CRISPR Therapeutics (CRSP) Surges 71% Last Quarter With Inclusion In Russell Indices

CRISPR Therapeutics (CRSP) has recently been included in numerous Russell indices, highlighting its increasing market recognition. This, coupled with promising advancements in their cardiovascular disease programs, may have significantly impacted the company's 71% price move last quarter. While the broader market also experienced gains, with the S&P 500 closing at record highs, CRSP's substantial rise stands out, possibly buoyed by these pivotal company-specific events, in addition to general market optimism surrounding trade deals. The company's development in health innovations could have contributed positively to its market performance, enhancing investor confidence.

We've discovered 1 risk for CRISPR Therapeutics that you should be aware of before investing here.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

CRISPR Therapeutics AG has seen a total return of 15.28% over the past year, illustrating its appeal amid industry challenges. This is a favorable contrast to the wider US Biotechs industry, which saw a decline of 11.2% over the same period. The company's performance aligns closely with the broader US market, which achieved a 14.6% increase.

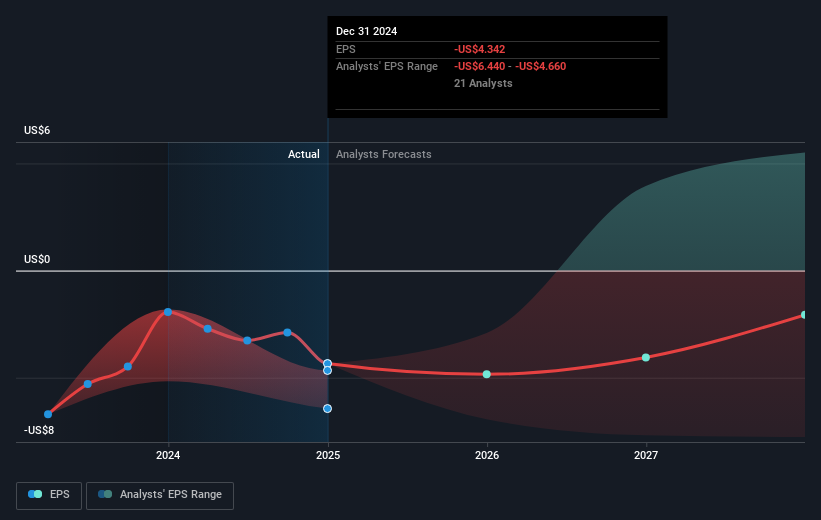

The developments mentioned in the introduction, including their inclusion in Russell indices and advances in cardiovascular programs, may positively influence revenue and earnings forecasts. Despite the company's recent progress, its unprofitable status indicates that revenue growth may not immediately translate into positive earnings. The current share price of US$65.93 is trading below the consensus price target of US$81.75, highlighting potential market optimism about the company's prospects amid ongoing operational and clinical advancements.

Unlock comprehensive insights into our analysis of CRISPR Therapeutics stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10