Arm Holdings (ARM) Reports Strong Year-Over-Year Performance Despite Net Income Dip

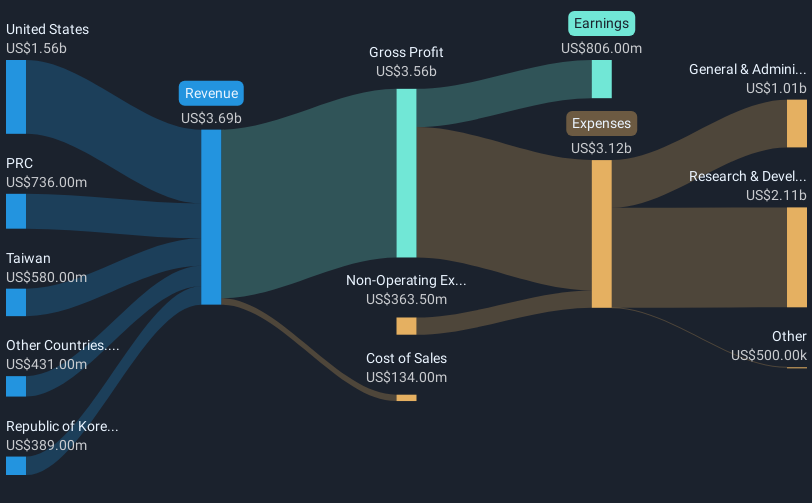

Arm Holdings (ARM) benefited from a recent partnership with Cerence Inc., which may have supported its 61% price increase last quarter. The collaboration aims to enhance AI in vehicles, potentially giving Arm significant market leverage, especially given Cerence's focus on the automotive sector. Additionally, Arm’s earnings report showcased a strong year-over-year performance, despite a dip in net income for the quarter. Amid a backdrop where the S&P 500 and Nasdaq retreated from record highs, Arm's positive developments might have countered the broader market's trends, marking a distinctive contrast in its overall market performance.

Buy, Hold or Sell Arm Holdings? View our complete analysis and fair value estimate and you decide.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

The partnership between Arm Holdings and Cerence Inc. highlighted in the introduction could potentially bolster Arm's revenue and earnings forecasts. By enhancing AI capabilities in the automotive sector, Arm may strengthen its position and capitalize on emerging market opportunities. This collaboration aligns with Arm's existing narrative of strategic engagement with hyperscalers and its focus on AI-driven revenue growth. Given the ambitious projections within the company's narrative, this partnership provides potential validation for expected revenue and royalty increases, though existing risks, such as legal uncertainties with Qualcomm, remain pertinent.

Over the longer term, Arm's total shareholder return was a 1% decline over the past year, contrasting with its significant quarterly share price increase. In comparison, the company underperformed the US Semiconductor industry, which returned 26.9% over the same one-year period. This discrepancy suggests a tangible impact from recent developments, but it also underlines the volatility in Arm's stock performance amidst broader industry trends.

Despite Arm's current share price of US$161.92, which exceeds consensus analyst price targets like US$142.28, the partnership news may influence reevaluation of these targets. The market's confidence in Arm’s projected growth must adjust not just to positive developments but also to challenges like R&D expenses and customer concentrations. The ongoing analysis suggests a cautious market view on expectations versus potential, reflecting concerns about elevated valuation metrics in light of industry comparatives.

Understand Arm Holdings' track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10