NXP Semiconductors N.V. (NASDAQ:NXPI) will release earnings results for the second quarter, after the closing bell on Monday, July 21.

Analysts expect the Eindhoven, the Netherlands-based company to report quarterly earnings at $2.66 per share, down from $3.20 per share in the year-ago period. NXP Semiconductors projects to report quarterly revenue at $2.9 billion, compared to $3.13 billion a year earlier, according to data from Benzinga Pro.

On June 12, the company's board of directors approved the payment of an interim dividend of $1.014 per ordinary share for the second quarter.

NXP Semiconductors shares gained 0.6% to close at $225.90 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

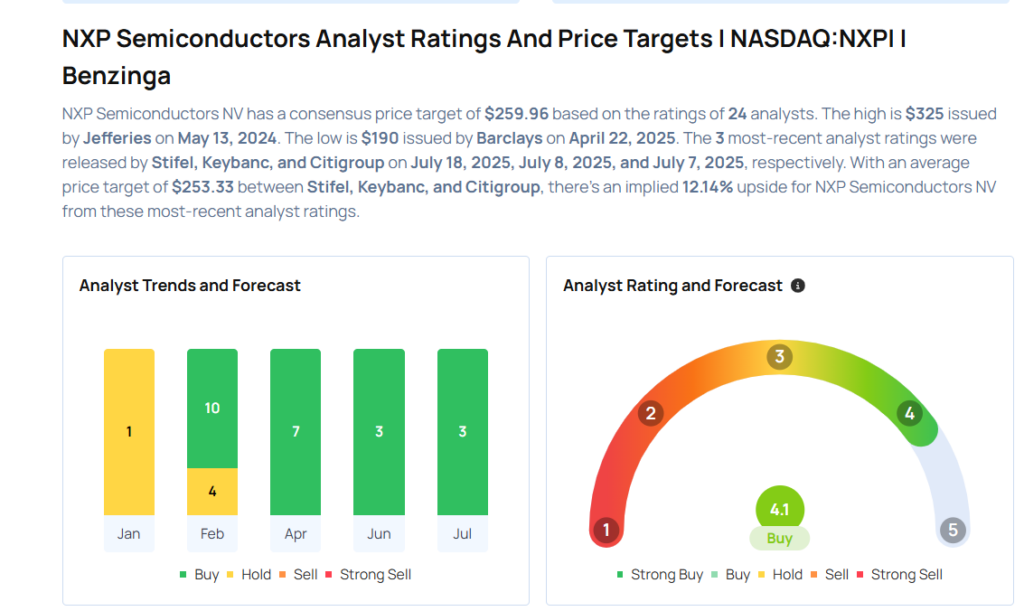

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Citigroup analyst Christopher Danely maintained a Buy rating and raised the price target from $210 to $275 on July 7, 2025. This analyst has an accuracy rate of 80%.

- Cantor Fitzgerald analyst Matthew Prisco maintained an Overweight rating and boosted the price target from $225 to $250 on June 18, 2025. This analyst has an accuracy rate of 72%.

- Evercore ISI Group analyst Mark Lipacis maintained an Outperform rating and increased the price target from $237 to $289 on June 12, 2025. This analyst has an accuracy rate of 75%.

- Truist Securities analyst William Stein maintained a Buy rating and slashed the price target from $258 to $230 on April 29, 2025. This analyst has an accuracy rate of 86%.

- Barclays analyst Blayne Curtis maintained an Overweight rating and cut the price target from $230 to $190 on April 22, 2025. This analyst has an accuracy rate of 74%.

Considering buying NXPI stock? Here’s what analysts think:

Read This Next:

- Top 2 Energy Stocks That May Fall Off A Cliff This Quarter

Photo via Shutterstock