Exploring Three High Growth Tech Stocks in Australia

As we reach the end of the first day of Week 30 in 2025, the Australian market experienced a pullback with the ASX dipping back to the high 8,600s after an unexpected climb into the 8,700s on Friday. Despite this minor setback and profit-taking activities following Wall Street's flat finish last week, investor sentiment remains cautiously optimistic with US futures trending upward and no immediate adverse impacts from recent tariffs. In this context, identifying high-growth tech stocks in Australia involves looking for companies that can leverage current market dynamics and global economic shifts to maintain strong performance potential.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pro Medicus | 20.17% | 22.26% | ★★★★★★ |

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Echo IQ | 49.20% | 51.35% | ★★★★★★ |

| WiseTech Global | 24.60% | 23.18% | ★★★★★★ |

| BlinkLab | 51.57% | 52.67% | ★★★★★★ |

| Wrkr | 55.92% | 116.30% | ★★★★★★ |

| Pointerra | 50.42% | 159.12% | ★★★★★☆ |

| Immutep | 70.84% | 42.55% | ★★★★★☆ |

| Adveritas | 52.34% | 88.83% | ★★★★★★ |

| SiteMinder | 18.77% | 55.55% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our ASX High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★★★

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging software and radiology information system (RIS) software to hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe with a market cap of A$33.59 billion.

Operations: Pro Medicus generates revenue primarily through the production of integrated software applications for the healthcare industry, amounting to A$184.58 million. The company focuses on delivering advanced imaging and radiology information system solutions across key markets in Australia, North America, and Europe.

Pro Medicus stands out in the Australian tech landscape, demonstrating a robust growth trajectory with a 41% increase in earnings over the past year and expectations to grow at 22.26% annually. Notably, its revenue growth rate of 20.2% surpasses the broader Australian market's average of 5.5%. This performance is underpinned by significant investments in R&D, ensuring continuous innovation and enhancement of their healthcare imaging software solutions. With an anticipated Return on Equity of 49.1%, Pro Medicus is not just keeping pace but setting benchmarks within the tech sector, reflecting both strong operational execution and strategic foresight in expanding its market presence.

- Delve into the full analysis health report here for a deeper understanding of Pro Medicus.

Understand Pro Medicus' track record by examining our Past report.

SEEK (ASX:SEK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SEEK Limited operates as an online employment marketplace service provider across Australia, South East Asia, New Zealand, the United Kingdom, Europe, and other international markets with a market cap of approximately A$8.67 billion.

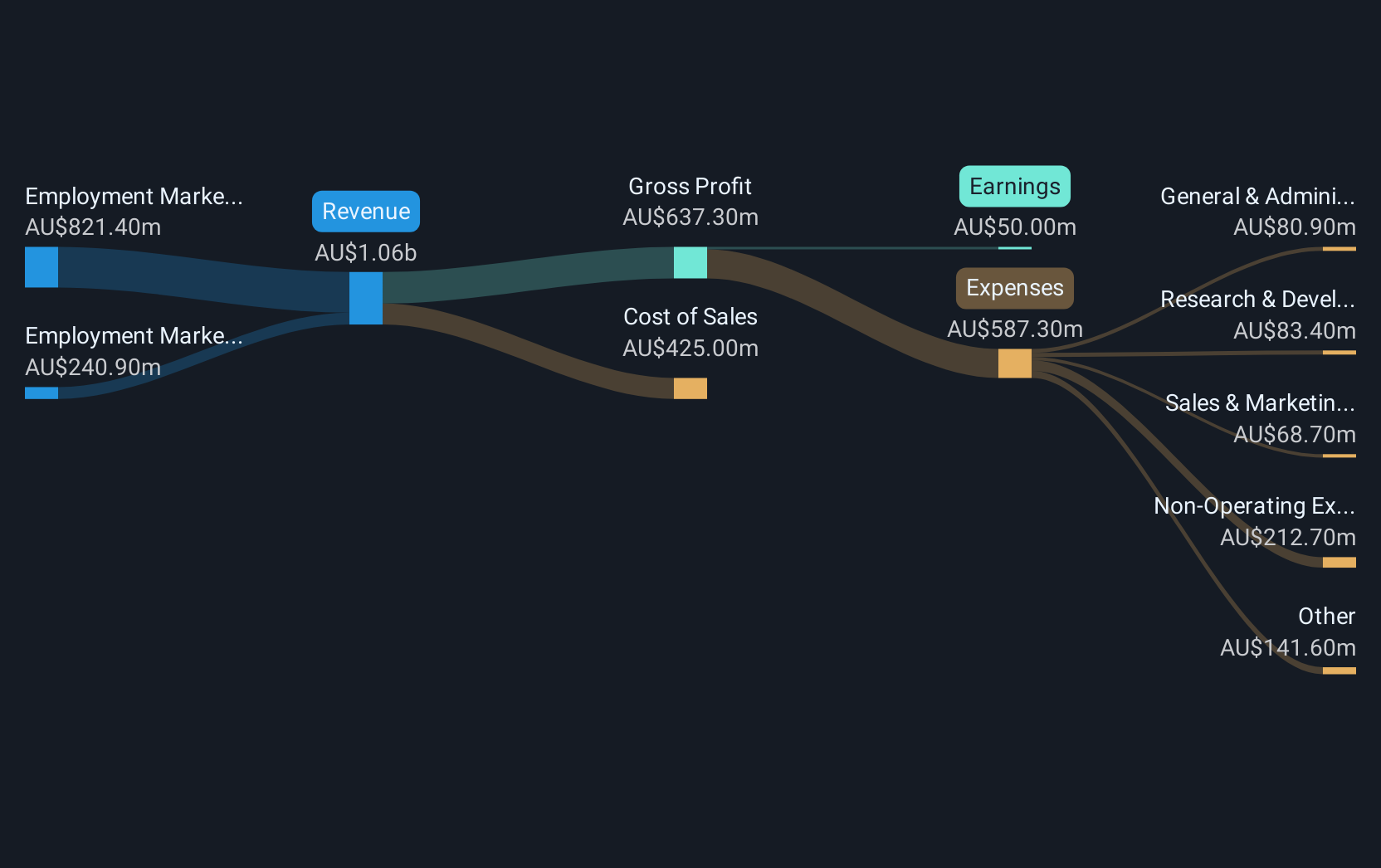

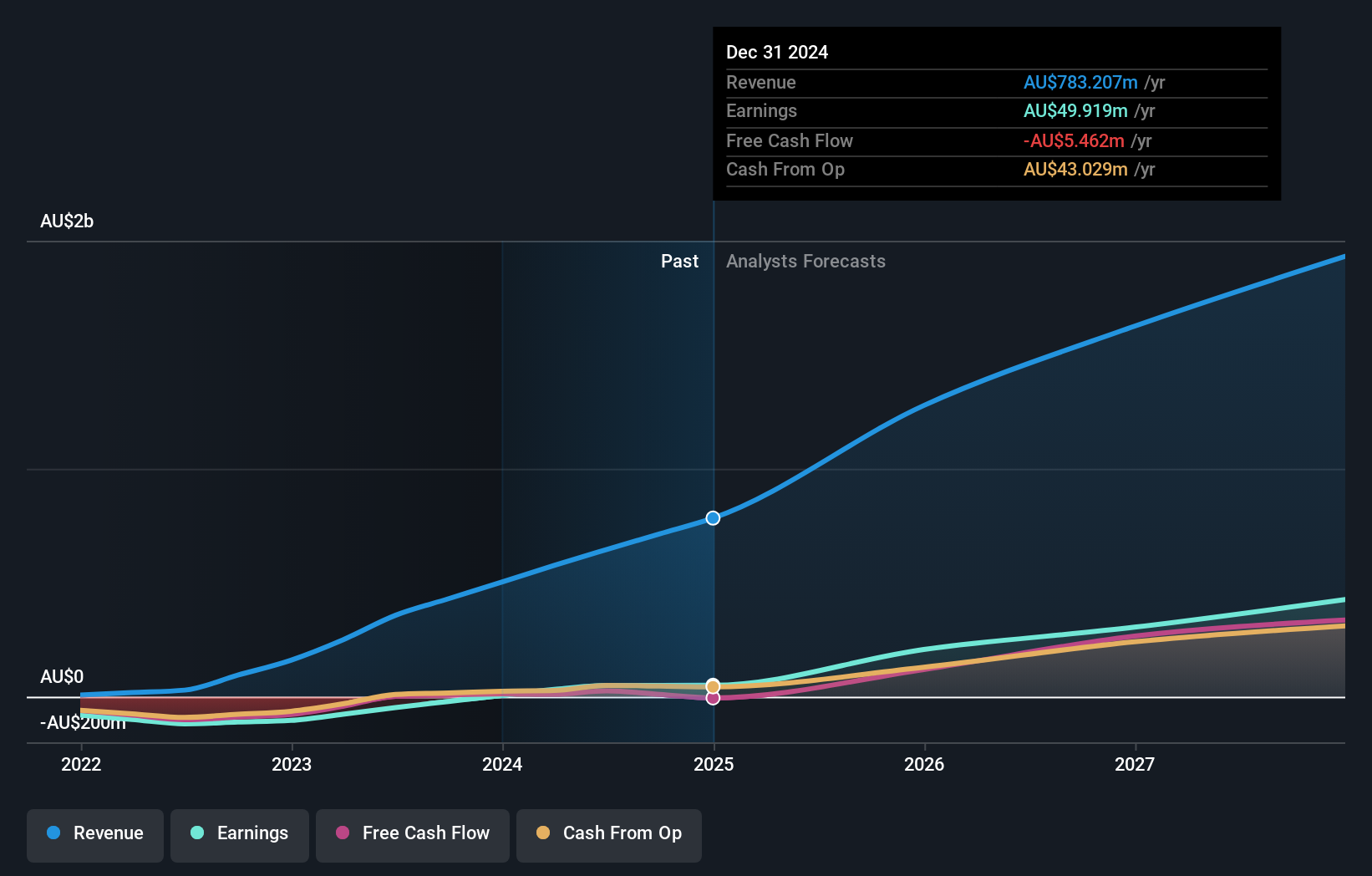

Operations: SEEK Limited generates revenue primarily from its Employment Marketplaces segments, with A$821.40 million from ANZ and A$240.90 million from Asia.

SEEK Limited, a player in the Australian tech scene, showcases promising growth with an 8.6% annual revenue increase and a notable 22% rise in earnings annually, outpacing the market average of 5.5%. Despite recent challenges, including a significant one-off loss of A$119.8M last year, its strategic focus on innovation through R&D investments positions it for future resilience. The company's robust performance is further evidenced by its positive free cash flow and an evolving product line that meets diverse client needs, suggesting potential for sustained advancement in the competitive tech industry.

- Get an in-depth perspective on SEEK's performance by reading our health report here.

Gain insights into SEEK's past trends and performance with our Past report.

Telix Pharmaceuticals (ASX:TLX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Telix Pharmaceuticals Limited is a commercial-stage biopharmaceutical company that develops and commercializes therapeutic and diagnostic radiopharmaceuticals for cancer and rare diseases, with a market cap of approximately A$8.45 billion.

Operations: The company generates revenue primarily from Precision Medicine, contributing A$771.11 million, followed by Therapeutics at A$9.35 million and Manufacturing Solutions at A$2.75 million.

Telix Pharmaceuticals, amid a dynamic Australian tech landscape, has demonstrated significant strides in the radiopharmaceutical sector. With a robust annual revenue growth of 19.8% and an impressive earnings surge of 32.7%, Telix outpaces many peers. Recent regulatory approvals and strategic expansions underscore its commitment to innovation; for instance, the U.S. CMS's recent HCPCS code assignment for Gozellix® enhances billing and reimbursement frameworks, pivotal for broader market penetration. Furthermore, the company's R&D expenditure aligns with its forward-looking agenda in precision medicine—evident from its extensive involvement in developing next-generation diagnostic agents like Illuccix® and Gozellix®, which are setting new standards in prostate cancer imaging with high specificity rates. These developments not only bolster Telix's market position but also promise enhanced patient outcomes through earlier and more accurate disease detection.

- Navigate through the intricacies of Telix Pharmaceuticals with our comprehensive health report here.

Evaluate Telix Pharmaceuticals' historical performance by accessing our past performance report.

Key Takeaways

- Explore the 46 names from our ASX High Growth Tech and AI Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telix Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10