Hartford Insurance Group (HIG) Appoints New Chief Risk Officer As Paiano Retires

Hartford Insurance Group (HIG) recently announced the promotion of Prateek Chhabra to Chief Risk Officer and the retirement of Robert Paiano, marking significant leadership changes. During the last quarter, the company's stock price increased by 2%, in line with broader market trends, as major indices like the S&P 500 and Nasdaq experienced upward momentum. The broader market performance overshadowed any single event for The Hartford, though leadership changes and declared dividends of $0.52 per share may have contributed positively to investor sentiment. This backdrop reflects a stable quarter for the company amid wider market gains.

We've spotted 1 weakness for Hartford Insurance Group you should be aware of.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

The recent leadership changes at Hartford Insurance Group, particularly the appointment of Prateek Chhabra as Chief Risk Officer, could potentially influence the company's future strategy in managing risk, which is a critical component for international insurers. These changes may reassure investors about the company’s ongoing commitment to effective risk management, potentially contributing to revenue and earnings stability. Over a period of five years, the company's total shareholder return, including dividends, was 219.54%, showcasing robust long-term performance. In contrast, over the past year alone, Hartford Insurance Group outperformed both the US market and its industry, positioning it as a compelling player in the insurance sector.

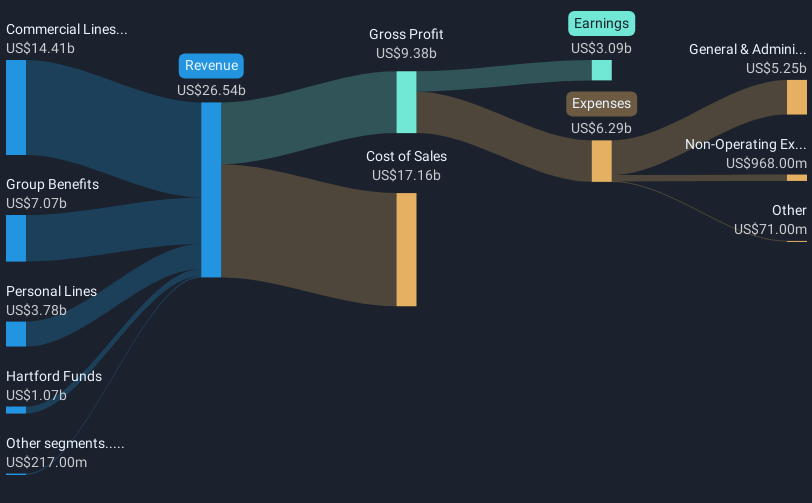

As of today, Hartford's stock price stands at US$120.55, close to the analyst consensus price target of US$136.54, reflecting a market view that largely sees the company fairly valued. The recent dividend declaration and stock performance provide a comforting backdrop for revenue and earnings expectations, with forecasts suggesting growth driven by digital initiatives and international expansion. Analysts project revenues to reach US$32.1 billion and earnings US$3.8 billion by 2028. However, enduring external pressures such as regulatory challenges could influence these forecasts. Investors are encouraged to consider these various factors as they reflect on Hartford's financial trajectory and the influence of the recent leadership shake-up.

Click to explore a detailed breakdown of our findings in Hartford Insurance Group's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hartford Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10