Is Focus Minerals Limited's (ASX:FML) ROE Of 3.1% Concerning?

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. We'll use ROE to examine Focus Minerals Limited (ASX:FML), by way of a worked example.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Focus Minerals is:

3.1% = AU$3.0m ÷ AU$96m (Based on the trailing twelve months to December 2024).

The 'return' is the amount earned after tax over the last twelve months. That means that for every A$1 worth of shareholders' equity, the company generated A$0.03 in profit.

View our latest analysis for Focus Minerals

Does Focus Minerals Have A Good Return On Equity?

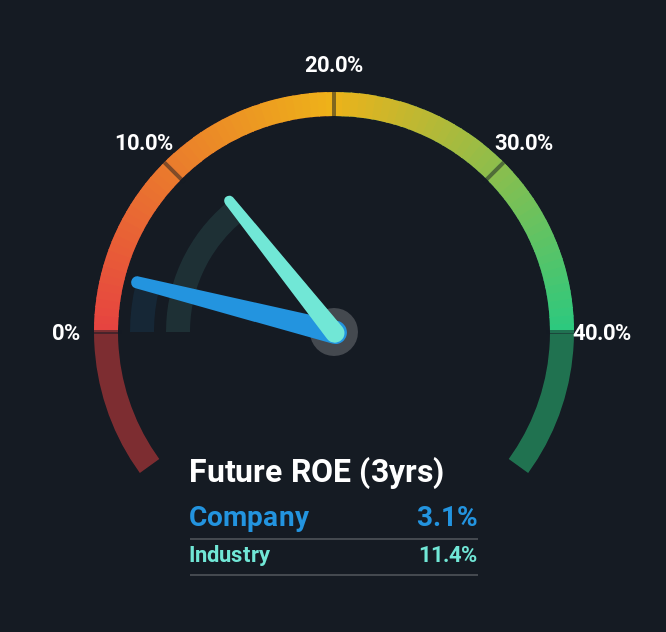

Arguably the easiest way to assess company's ROE is to compare it with the average in its industry. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. As is clear from the image below, Focus Minerals has a lower ROE than the average (11%) in the Metals and Mining industry.

That's not what we like to see. Although, we think that a lower ROE could still mean that a company has the opportunity to better its returns with the use of leverage, provided its existing debt levels are low. A high debt company having a low ROE is a different story altogether and a risky investment in our books. You can see the 3 risks we have identified for Focus Minerals by visiting our risks dashboard for free on our platform here.

The Importance Of Debt To Return On Equity

Companies usually need to invest money to grow their profits. The cash for investment can come from prior year profits (retained earnings), issuing new shares, or borrowing. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the debt used for growth will improve returns, but won't affect the total equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking.

Focus Minerals' Debt And Its 3.1% ROE

Focus Minerals clearly uses a high amount of debt to boost returns, as it has a debt to equity ratio of 1.63. With a fairly low ROE, and significant use of debt, it's hard to get excited about this business at the moment. Debt does bring extra risk, so it's only really worthwhile when a company generates some decent returns from it.

Summary

Return on equity is useful for comparing the quality of different businesses. A company that can achieve a high return on equity without debt could be considered a high quality business. All else being equal, a higher ROE is better.

But when a business is high quality, the market often bids it up to a price that reflects this. Profit growth rates, versus the expectations reflected in the price of the stock, are a particularly important to consider. Check the past profit growth by Focus Minerals by looking at this visualization of past earnings, revenue and cash flow.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10