Pagaya Technologies (PGY) Reports Upcoming Revenue Guidance of US$290M to US$310M

Pagaya Technologies (PGY) experienced a considerable share price increase of 247% over the last quarter, coinciding with its addition to multiple Russell growth indices, which likely played a role in elevating investor confidence. The recent announcement of revenue guidance for the upcoming quarter ranging between $290 and $310 million, alongside expectations for a modest net income, further aligns with Pagaya's growing financial stature. The inclusion in key growth indices could have amplified the company's visibility, while the flat market in the last week did not notably influence these movements, although the broader market's 15% annual climb indicates general optimism.

We've spotted 2 warning signs for Pagaya Technologies you should be aware of.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

The significant share price increase over the last quarter, attributed to Pagaya Technologies' addition to various Russell growth indices, reflects growing investor confidence and enhanced visibility. This aligns with the company's ongoing efforts in digital transformation and AI deployment, which are expected to broaden lending channels and drive sustainable revenue growth.

Over the past year, Pagaya's shares saw a total return of 112.28%, showcasing a remarkable performance compared to the US Software industry, which returned 26.3%. This strong return was fueled by strategic advances in AI-powered solutions and expanding partnerships, despite the broader market's annual climb of 15% over the same timeframe. The company's growth, however, is juxtaposed with challenges like regulatory scrutiny and reliance on the asset-backed securities market.

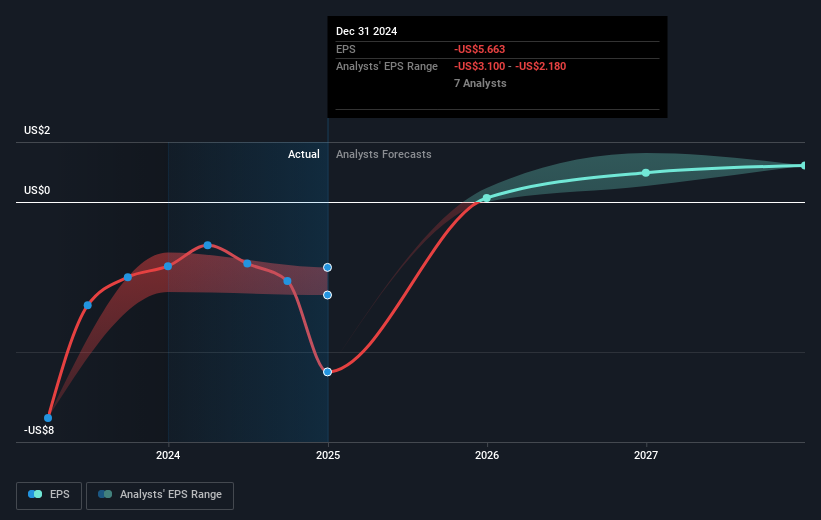

The recent revenue guidance between US$290 and US$310 million and the modest net income projection indicate positive momentum in both current operations and future prospects. Analyst forecasts expect Pagaya's earnings to grow significantly, supported by increasing adoption of AI models designed for fair lending. However, with the current share price slightly above the consensus price target of US$30.97, the market appears to be pricing in this optimism, suggesting a fully valued stock unless future earnings outperform current expectations.

Review our growth performance report to gain insights into Pagaya Technologies' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10