Think the Stock Market Is Too Expensive? This Historical Chart Might Change Your Mind.

-

The S&P 500 has generated a 7.5% compound annual growth rate (CAGR) dating back to 1957.

-

Despite many bear markets and 10 recessions, the stock market has consistently moved higher over time.

-

Trying to time the market is folly. It is far better to buy and hold.

Is now the right time to buy stocks? It's a question that's been asked countless times, and whenever I field it, my answer is the same: "Yes!"

That might seem crazy, but I assure you, it isn't. Here's why: Over the long term, investing in a benchmark stock index like the S&P 500 (^GSPC 0.40%) has always proven to be a winning strategy -- even if someone's timing is horrible.

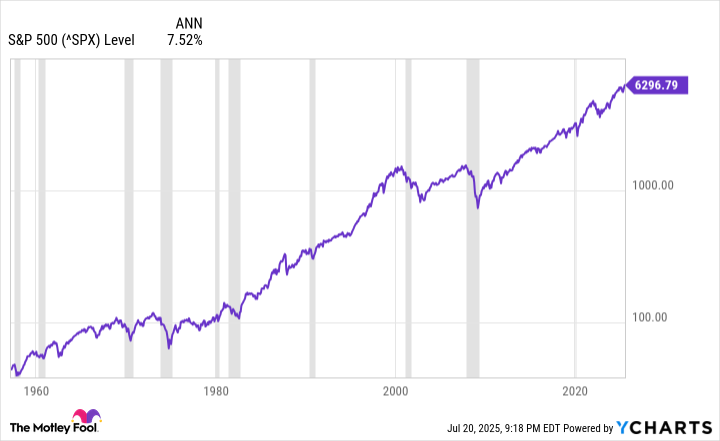

Still don't believe me? Then take a look at this chart:

^SPX data by YCharts

This is the S&P 500 dating back to 1957, when the index expanded to 500 companies and acquired its current name. Since then, it has increased by an astounding 14,000%. That works out to a compound annual growth rate (CAGR) of 7.5% -- and that's before accounting for dividend payments.

During that stretch, there have been many corrections, several bear markets, and 10 full-blown recessions. And yet, no matter when someone bought, they would have made money -- if they had stayed invested in the market.

Image source: Getty Images.

There's a lesson here: Timing the market is folly. Many fortunes have been made by people claiming to know when the right time to buy -- or sell. But far more money has been left on the table by investors trying to time the top or the bottom.

The best advice is the simplest: Avoid trying to predict price movements in the short term. Instead, save what you can and invest for the long term. Ignore the headlines -- particularly when the market is going down. And whenever you have doubts, glance at the chart above and remember: Stay patient, hold your stocks for the long term, and you'll come out a winner.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10