How Investors May Respond To Bank OZK (OZK) Q2 2025 Earnings Growth Announcement

- Bank OZK reported its second quarter 2025 earnings results, showing net interest income of US$396.75 million and net income of US$182.98 million, both up from the same period a year ago.

- This announcement highlights that both net interest income and net income saw incremental year-over-year growth, reflecting stable financial performance through mid-year 2025.

- We will now explore how this steady gain in earnings influences the company’s investment narrative and expectations for future performance.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Bank OZK Investment Narrative Recap

To be a shareholder in Bank OZK, one needs to believe in the bank’s ability to deliver steady financial performance through both loan growth and disciplined risk management, despite any external uncertainty. The latest earnings results show continued, incremental growth in both net interest income and net income, but this update doesn't materially impact the main short-term catalyst, which is success in non-RESG lending, nor does it significantly reduce the most important risk: ongoing macroeconomic volatility affecting loan demand and credit quality.

Of recent announcements, the steady quarterly dividend increase, most recently up another US$0.01 to US$0.44 per share in July 2025, stands out for income-focused investors. This signals management confidence and supports the investment case for strong, recurring returns, but it does not address potential headwinds from market swings or slower asset growth in the coming quarters.

But even as earnings rise, investors should be aware that market risks like a potential decline in the bank’s net interest margin remain a concern if...

Read the full narrative on Bank OZK (it's free!)

Bank OZK's narrative projects $2.0 billion revenue and $774.6 million earnings by 2028. This requires 9.5% yearly revenue growth and a $77.9 million earnings increase from $696.7 million.

Uncover how Bank OZK's forecasts yield a $50.60 fair value, a 4% downside to its current price.

Exploring Other Perspectives

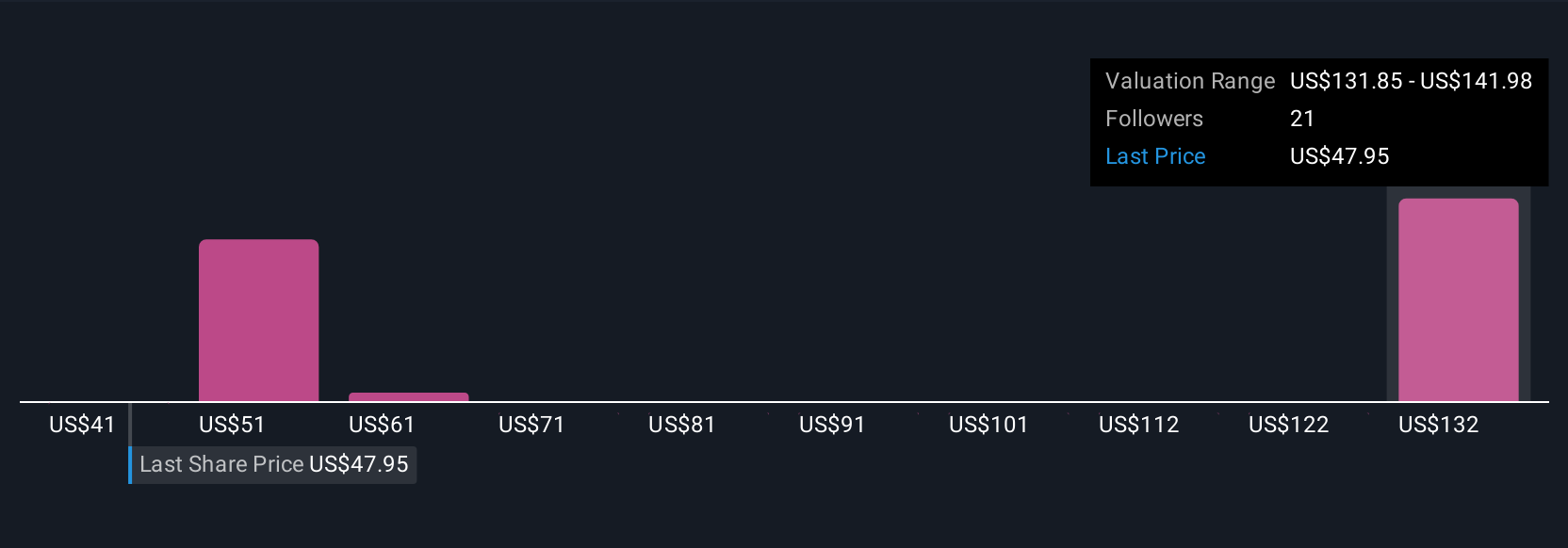

Fair value estimates from the Simply Wall St Community span from US$40.67 to US$154.05 across five viewpoints. While many see Bank OZK’s stable earnings as a strength, concerns still persist about how interest rate shifts could pressure profitability, urging you to consider multiple angles before making decisions.

Explore 5 other fair value estimates on Bank OZK - why the stock might be worth over 2x more than the current price!

Build Your Own Bank OZK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank OZK research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Bank OZK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank OZK's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank OZK might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10