Did Leadership Appointments Just Shift QXO's (QXO) Investment Narrative?

- QXO, Inc. recently appointed Michael DeWitt as chief procurement officer and Eric Nelson as chief information officer, both bringing decades of leadership in procurement innovation and enterprise technology from top global companies including Walmart International and Kraft Heinz.

- Their expertise in advancing digital transformation and scaling procurement processes highlights QXO’s ambition to modernize operations within the vast US$800 billion building products distribution sector.

- We'll explore how the addition of leaders experienced in digital and operational transformation could reshape QXO’s investment narrative.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is QXO's Investment Narrative?

For anyone following QXO, the investment case has always hinged on successful transformation within a massive US$800 billion building products distribution sector. The latest executive hires, including Michael DeWitt as chief procurement officer and Eric Nelson as chief information officer, mark a possible turning point: both bring blue-chip leadership from Walmart and Kraft Heinz, and their appointment is a signal that QXO is serious about ramping up digital and operational expertise. That could help address short-term catalysts like integrating recent M&A moves and scaling operations as revenue growth is forecast to accelerate. However, it remains to be seen whether this influx of executive talent can accelerate real progress in profitability, and persistent challenges, such as a largely new board and management team with an average tenure under two years, high CEO pay, recent shareholder dilution, and ongoing unprofitability, present clear risks. The muted market reaction to these appointments suggests the impact could take time to play out, with operational improvements and board stability still top of mind for current and prospective shareholders.

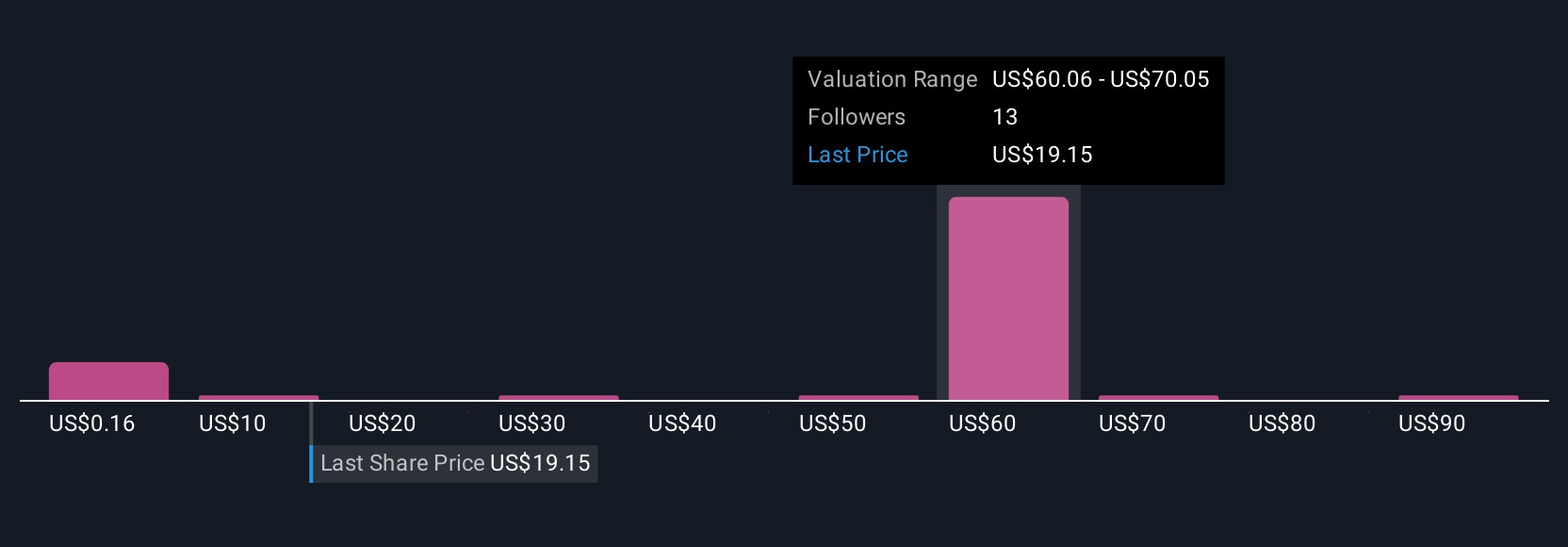

But investors should be aware board inexperience remains a near-term risk right now. QXO's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 7 other fair value estimates on QXO - why the stock might be worth over 4x more than the current price!

Build Your Own QXO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QXO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free QXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QXO's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QXO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10