Did Ammonia-Fueled Ship JV With Amon Maritime Just Shift Navigator Holdings' (NVGS) Investment Narrative?

- On July 14, 2025, Navigator Holdings formed a joint venture with Amon Maritime to construct two 51,530 cubic meter ammonia-fueled carriers in Norway, set for deliveries in 2028, with each ship also capable of carrying liquefied petroleum gas and supported by Norwegian government grants.

- This move positions Navigator Holdings at the forefront of clean shipping technology adoption and secures multi-year charters, reflecting a shift toward more sustainable and reliable revenue sources.

- We'll explore how the planned addition of ammonia-fueled vessels with long-term charters shapes Navigator Holdings' investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Navigator Holdings Investment Narrative Recap

To be a shareholder in Navigator Holdings, one needs to believe in the firm’s ability to capitalize on the global shift to low-carbon shipping while managing near-term challenges in petrochemical trade flows. The recent joint venture with Amon Maritime could reinforce longer-term revenue streams through secured charters but does not materially alter the most important catalyst, which is expanded capacity at Morgan's Point, nor does it reduce nearer-term risks tied to potential slowdowns in US natural gas liquids production or contract repricing across the fleet.

Among the company’s latest updates, the completion of the Morgan's Point terminal expansion is especially relevant. With ethylene export capacity tripling, this supports Navigator Holdings’ efforts to boost recurring revenue, although the pace at which additional contract volumes are secured may depend on the same market forces that create risk for new order investment and competition.

However, investors should also be mindful that while new chartered, ammonia-fueled vessels offer long-term revenue clarity, ongoing exposure to US NGL supply trends means...

Read the full narrative on Navigator Holdings (it's free!)

Navigator Holdings' outlook suggests $494.1 million in revenue and $138.0 million in earnings by 2028. This implies an annual revenue decline of 4.5% and an earnings increase of $52.4 million from current earnings of $85.6 million.

Uncover how Navigator Holdings' forecasts yield a $22.25 fair value, a 40% upside to its current price.

Exploring Other Perspectives

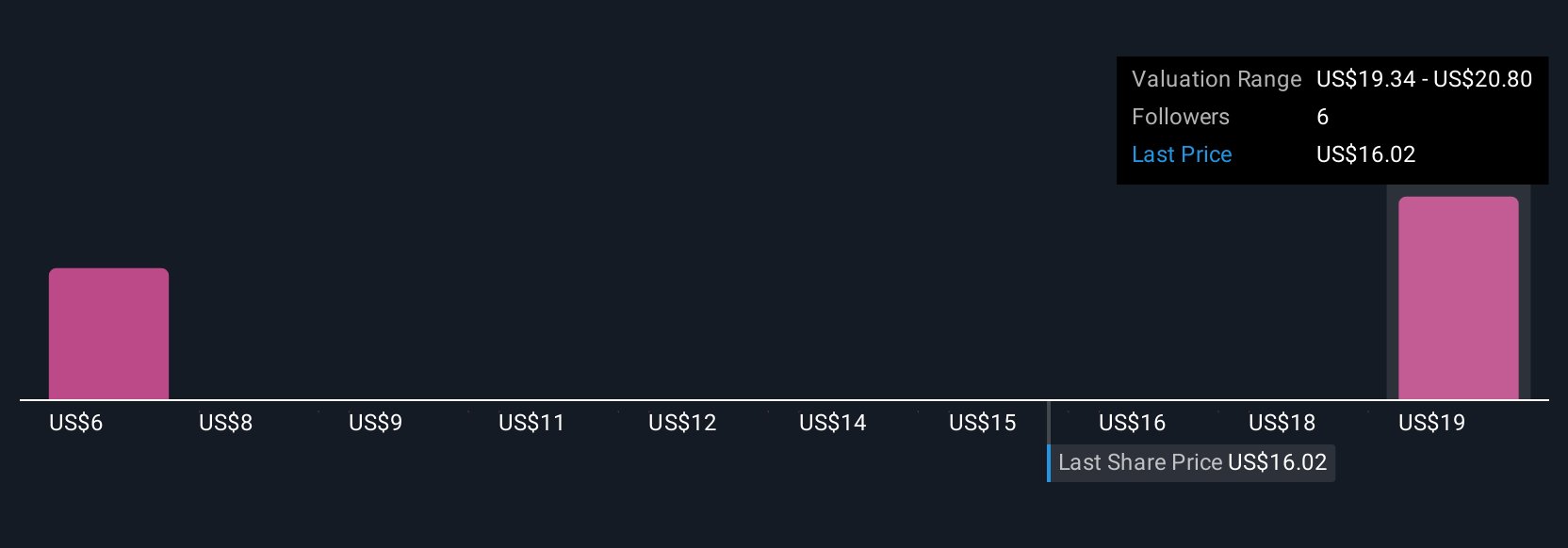

Two members of the Simply Wall St Community estimate fair values between US$6.20 and US$22.25 for Navigator Holdings. While these views vary widely, the expanded ethylene export capacity remains the key catalyst shaping many performance expectations.

Explore 2 other fair value estimates on Navigator Holdings - why the stock might be worth less than half the current price!

Build Your Own Navigator Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Navigator Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Navigator Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Navigator Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navigator Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10