Discovering US Market's Undiscovered Gems In July 2025

Over the last 7 days, the United States market has seen a rise of 1.7%, contributing to an impressive 18% increase over the past year, with earnings forecasted to grow by 15% annually. In this thriving environment, identifying stocks that are not only underappreciated but also poised for growth can be key to uncovering potential opportunities in the market's lesser-known corners.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

Click here to see the full list of 284 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Let's review some notable picks from our screened stocks.

ScanSource (SCSC)

Simply Wall St Value Rating: ★★★★★★

Overview: ScanSource, Inc. is a distributor of technology products and solutions operating in the United States, Canada, and Brazil with a market capitalization of $921 million.

Operations: ScanSource generates revenue primarily from its Specialty Technology Solutions segment, contributing $1.71 billion, while the Segment Adjustment accounts for $1.27 billion.

ScanSource, a nimble player in the tech distribution space, has been making strategic moves with recent acquisitions like Resourcive and Advantix to bolster its growth. Despite facing a 13.5% earnings dip last year against the electronic industry's 4.9% drop, it trades at 13.4% below fair value and maintains more cash than total debt, suggesting financial resilience. The company repurchased over 719K shares for US$28.83 million this year, reflecting confidence in its future prospects amid plans for further buybacks up to US$200 million without time constraints.

- ScanSource's hybrid distribution strategy and SaaS growth indicate potential for sustainable profitability; click here to explore the full narrative on ScanSource.

Sohu.com (SOHU)

Simply Wall St Value Rating: ★★★★☆☆

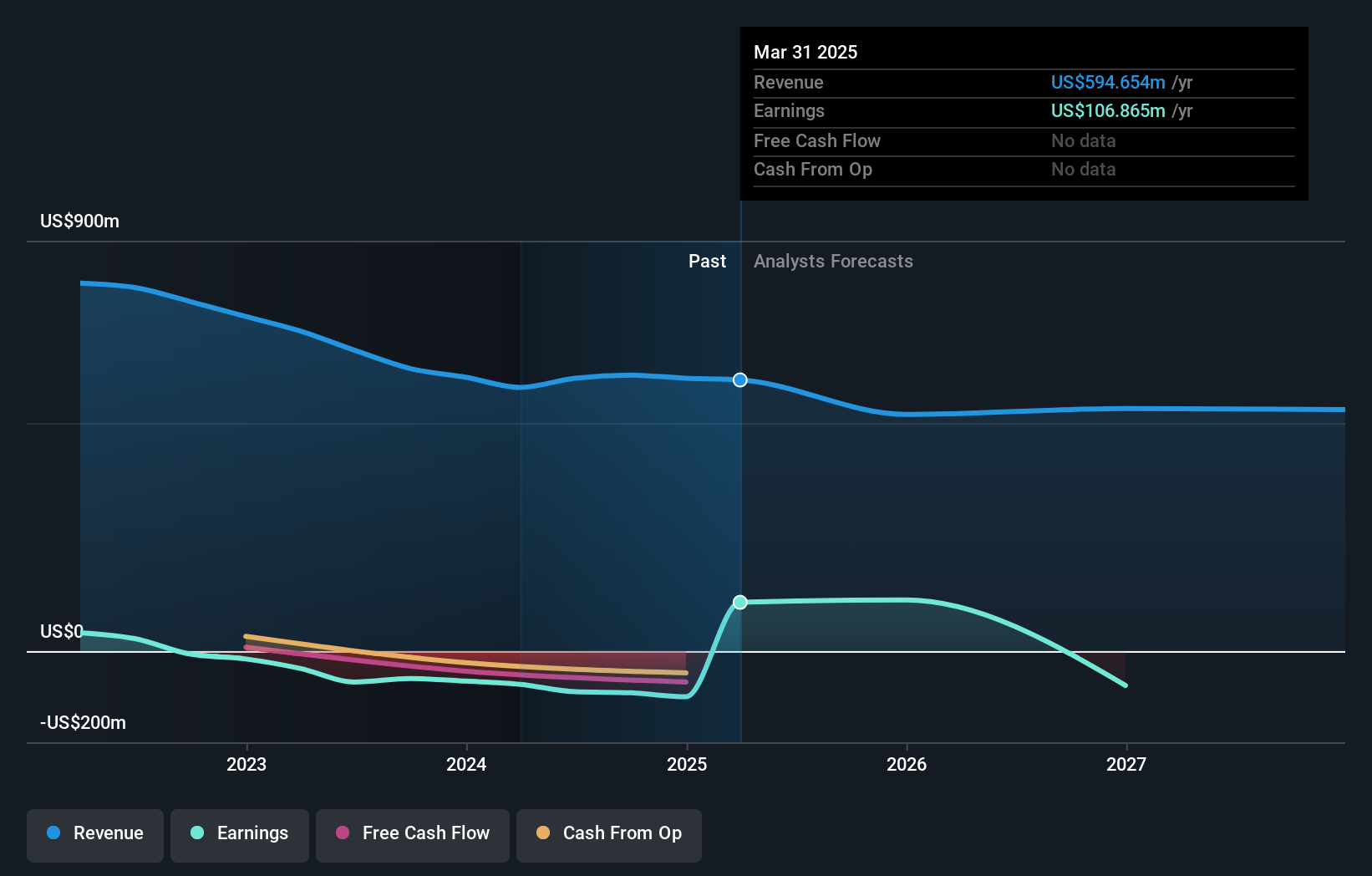

Overview: Sohu.com Limited is an online media platform and gaming company offering a range of online products and services for PCs and mobile devices in China, with a market cap of $455.19 million.

Operations: Sohu.com generates revenue primarily from its online advertising and gaming segments. The company's cost structure includes expenses related to content creation, technology development, and marketing. Notably, the net profit margin has shown fluctuations over recent periods.

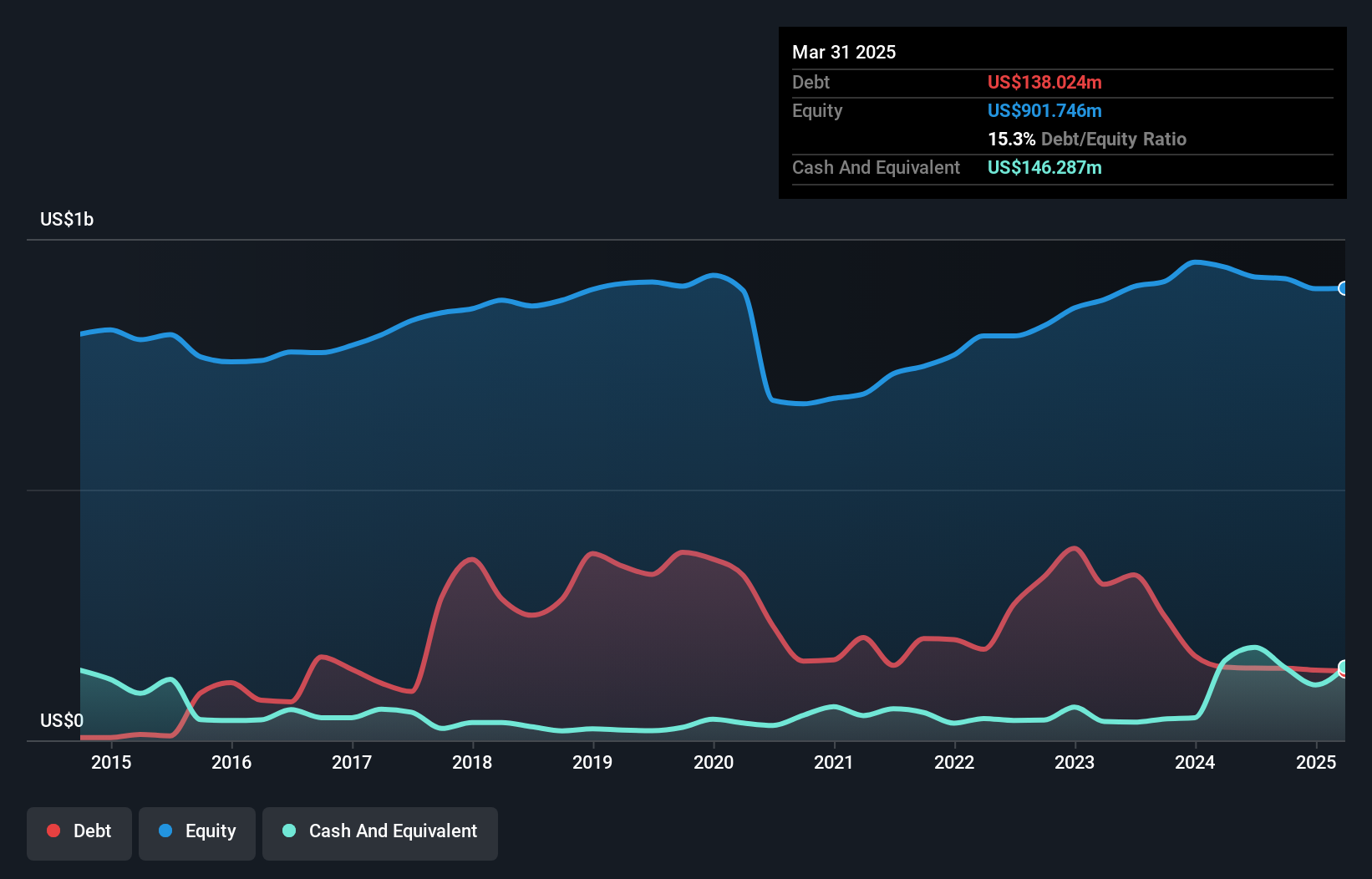

Sohu.com, with its small cap stature, has shown a remarkable turnaround by achieving profitability this year. The company's debt to equity ratio has impressively decreased from 6.7 to 0.3 over five years, highlighting effective financial management. Despite a low price-to-earnings ratio of 4.3x compared to the US market's 18.8x, Sohu faces challenges as earnings are forecasted to decline significantly over the next three years. Recent buybacks saw the company repurchase over 1 million shares for $19.56 million by mid-May 2025, underscoring confidence in its valuation amidst fluctuating revenue and net income figures.

- Get an in-depth perspective on Sohu.com's performance by reading our health report here.

Learn about Sohu.com's historical performance.

United Fire Group (UFCS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: United Fire Group, Inc. operates as a provider of property and casualty insurance for individuals and businesses across the United States, with a market capitalization of approximately $701.94 million.

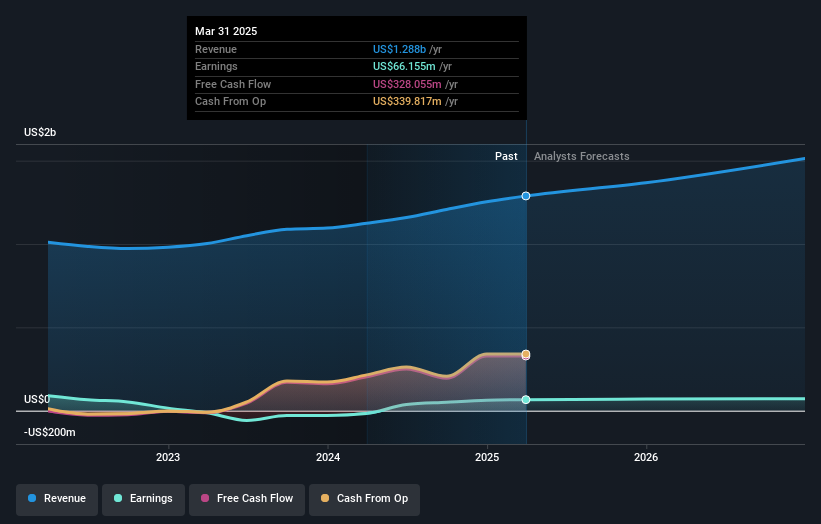

Operations: UFCS generates revenue primarily from its property and casualty insurance segment, totaling $1.29 billion. The company has a market capitalization of approximately $701.94 million.

United Fire Group, a nimble player in the insurance sector, has shown promising financial health with a price-to-earnings ratio of 10.7x, which is below the US market average of 18.8x. Over the last five years, its debt-to-equity ratio rose to 14.3%, yet interest payments remain well covered at 10.3 times by EBIT. Recently profitable, UFG's earnings are expected to grow annually by 4.68%. The company completed a $30 million private placement of senior unsecured notes to support growth and corporate purposes while maintaining more cash than total debt, indicating robust financial management and strategic foresight.

- United Fire Group's record high net written premiums reflect strong revenue growth momentum. Click here to explore the full narrative on United Fire Group's strategic initiatives and financial outlook.

Make It Happen

- Click here to access our complete index of 284 US Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10