Think SoFi Stock Is Expensive? This Chart Might Change Your Mind.

-

SoFi stock is expensive according to traditional valuation metrics.

-

It's growing much faster than similar banks.

-

It aims to become a top-10 bank.

Determining what constitutes a cheap or expensive stock is anything but simple. Even the king of value investing, Warren Buffett, recently bought several stocks that don't look cheap according to traditional metrics. That's because any valuation needs to be understood in context with other factors.

SoFi Technologies (SOFI -3.07%) is a great example. Its stock is definitely expensive-looking based on several traditional valuation metrics as well as specific bank valuation metrics. But a chart below might change your viewpoint on SoFi.

Image source: Getty Images.

Priced for growth

SoFi stock trades at a P/E ratio of 51, a price-to-sales ratio of 8.6, and a price-to-book ratio of 3.5. The price-to-book ratio is the more common valuation metric for banks, and a ratio higher than 1 is considered expensive. To be fair, many of the big banks have P/B ratios above 1, but SoFi is still much higher.

SoFi is a young bank stock that's just getting started. Its roots are in lending, and that's its largest segment. But it got a bank charter in 2022 when it acquired Golden Pacific Bancorp, and that has opened its business to offering a large suite of banking services. Its non-lending financial services segment is growing fast, more than doubling in the 2025 first quarter, and driving total company adjusted net revenue increase of 33%.

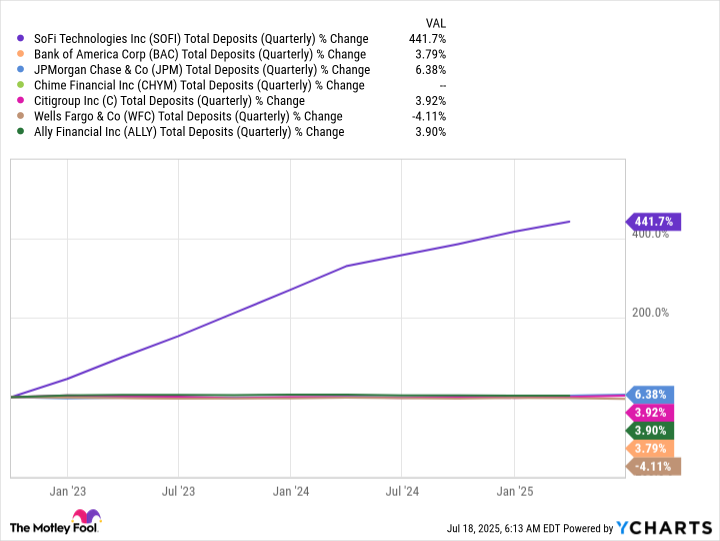

These are increases that other banks can't match. Not only does this include the large banks, like Bank of America, JPMorgan Chase, Citibank, and Wells Fargo, but consider how fast its deposits are growing compared to newcomer Chime and all-digital bank Ally.

Data by YCharts.

SoFi is more expensive than most of the stocks on almost every basis, but it deserves a premium for its incredible performance and growth prospects. CEO Anthony Noto has repeated several times that he envisions becoming a top-10 financial services company. If SoFi can keep this growth pace up, that could become a reality.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10