 388.93% over the past three years. This substantial increase illustrates robust growth, although in the past year alone, TME underperformed the US Entertainment industry, which posted a return of 69.5%.

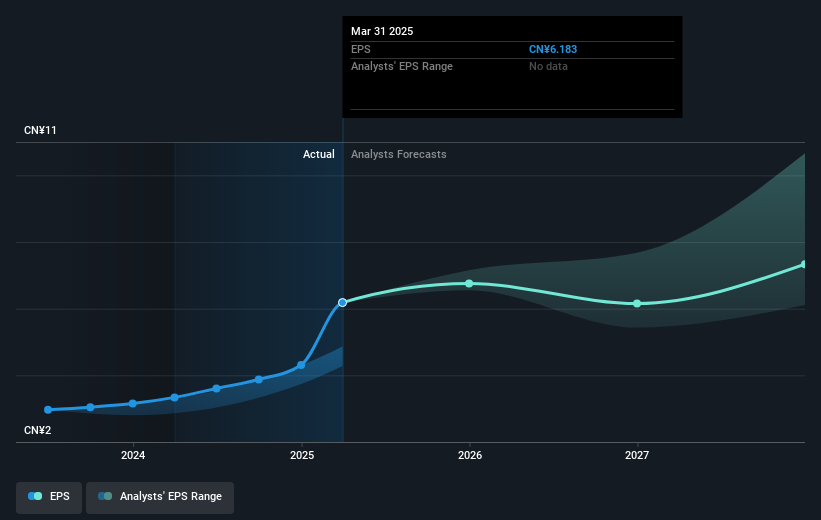

The current share price of US$22.36 reflects a 12.5% higher valuation than the consensus analyst price target of US$19.03, suggesting potential overvaluation. Nonetheless, the ongoing initiatives and positive sentiment from recent earnings could bolster revenue and margin forecasts. Analysts project TME's earnings to grow with anticipated improvements in profit margins, though continued success depends on maintaining strategic partnerships and competitive positioning within the music streaming market. As TME navigates these challenges, the focus will be on whether revenue growth aligns with or surpasses analyst expectations, which help justify current price movements against target valuations.

Our valuation report unveils the possibility Tencent Music Entertainment Group's shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Music Entertainment Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10